Hitting your thirties signify that you are halfway to retirement. After establishing a financial foundation in your twenties, it is up to you to use the following decade of your life to build and protect your wealth.

Whether you want to purchase a flat or to travel the world, these seven financial commandments can help you stretch your dollar.

#1: YOU SHALL LEARN SELF-CONTROL

Throughout your childhood, your parents or teachers taught you to practice self-control. The sooner you learn the importance of delayed gratification, the better off you will be. Applying self-control makes it easier to stay on top of your finances.

Select consciously spending cash rather than swiping your credit cards. Credit cards are convenient, but you must pay your bills on tip to maintain a good credit score. Do you really want to pay interest on a pair of jeans or a box of cereal? Think about it.

#2: YOU SHALL GET YOUR INSURANCE IN ORDER

Let us face it! You are not getting any younger. You need to sort out your health insurance, life insurance, and other policies. Considering a life insurance is prudent, especially if you have people depending on you.

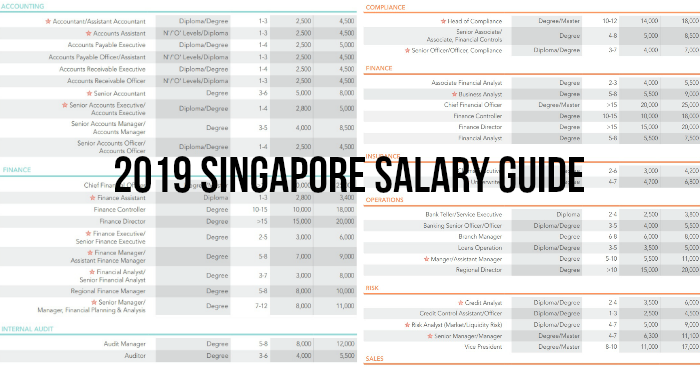

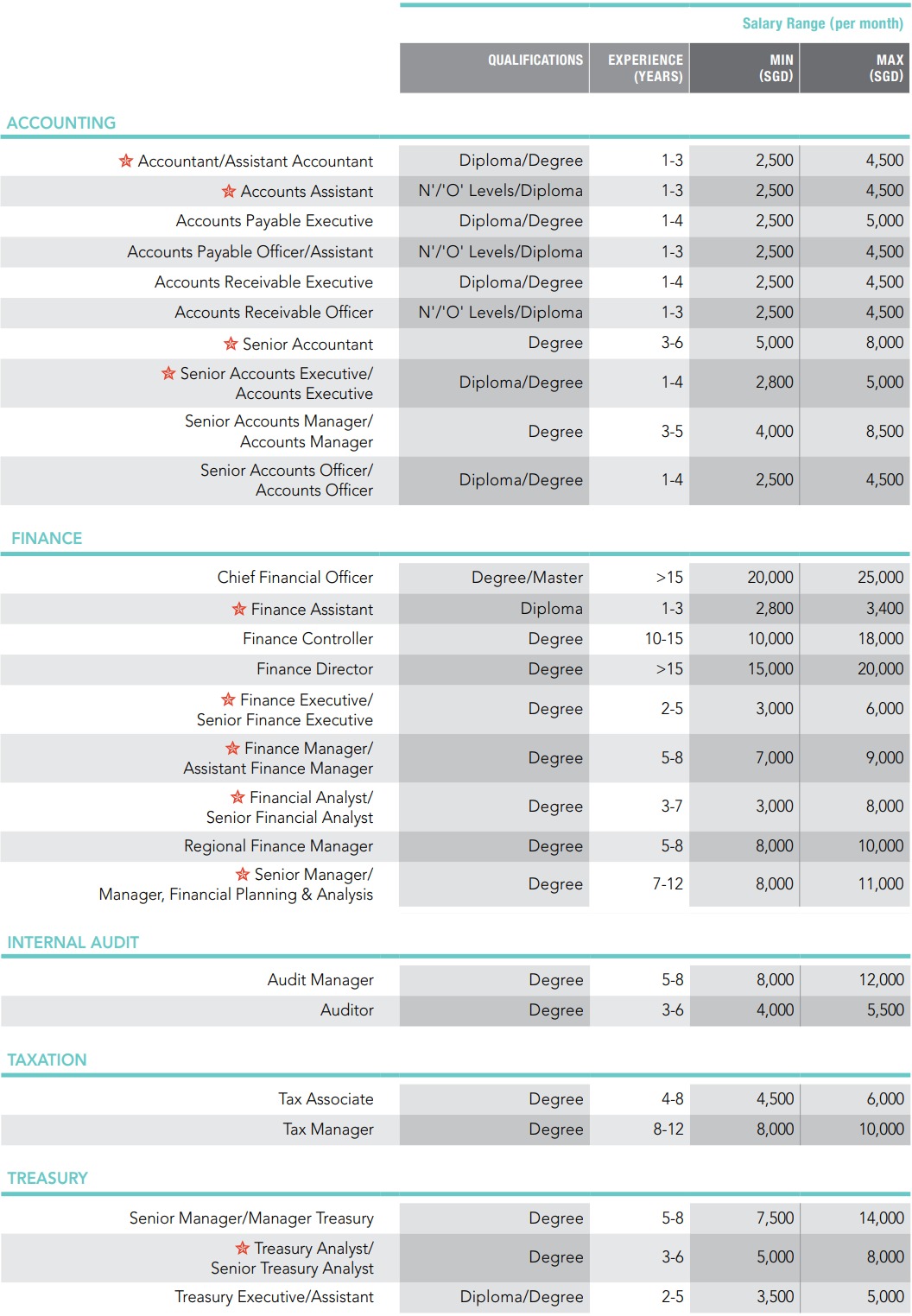

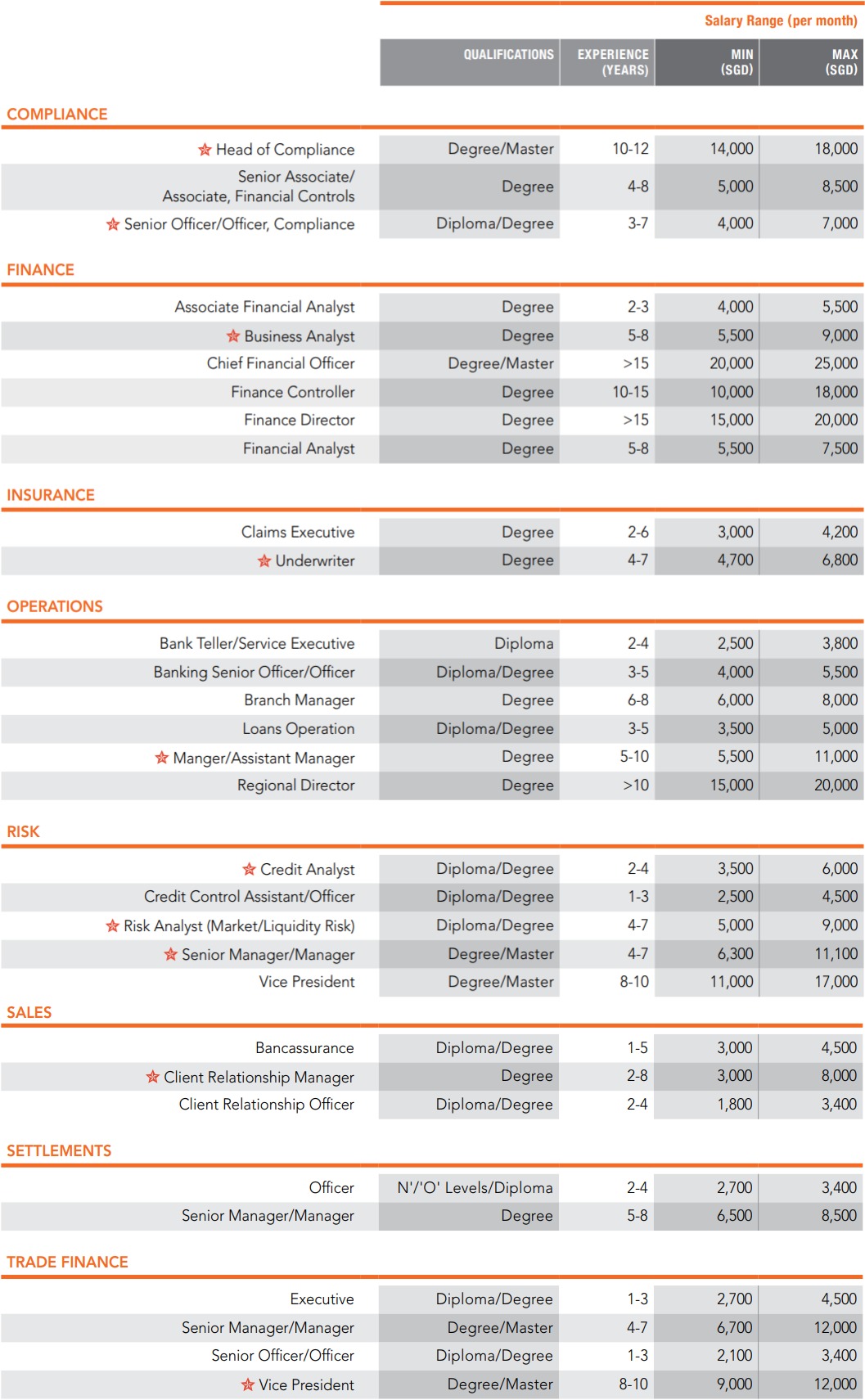

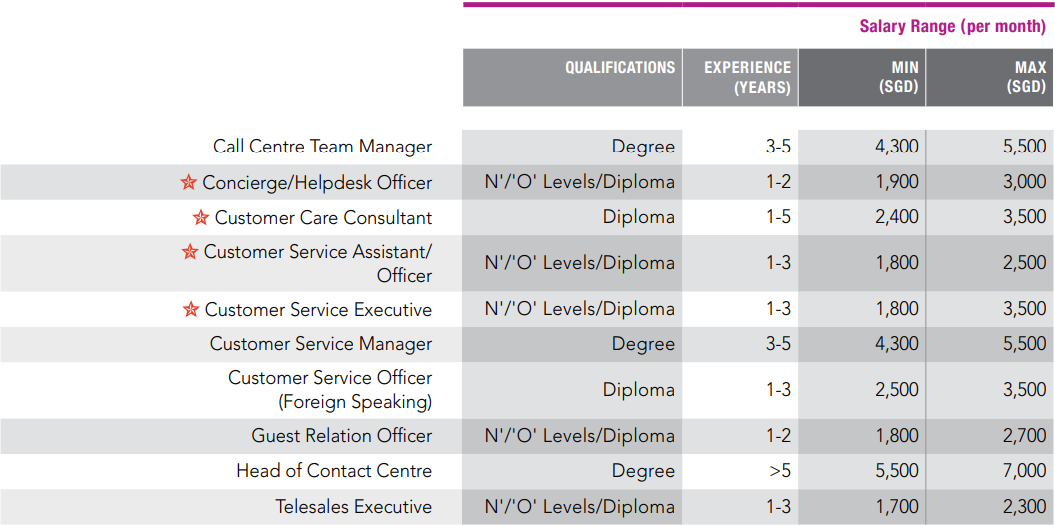

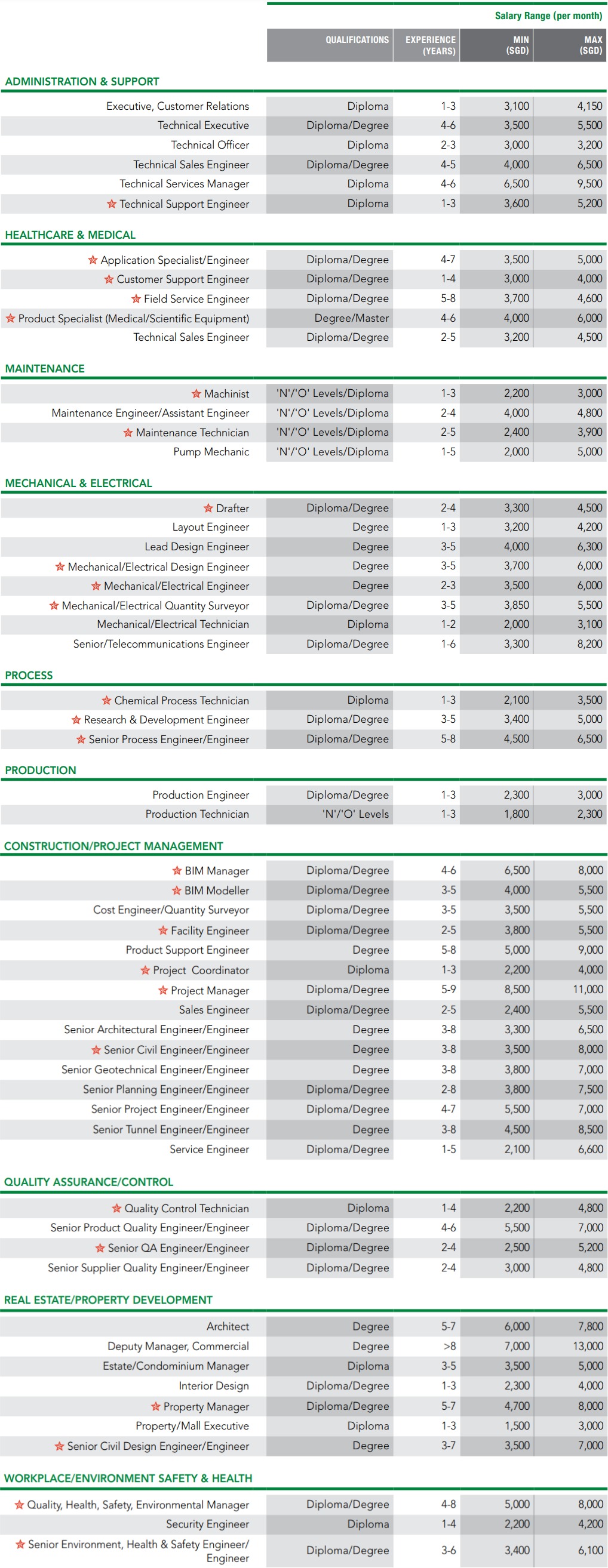

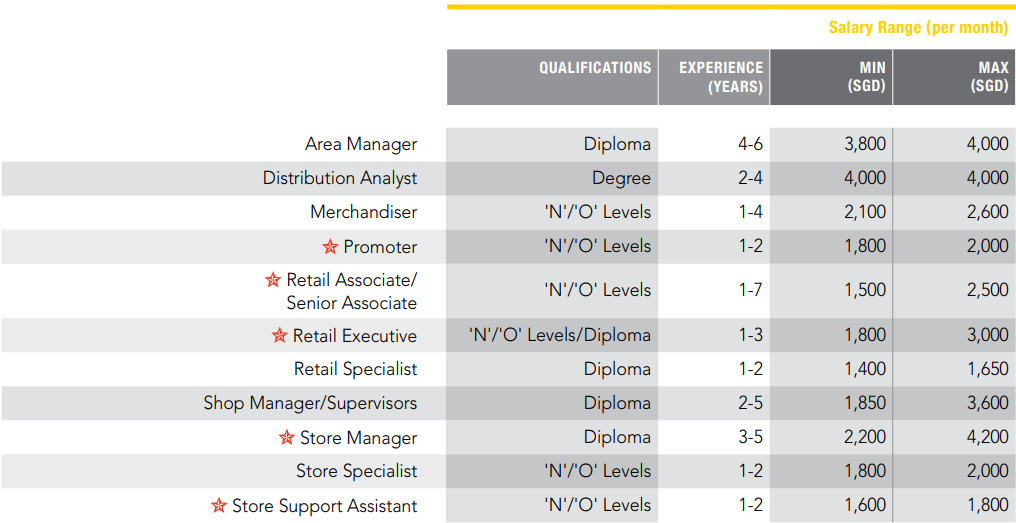

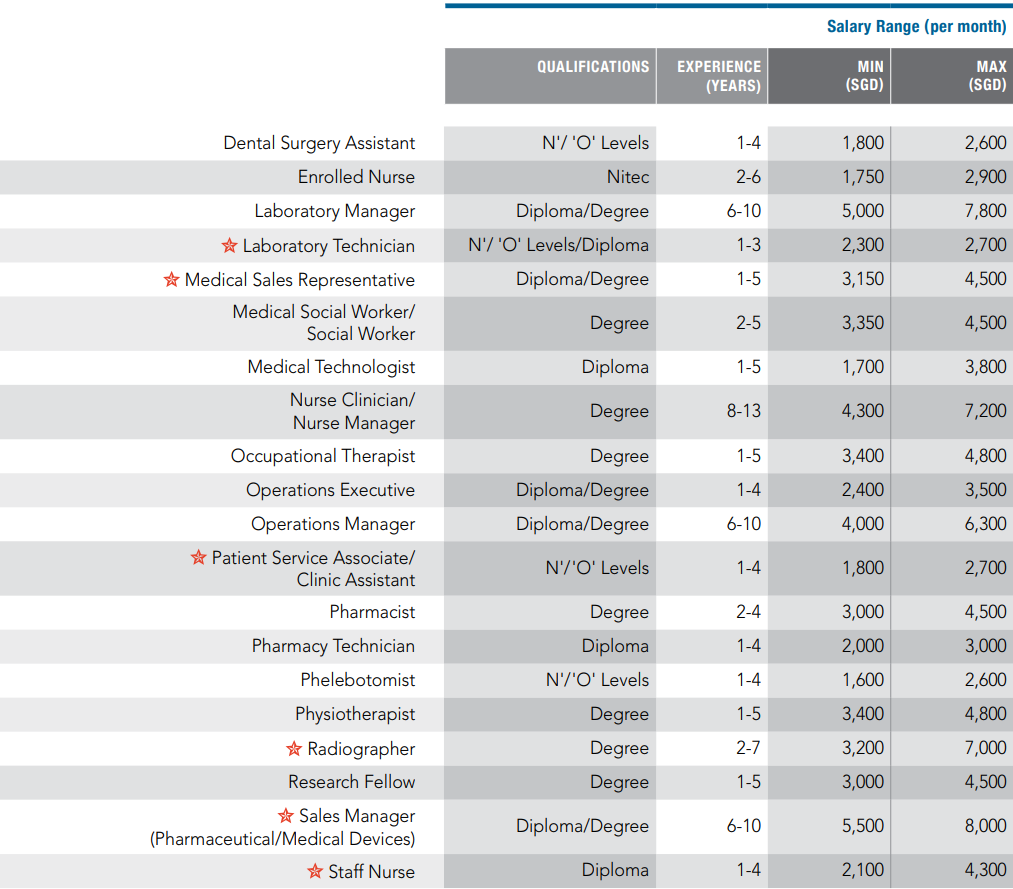

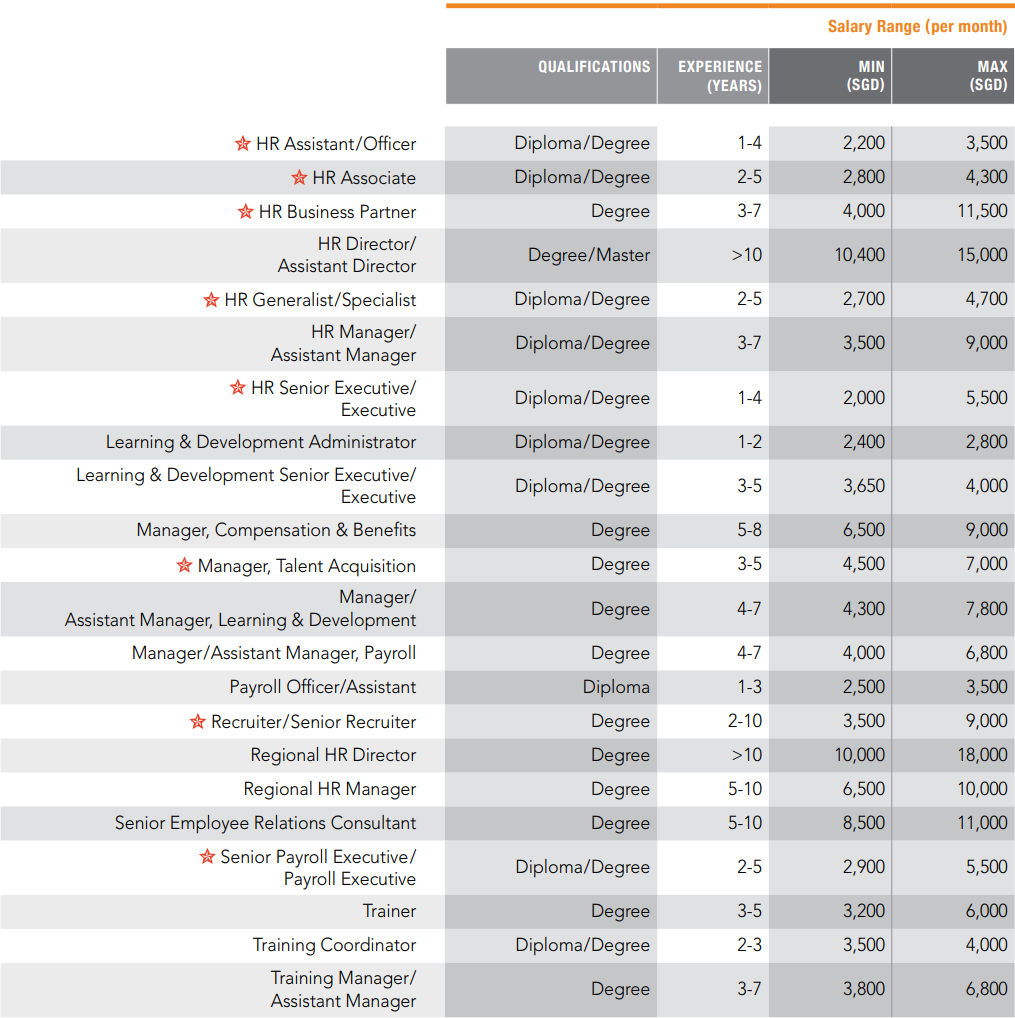

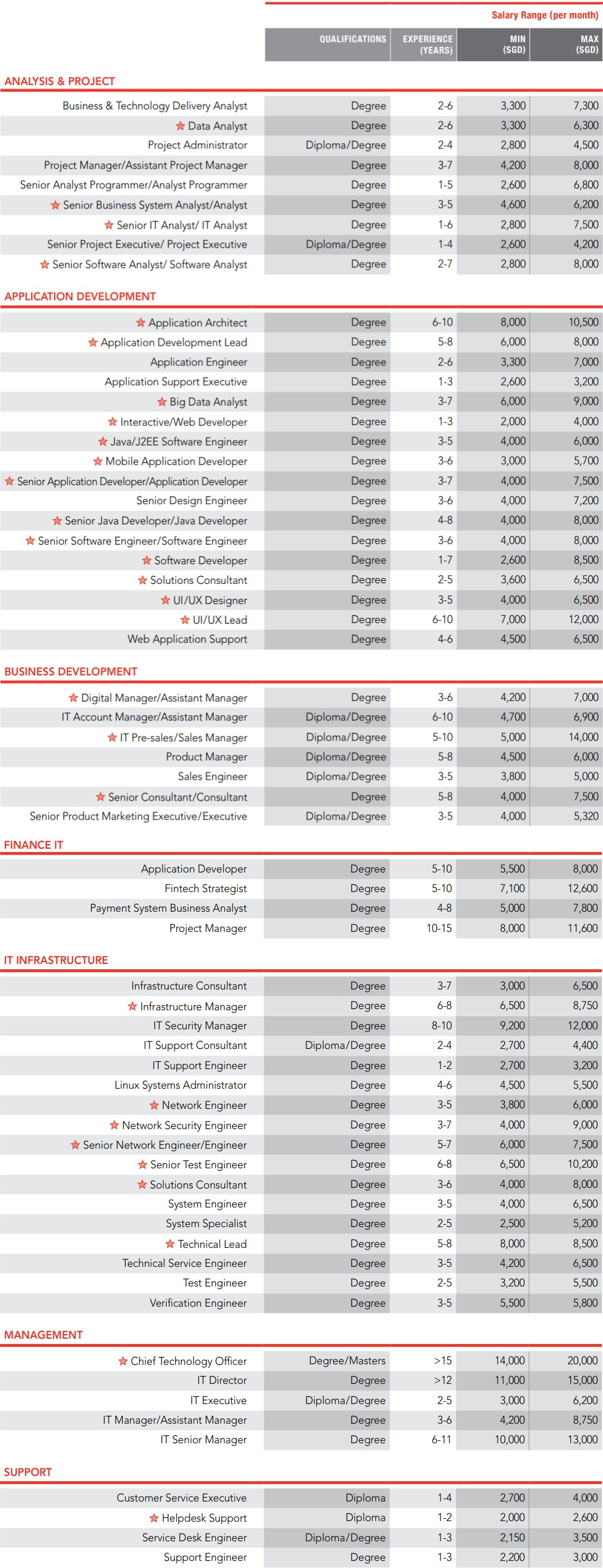

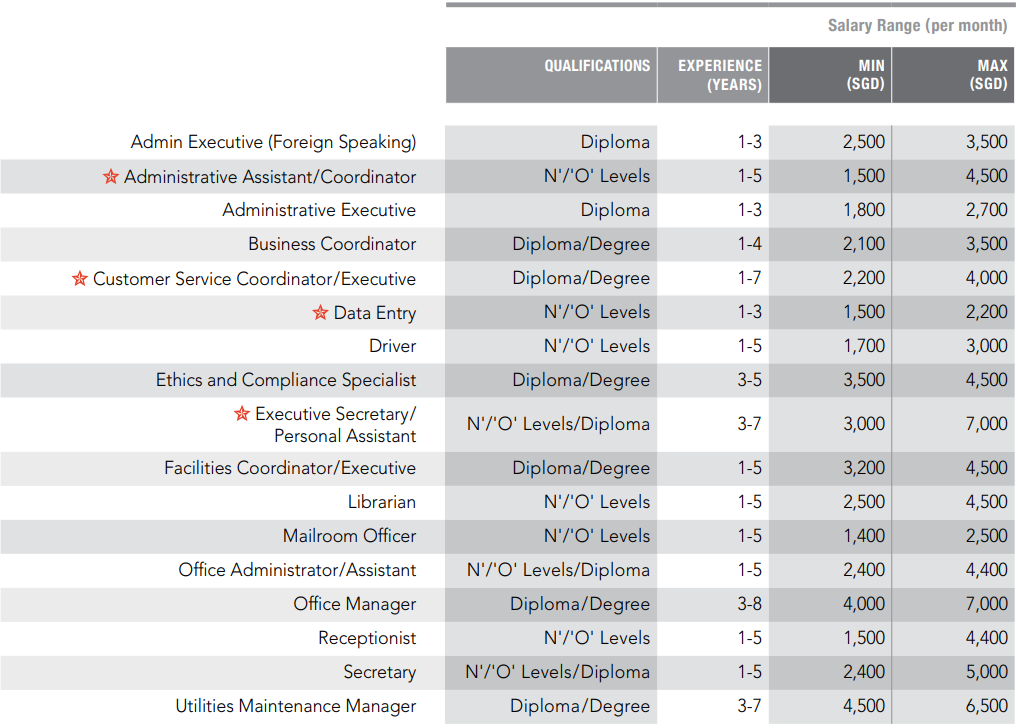

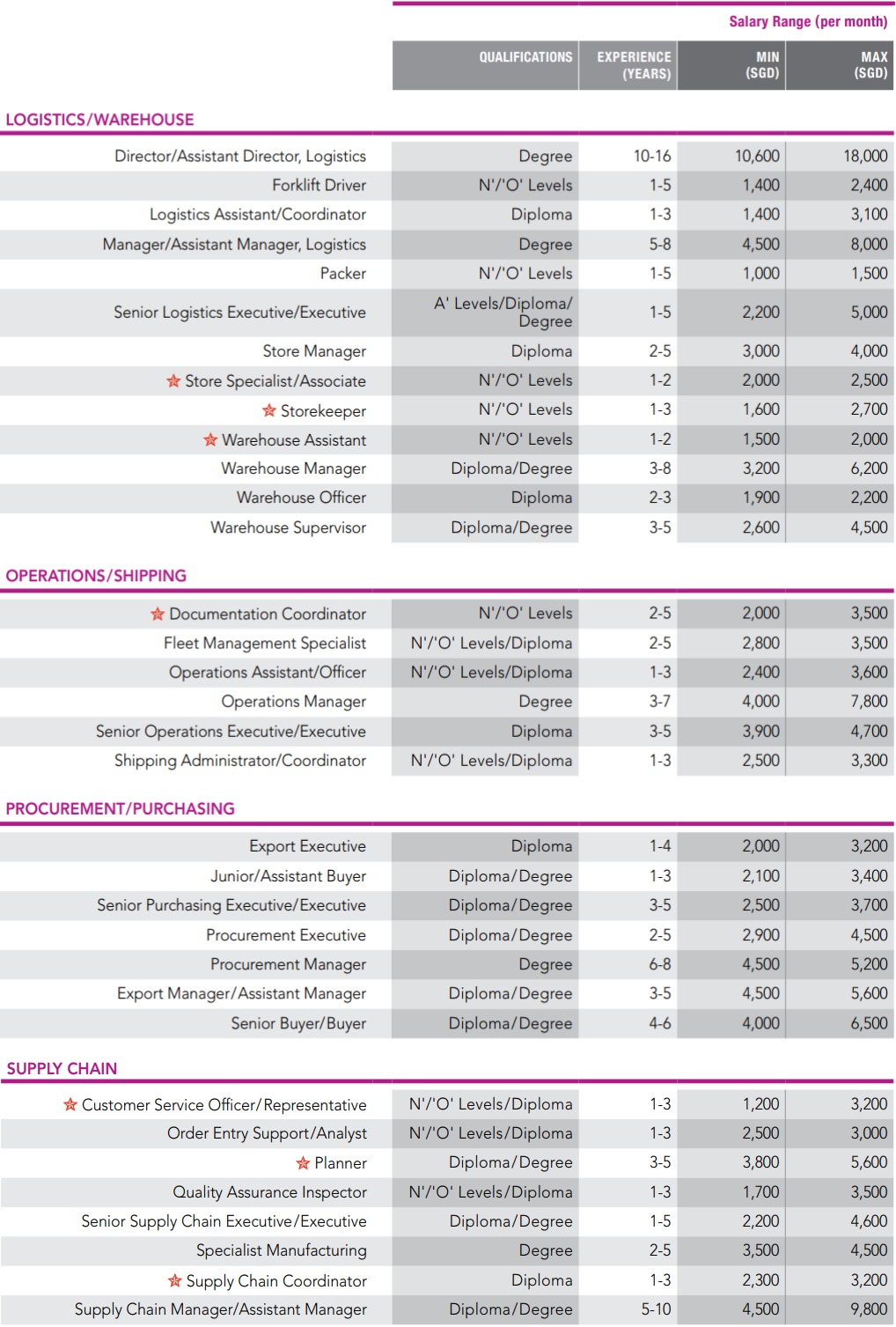

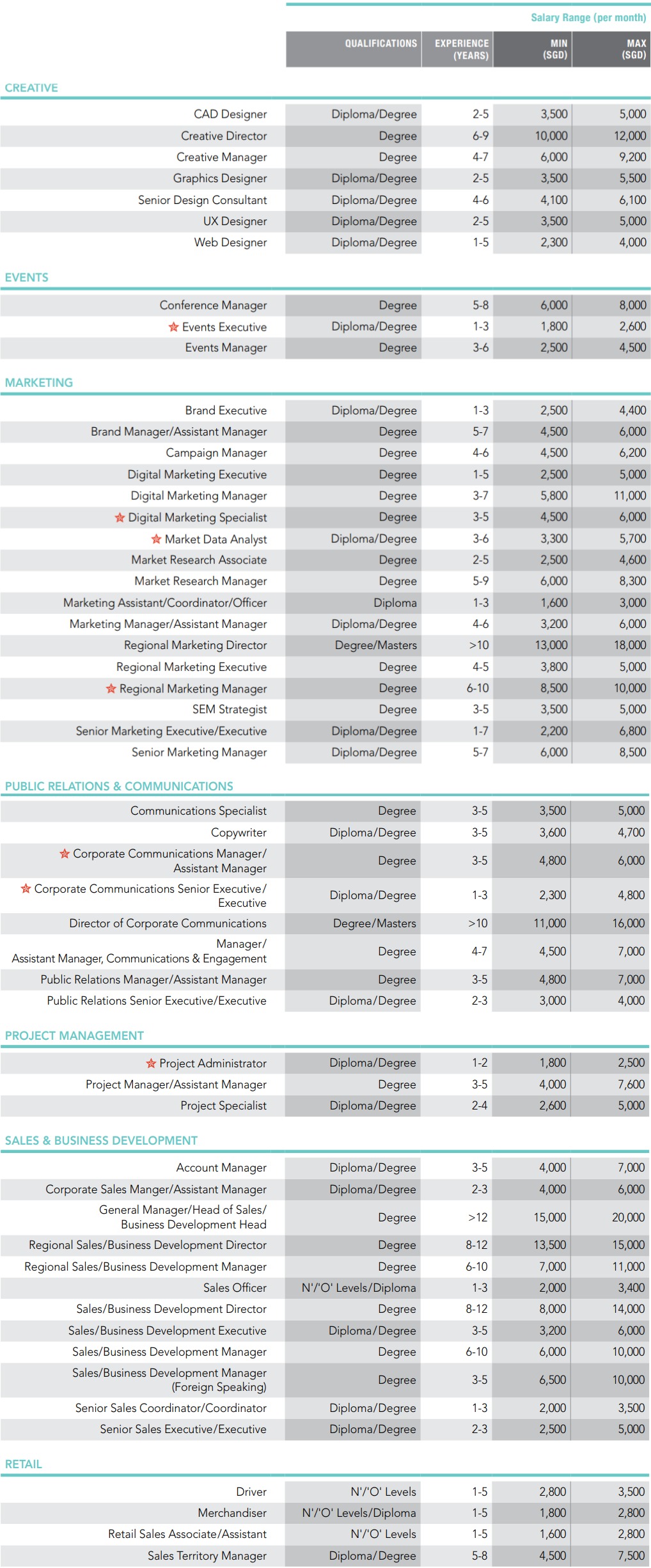

#3: KEEP ADVANCING IN YOUR CAREER PATH

Developing your skill set occurs in your twenties. In your thirties, you will need to apply these skills to increase your earnings. Start by researching potential career paths and identifying companies where you can fit in. If you have the resources, you can go back to school to further your studies. Alternatively, you can take free online courses to boost your career.

Related Post: 5 Websites Where You Can Learn For Free

#4: YOU SHALL INCREASE YOUR EMERGENCY FUND

The pandemic highlighted the importance of keeping an emergency fund. Having an emergency fund can help cushion the financial blow of unexpected events. If you started an emergency fund in your twenties, you followed the standard rule of keeping at least six months’ worth of your expenses.

Image credits: unsplash.com

As your income increases in your thirties, you should also boost the balance in your emergency fund and take your family in consideration. Make it a habit to save money and to pay yourself first!

#5: HONOR YOUR PAYCHECK

Stop spending your entire paycheck in less than a month! Live within your means and do your best to save a portion of your paycheck to propel your future. Gradually increase the amount you save while decreasing the amount from which you live off.

Use the 60-80% of your income to fulfill your needs and allocate the remaining 20-40% of it to your savings and investments. Transferring the money automatically to your savings ensures that you will not be tempted to use it.

#6: YOU SHALL WRITE YOUR WILL

Do you still think that you are invincible? Try waking up in your thirties after a night of heavy partying! Protect the people you love by writing a will. Without one, others will have the power to decide how to split up your estate and how to raise your children.

#7: YOU SHALL NOT COVET THEY NEIGHBOR’S THINGS

As you reach your thirties, you may find yourself in a place where you tend to compare your accomplishments to your peers. Scrolling through your feed can highlight the milestones that your friends have reached such as purchasing a flat or getting married. You can admire your neighbors’ new car or new job. However, you do not need to stretch your budget to keep up with them. Doing so will ruin your finances.

Focus on your financial goals, live within your means, increase your savings, and do your best to be content. Acknowledge your inner strengths and use it to succeed!