These Singapore-Inspired SG60 Merlion Plushies Are Up For Grab — Here’s How to Collect Yours for Free

If you thought Singapore’s 60th birthday would be all about fireworks and flags — think again. This SG60, Singtel is going plush.

Meet the SG60 Merlion plushie blind boxes — a quirky, collectible celebration of Singapore’s most iconic flavours and symbols. These aren’t your average souvenirs. Imagine a Merlion dressed like kaya toast. Or one with chilli crab claws. Or even a spiky little durian Merlion that’s almost too adorable to handle. There are five designs in total, each crafted to honour something uniquely Singaporean — from curry puffs to orchids — and every plushie comes as a surprise.

You can’t choose which Merlion you’ll get. That’s half the fun. It’s like gacha — but make it national pride.

Here’s the scoop: Singtel is giving these plushies away for free with selected SIM card purchases and top-ups. And yes, they’re totally legit collectibles. Whether you’re a tourist looking for a fun memento or a local who’s just obsessed with all things cute and Singaporean, this is one you’ll want to get your hands on.

Kaya Toast Merlion

Chilli Crab Merlion

Orchid Merlion

Durian Merlion

Curry Puff Merlion

They’re fuzzy. They’re cheeky. And yes — they’re totally collectible.

Here’s how to score yours:

- Flying in? Pick up a $30 Singtel 5G+ Tourist SIM at Changi Airport’s Travelex counters, 313@Somerset, Bugis Singtel Shops, or online at www.singtel.com/hitourist, and you’ll get a free blind box Merlion to kickstart your trip.

- On the go? From 21 May, you’ll get a plushie when you buy a $15 Prepaid SIM or top up $20 or more at any 7-Eleven or Cheers store.

- Thinking long-term? New Singtel postpaid plan sign-ups from 21 May will also get to take a Merlion home.

Whether you’re into blind boxes, Merlion merch, or just love surprises, this campaign is a delightfully fuzzy way to show your Singapore spirit. Start collecting, start trading, and start celebrating SG60 — one plushie at a time.

Fair usage policy applies for unlimited 5G+ data. Merlion plushies are distributed randomly. Collect them all — if you can!

Beginner’s Guide to Saving Money in Singapore

Living in Singapore isn’t cheap. With rising costs and temptations everywhere, it can feel tough to set money aside. But whether you’re saving for a rainy day, your BTO, or a well-deserved holiday, getting into the habit now can make a big difference.

Read this simple guide to help you get started.

#1: SET A CLEAR GOAL

Don’t just say “I want to save more.” Be specific! Are you saving for an emergency fund, a new laptop, or a holiday?

Once you have a clear goal, break it into monthly targets. Open a separate savings account to track progress. Naming it something fun like Japan Trip Fund can keep you motivated.

#2: LET YOUR MONEY WORK

Put your savings in an account that earns interest. Local banks like DBS, OCBC, and UOB offer savings accounts that reward you for crediting your salary or paying bills.

Every little bit of interest adds up, and your money grows even while you sleep.

#3: EAT OUT LESS

Eating out often can burn a hole in your pocket quickly. Cooking at home a few times a week can save you serious cash and help you eat healthier.

Image Credits: unsplash.com

Even simple home-cooked meals cost less than most hawker or café food. Plus, you’ll waste less and stretch your grocery dollar further.

#4: USE THE SAVINGS BUCKETS

Organize your savings into three buckets namely:

a. Emergency fund: For unexpected expenses like medical bills or home repairs

b. Short- to mid-term goals: For things like education, weddings or travel

c. Long-term goals: Retirement or financial independence

Having separate goals helps you stay focused and on track.

#5: BE CAREFUL WITH CREDIT CARDS

Credit cards can be useful for rewards, but only if you pay off the full amount every month. Otherwise, interest charges add up fast.

If you find yourself carrying a balance, switch to cash or debit to stay in control of your spending.

#6: PAY BILLS ON TIME

Late payments lead to extra fees and can hurt your credit score. Set reminders or automate payments to avoid unnecessary charges.

If you can’t pay on time, contact the provider early. They might offer an extension or payment plan.

IN A NUTSHELL

Image Credits: unsplash.com

Saving money doesn’t mean you have to give up fun. Start small, stay consistent and track your progress. Even saving an extra S$50 a month puts you on the right path. Small habits today build a more secure future tomorrow.

6 marvelously rated accommodations in Melbourne, Australia, to book a stay in 2025

Planning a trip to Melbourne?

A marvelous trip starts with marvelous accommodations, and that’s why we’ve handpicked a list of awesomely rated places, your starting point for your Australia adventures.

Let’s dive right in!

Melbourne Lifestyle Apartments

Agoda Rating: 9.5 (2.1K+ reviews)

First up, we have Melbourne Lifestyle Apartments, nestled along Yarra River, between neighborhoods like Chinatown and Queen Victoria Market (within 4 km).

Various apartments are available for booking, ranging from one-bedroom hideaways to spacious sub-penthouses.

Cap off each day with a dip in the indoor pool if you’d like.

Awarded as a top choice for Agoda travelers in 2024, this one sits right at the top of our list with a superb 9.5 rating.

Treasury on Collins

Agoda Rating: 9.4 (1.2K+ reviews)

Sitting squarely in the heart of Melbourne’s CBD, Treasury on Collins is a 4-star option.

Rooms range from standard heritage queens/kings/suites and one-/two-bedroom apartments that are made for chilling.

It’s sited between Southern Cross and Flinders Street stations, which places tram lines and trains close by.

You can wander to the Block Arcade and the SEA LIFE Melbourne Aquarium on foot, since they are just 600 m away.

The StandardX, Melbourne

Agoda Rating: 9.4 (900+ reviews)

The StandardX, Melbourne’s 5-star hotel, opened in 2023, placing you directly on Rose Street and just 1 km from Melbourne Museum and under 3 km from Melbourne Zoo.

Accommodations range from doubles to standard kings and suites.

With wonderful hospitality and a prime central location, The StandardX has won itself 3rd place on our list.

Quest Collingwood

Agoda Rating: 9.3 (1.1K+ reviews)

Centrally located yet quietly tucked away, Quest Collingwood is a mere 800m from Collingwood station and a 20-minute stroll from Melbourne Museum.

This new 4-star haven (opened in 2023) puts you steps from the city’s attractions.

They have a range of studio and apartment accommodations to choose from, and we like how the hotel’s disability access options ensure every guest feels at home.

Lanson Place Parliament Gardens

Agoda Rating: 9.3 (700+ reviews)

Lanson Place Parliament Gardens is a brand-new accommodation that opened last year.

Right around the corner from Parliament House and Saint Patrick’s Cathedral, this hotel has an indoor swimming pool and a range of accommodations spanning standard twin/king rooms to roomy multi-bedroom apartments.

Families will be glad to know that there’s a kids-stay-free perk (up to 12 years old).

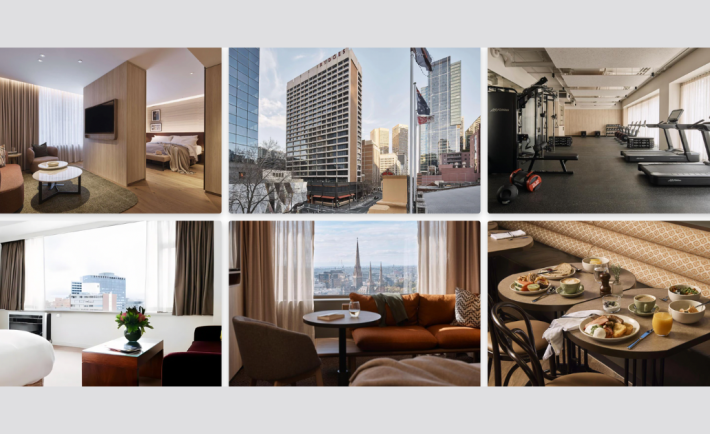

Rydges Melbourne

Agoda Rating: 9.2 (4.4K+ reviews)

Last but not least, we have this newly renovated Rydges Melbourne hotel (in 2023) hitting all the right notes with a curtain-opening location between Her Majesty’s and Princess Theaters.

It’s also a five-minute stroll from Parliament train station, making getting around easy peasy.

It offers a deluxe-to-suite room lineup and has a rooftop sundeck, where you can catch the Melbourne air and skyline.

Bad Money Habits We Grew Up With (& Why We Must Unlearn Them)

Money talk isn’t exactly dinner table conversation in many Singaporean homes. You can bet we’ve all heard the usual: “Don’t spend unnecessarily”, “Save your angbao money”, or worse, just silence when it comes to CPF, loans, or budgeting.

Whether it was your mom, your dad, your loud uncle at Chinese New Year, or your office colleague who still pays minimum on their credit card, the financial “wisdom” we grew up with often came with good intentions but not always good outcomes.

So here’s a real talk list of bad financial lessons many of us were taught.

#1: NO CREDIT IS GOOD CREDIT

Some of us were raised with the fear of credit cards. “Ah girl, don’t take credit card ah. Later you kena debt!”

My friend’s parents had their struggles with borrowing, so they swung the other way and taught them to avoid debt completely. But here’s the thing. No credit history can actually work against you.

Without any credit activity, like responsibly using a card and paying it off, you might find it hard to get a loan or rent a flat. Credit isn’t the enemy. Misusing it is.

#2: DON’T WASTE = REPLACE EVERYTHING

You know the classic auntie logic: “Don’t waste money on repairing lah, just buy new one.”

Whether it was a microwave, a pair of shoes, or even a fan, if it broke, we just tossed it and replaced it. Never mind that a simple fix might cost less and last longer. Somewhere along the way, the “waste not, want not” principle got twisted.

#3: SWIPE FIRST, THINK LATER

Living beyond our means is something many of us saw growing up but didn’t realize was a problem until adulthood.

Image Credits: unsplash.com

Some elders would say, “Just put on card first lah, pay later.” But later never really came. Buying branded goods on installment plans, splurging at Robinsons or TANGS sales, or upgrading gadgets every year became the norm, not the exception. Saving up first before spending? Almost unheard of.

#4: NO PLAN, NO PROBLEM (UNTIL IT’S A PROBLEM)

Planning for the future? Wah, so far one. Whether it was not having insurance, skipping CPF top-ups, or not saving for retirement, the mindset was very much “today first, tomorrow worry later.”

Problem is, later always comes and then we scramble.

#5: ONE-DAY MILLIONAIRE SYNDROME

You know this one. Payday comes, and suddenly it’s crab dinner, new clothes, kopi upgraded to Starbucks. Next thing you know, end of the month liao, and it’s instant noodles until the next pay comes in.

It wasn’t that our parents were reckless. Just that budgeting wasn’t something they were taught either. So what did we learn? That spending is reward and saving is optional. Oops!

#6: MONEY TALK = TABOO

In many households, money talk is more hush-hush than your cousin’s secret engagement.

We don’t discuss how much we earn, how much we owe, or whether we’re struggling. The result? Most of us grew up with a very murky idea of how money works. We weren’t taught about insurance, taxes, or loans. We were just expected to figure it out, somehow.

IN A NUTSHELL

Our parents did their best, but now it’s our turn to get smart.

Start small. Track your spending, ask questions, learn what you missed. There are loads of free financial literacy programs now. DBS, OCBC, and even CPF have online tools to help you budget, plan for retirement, or understand your savings options. Nonprofits like Credit Counselling Singapore (CCS) also offer workshops if you’re feeling a little lost about managing debt or building your credit.

Image Credits: unsplash.com

There’s no shame in learning money skills as an adult. Better late than broke!

Want hair that looks thicker, fuller & denser? Then you’ve got to give these ginger haircare products from $8 a try

You want thicker, fuller, and denser hair.

You’ve tried all that you can with what’s out there in the shops.

You sure?

If you’ve not heard of ginger haircare products, it’s not too late to give them a go.

Shampoos, conditioner, scrub, and serum, here’s what you need to get this time around

Shampoos

Ginger Anti-dandruff Shampoo

Price: from $8

We will start us off with this most-loved shampoo from The Body Shop, a clarifying cavalry for dry and itchy scalps.

It contains botanical actives like ginger root from Madagascar, Chinese skullcap, soy, and wheat sprout that rid hair of flakes while cleansing to promote healthy growth.

As the dandruff vanishes, birch bark and white willow extracts swoop in to comfort irritation.

And yes, if you prefer to reduce your use of plastic (bottles), you could go for their Ginger Anti-Dandruff Shampoo Bar ($20) instead; each bar can apparently last up to 50 washes.

Haruhada Ginger Shampoo

Price: $39

Don’t settle for hair products that irritate or strip your strands.

Try Haruhada’s Ginger Shampoo, a formula containing ginger extract to nourish your hair from scalp to ends without aggravating the scalp because there’s no harsh dimethicone or mineral oil in sight.

Instead, you will enjoy a cleanse that washes away dirt, leaving your locks soft and static-free.

Lush Ginger Shampoo

Price: $49

Or consider this Lush shampoo made with the essence of ginger and a bevy of botanical heroes.

A blend of herbs and spices combines with antifungal and soothing ingredients to sweep away buildup.

And you can almost taste the zing as sea salt whisks away residue.

But it’s not all tough love—there’s also honey in it to lend a softening touch.

Plus, with yogurt-derived probiotics, this shampoo is a head spa trip for your hair.

Conditioner

Ginger Scalp Care Conditioner

Price: from $8

Couple your routine with The Body Shop’s Ginger Scalp Care Conditioner to tame weak, fine strands.

This conditioner contains vegan silk protein and ginger root oil to banish breakage and smooth hair strands.

Brushing becomes easier as the formula’s friction-fighting powers cut down on tugging and damage.

Scrub

Ginger Scalp Care Scrub

Price: $33

Made with finely crushed walnut and coconut shells, this ginger scrub gently buffs away buildup to leave hair feeling lighter and prepped for your next haircare routine.

Ideal for weekly use in place of your regular shampoo, this scrub detoxes your scalp.

Using ginger and natural exfoliants, it draws out impurities while relieving dryness.

For folks craving a refresh or a deeper clean than usual, just massage this scrub into your scalp to stimulate circulation and let it work to purge.

Serum

Ginger Scalp Care Serum

Price: $33

Last but not least, consider this serum to round up your ginger haircare routine.

The standout ingredient is a ginger root density complex that promotes denser hair growth in just months.

It’s a lightweight formula with botanical bio-actives and a fast-absorbing serum that also leaves zero greasiness behind, so you can let your hair’s natural body and movement shine through.