Prevent exceeding your monthly budget by taking control over your mobile or hand phone bills. May these tips help you save some of your hard earned money…

1. IDENTIFY YOUR MONTHLY USAGE

Look onto your carrier’s usage information or last month’s billing statement and check your monthly usage. Identify what you really need in terms of number of texts, call minutes, and Internet data each month. Then, start comparing the telecommunication plans available to get the best and cheapest deal.

2. CONTEMPLATE ON YOUR MOBILE PLAN

Examine your plan carefully. What is your telecommunication’s limit for your local and overseas calls, texts, and data usage per month? Does it harmonize with your actual usage? The truth is, majority of people do not maximize the use of their plans. Most under consume and over paying for the phone service they are using. So, consider switching to a lower plan or going on prepaid to save more money and to actually stretch your dollar’s worth.

3. AVOID EXTRA FEE BY COMMITTING TO YOUR CONTRACT

Before you switch to a new telecom, honor your current contract term first. Most companies have a two-year contract. Doing your research on the terms and conditions can save you from paying additional fees.

4. SAVE ON INTERNET DATA USAGE

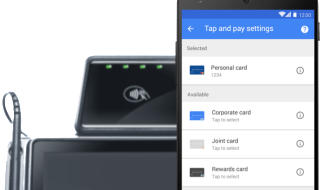

Avoid exceeding your monthly data allowance by regulating the phone’s settings. For Android users, go to settings then, click data usage to set a limit for a month. If you are using iOS, go to settings then, click cellular to track your cellular data usage every month.

5. USE WI-FI AS MUCH AS POSSIBLE

Using 3G or 4G does not only cost you more but it also decreases your battery life easily. Instead, use Wi-Fi whenever possible. Take advantage of the free Internet network services provided by your school or workplace and save money.

6. REDUCE YOUR CALLS AND TEXTS

Use Free Apps that provide call and text services without adding extra charges to your plan since you are using Wi-Fi connection anyway. These free online Apps are Line, Viber, Tango, and Facebook Messenger among others.