Wordle, the daily game that is taking the Internet by storm, is a relatively simple word game.

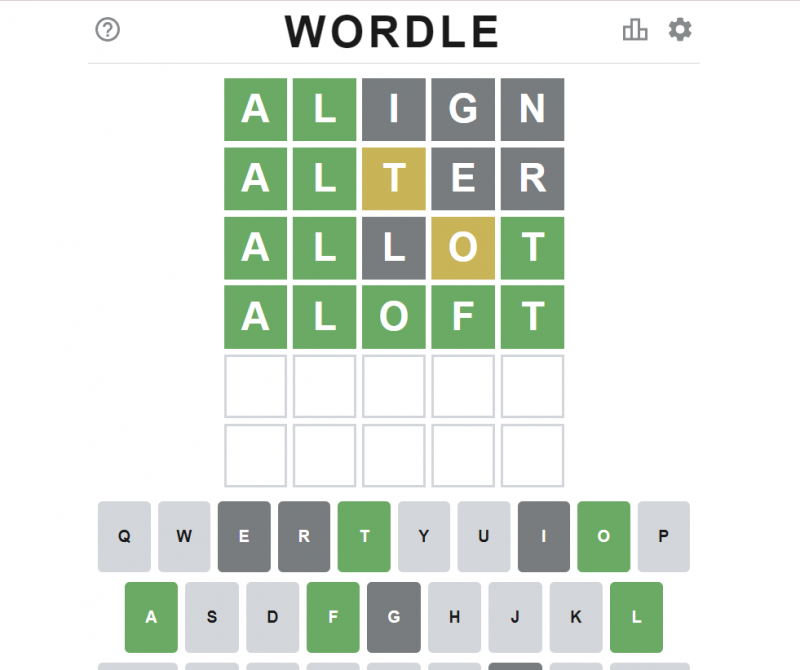

Players must guess a five-letter word within six tries. The game tells you if you placed the correct letters or if you guessed the correct word. If the letter you typed is right and is in the correct spot, it displays as green. If the letter you typed is right and is in the wrong spot, it displays as yellow. If the letter you typed does not belong to the word, it shows up as gray.

The mechanics may seem complicated at first, but you will get used to it. Here are a few useful tips to get you started!

#1: PICK COMMONLY USED LETTERS

Do not waste your first guess with random words. Instead, pick a word that includes many vowels or a word that includes frequently used consonants. For instance, “table” is a great word that includes two commonly used vowels “a” and “e” as well as a frequently used consonant “t”. Another good word to begin with is “audio”, which can get rid of four out of five vowels immediately.

Steer away from words that involve uncommonly used consonants such as “x”, “q”, and “z” on your first guess. Remember that the point of your first guess is to narrow down your search.

#2: EXPAND YOUR VOCABULARY

Is your vocabulary getting rusty? Enhance it through reading. Vocabulary is a tool that you can bring with you while playing this game. The more words you know, the better you will do at Wordle.

While you can get clues through the color displays, using these clues to figure out the solution requires knowledge of the English language. So, reading non-fiction or fiction books as well as playing text-heavy video games can help strengthen your vocabulary.

#3: TRY TO IDENTIFY PATTERNS

Patterns are your best friend when it comes to playing Wordle. Try to identify patterns that commonly used words have. For instance, “q” will almost always be followed by “u” in the English language.

Moreover, the most common letters at the beginning of an English word are a, d, o, t, and w. Lastly, the most common letters at the end of an English word are d, e, s, and t.

#4: NEVER USE THE GRAYED-OUT LETTERS AGAIN

Beginners at Wordle can make the mistake of using the letters displayed in gray. If the letter you typed does not belong to the word, it shows up as gray. You will be wasting your chances if you use the grayed-out letters again. Focus on the in-game keyboard to help you decide which letters to use.

#5: PLAY IT DAILY

To expand your vocabulary and to familiarize yourself with how the game works, you can play it every day. Wordle and other word games are good for your brain and can be beneficial in other areas of your life.

Image Credits: powerlanguage.co.uk/wordle

Word games are all about communication and problem solving. After the past few years, I think the world could use a game to help improve communication and to help decompress stress.