Which are the best ways for a beginner to understand forex? Learn about these different methods and how they help newbies in this market.

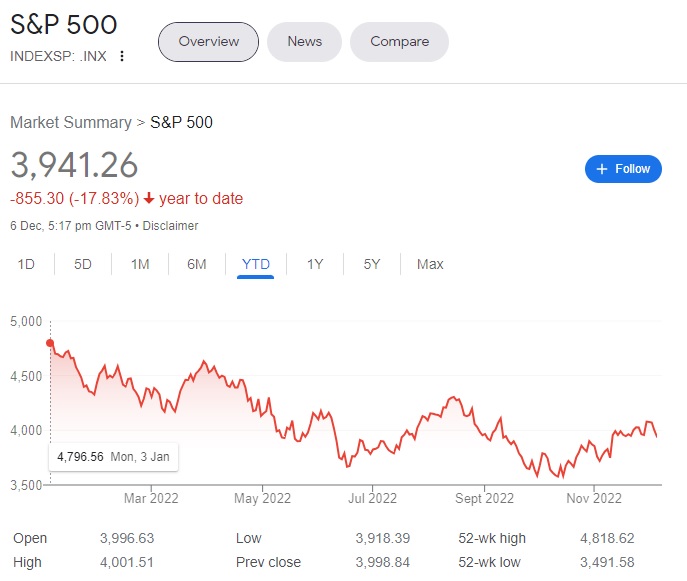

The rise of foreign exchange (forex or FX) trading has been quite dramatic. It has risen from around $1 trillion in the late 90s to over $8 trillion (according to the BIS Triennial Central Bank Survey).

Despite this immense value, much of the global population is still new to the foreign exchange market. This presents an exciting avenue for newbies, but it also presents challenges, given the complexities of online trading.

Thankfully, there are various ways to learn forex trading as a beginner.

Engage in Free Online Resources

The Internet is the first point of contact for first-timers who want to trade forex. Several economic aspects related to currencies may make some assume that university-level education is necessary.

However, forex is more of a discretionary activity. In other words, there is more than one way to skin a cat — even when all traders see the same chart.

Nonetheless, the Internet offers many free websites where you can learn about the currency market. Among these is Babypips, which uses a witty writing style to present all the basics of forex trading and break advanced concepts down in the simplest way possible. Newbies can navigate structured lessons through a free course that offers certification.

Other notable websites include Investopedia and DailyFX. While using a slightly more advanced tone, both resources are as comprehensive as Babypips. Thankfully, these are free platforms that provide excellent material.

Read Books on Trading

Nowadays, reading books is often seen as a forgotten pastime. Luckily, new traders can access many insightful works online related to forex, which have stood the test of time.

Below are some recommended titles to enjoy:

- Market Wizards: Interviews with the Top Traders (1989) by Jack Schwager: This book covers interviews with famous, high-net-worth traders of the past, from Paul Tudor Jones to Bruce Kovner. While not exclusive to forex, the interviews provide many valuable lessons beginners can apply in the former.

Other newer versions of the Market Wizards series exist with 1992, 2001, and 2020 editions.

- Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude’ (2000) by Mark Douglas: As with Jack Schwager’s book, Trading in the Zone is less about forex but a must-read for all traders. Many consider this body of work as a masterpiece in trading psychology.

However, the late Douglas went beyond the latter concept, covering other technical yet interesting topics such as probabilities, financial risk, and market randomness.

- Day Trading and Swing Trading the Currency Market (2015) by Kathy Lien: Kathy is a relatively young forex trader and author who contributes her high-level analysis to platforms like CNBC and Bloomberg. In its third edition, this book focuses more on trading currencies, covering advanced technical and fundamental analysis.

Join Forums Online

While trading is typically a personal activity, beginners can feed off the knowledge of other experienced traders in dedicated communities. These include Forex Factory, Babypips, Forex Peace Army, and the forex subreddit (r/forex) on Reddit.

One advantage of these discussion boards is that beginners can ask any question and get an excellent response from an existing trader. They are also a place of heated yet eye-opening debates. If you’re lucky, you may gain ‘top secret’ information from a generous, profitable trader or, at the very least, rare tips and tricks.

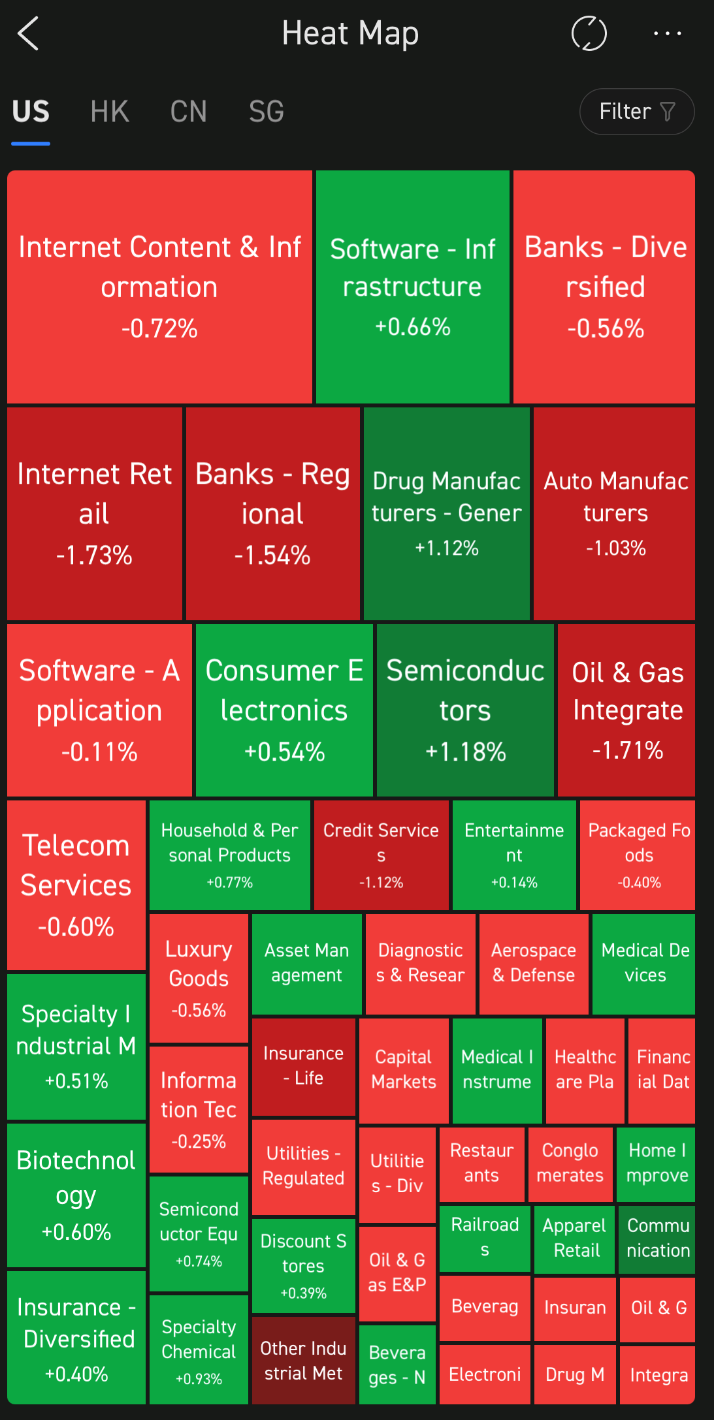

Use a Demo Account From a Reputable Broker

A demo account is essential for any first-time trader to learn about forex and test their strategies without financial risk. Even experienced participants will switch to this demo account from time to time to make tweaks or simulate a new trading system.

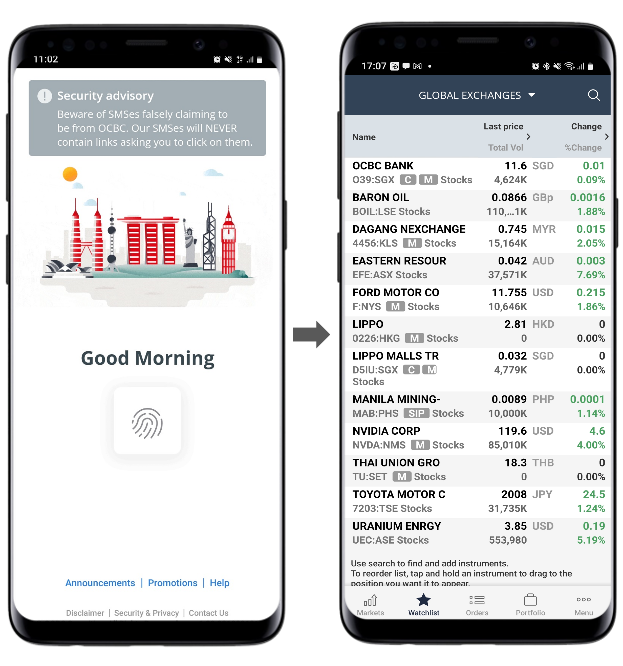

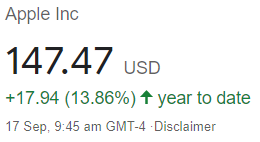

It’s also crucial for beginners to pick a reputable Singapore forex broker during the demo stage. Ultimately, the aim is to transition into a live account. Yet, using the right broker enhances the experience and ensures one receives the best trading conditions.

Get a Copy Trading Account

Even during the learning stage, newbies can earn while they learn by using a copy trading account during the learning stage. Copy trading is a system where you connect your account to an experienced trader whose positions get replicated automatically to your account.

Unfortunately, this avenue does come with a financial commitment. So, it’s not for everyone. Yet, it’s also a way to learn about trading currencies. Copiers can split their funds across many strategy providers. This exposes them to various trading methods and crucial performance metrics like drawdown, gain percentage, and profit factor.

Exploring the Numerous Ways To Learn Forex as a Beginner

The number of forex participants has yet to reach its full potential. This means millions of beginners are eager to engage in the most traded financial market.

Thanks to the Internet, the barrier to entry is low, and you can understand the game from several websites, books, online forums, a demo account, and a copy trading account. So, there is no single best way to learn forex. However, experience and never-ending learning are necessary.