It is amazing to start the Lunar New Year with a clean financial slate and increased savings. So, begin the year with a 2015 spending cleanse: short yet impactful exercise to help you clear your mind, focus on your goals, and improve your buying habits. There are no excuses because a short-term intervention (7 days) is a good place to start.

In just a week, your financial awareness can help you stop spending on unnecessary items and eventually help you break the bad habits. Try these 3 Spending Cleanse Ideas and come out more motivated, focused, and richer.

You must first figure out a budget plan that helps reach your financial goals before starting the cleanse. Seek guidance from family, friends, or YouNeedABudget.com.

1. ELIMINATE THE UNNECESSARY

Plan: Identify a category where you are overspending then, slash that problem area.

Purpose: To allocate more money for shopping, emergency fund, and savings.

If you a person who does not pack for lunch and only go for local restaurants, gourmet counters, and coffee shops everyday then your expenses can take about S$450 of your income. With this cleanse, you will have to go on cold turkey and avoid buying for outside food for 7 days. You will find yourself save more afterwards.

Just by reducing expenses in one category such as switching back to basic cell phone plan; you can save up for your dreams in just a few years. It is so simple! There is no sense if you go back to your unpleasant ways.

2. HAVE AN “AUTO-SAVE” SYSTEM

Plan: Program regular account transfers to help you reach your goals while having a busy schedule.

Purpose: To save money for retirement, emergency fund, and vacations before you spend it all.

Contemplate upon your budget and begin writing a list of the things you want to save for from your needs (e.g., emergency fund) to your wants (e.g., Christmas vacation in Paris). Divide your income to the needs first then, divide what is left to your wants. You need at least two bank accounts: one for your needs and one for your wants. The next step is to set up automatic transfers or direct deposits that will move your money into each account on payday.

3. NO MORE PLASTIC CARDS

Plan: Withdraw the week’s spending from the bank in cash. When it is gone…it is gone.

Purpose: Saying no to credit cards will cut down the impulse purchases.

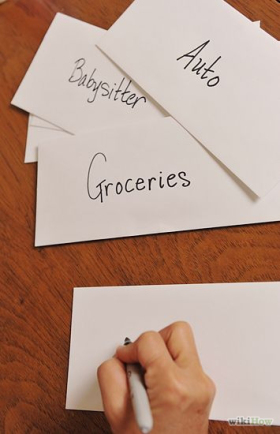

Most people talk about how important their long-term financial goals are but their regular buying decisions do not support their goals. This cleanse will have you keep your credit and debit cards at home so you can easily notice when you are losing money for every purchase. Before the week begins you must spare 25% of your income and divide it to your spending categories and put all in different envelopes.

This will be your only allowance for the whole 7 days and all for purchases shall only come from it. Research showed that the act of relying to cash for spending makes you savor the paying process, think more, and spend less. Trust me, it works.