Wedding planners or coordinators are consultants that work very closely with you to create your dream wedding.

Hiring a wedding planner in Singapore is not as expensive as you think. You see, you can opt for their on-the-day expertise and use them as support for a few hours. Although you are paying for a few hours, the wedding planners offer a variety of services. These services include creating your seating plan for your guests, hosting your ceremony, contacting your vendors, and more.

For couples who reside in Singapore or couples who plan to have a destination wedding here, getting a wedding planner on board the journey may help you overcome the wedding blues!

3 Things to Consider Before Getting a Wedding Planner

Discuss these things with your partner. You will be able to move forward with your wedding planning once you figure out your budget, priorities, and time allowance.

1. BUDGET

Apart from deciding the overall budget for the wedding, you must decide how much you are willing to set aside for professional help. The price range for a planner depends on the scope of service you require. Your budget will determine the scope of help you can get.

2. PRIORITIES

What are your prenuptial and wedding priorities? Do you want to experience a stress-free wedding planning, or do you want to ensure that your wedding is Instagram-worthy? Logistics may be important for you and your partner too. So, identify what is most important to you.

3. TIME

How much time do you have left before getting married? Are you willing to set aside your commitments to focus on wedding planning? This would include sourcing for vendors, creating the guest lists, establishing a ceremony theme, shopping for essentials, and communicating with the guests.

3 Benefits of Having a Wedding Planner

Wedding planning can make you experience a roller-coaster of emotions. A wedding planner can help you create your dream wedding celebration and bring you other benefits.

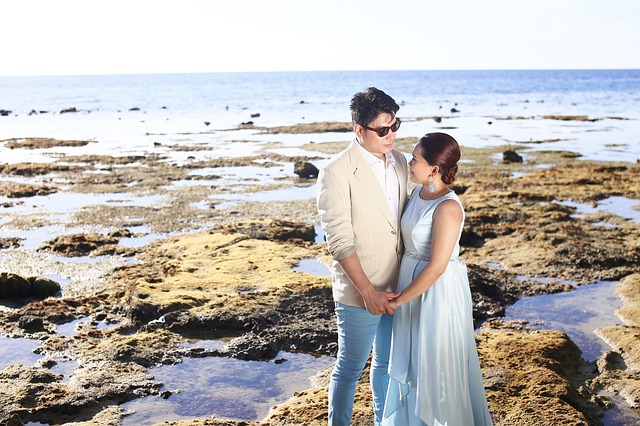

Image Credits: pixabay.com

1. RELIEVING STRESS

Leaving the most stressful tasks to the hands of a trustworthy wedding planner will allow the bride and groom to fully immerse themselves in the bliss of the moment. You do not have to think of the trivial details alone. A competent wedding planner will ensure that every detail is executed according to the plan. Moreover, the planner can play an important part in creating your dream wedding celebration.

2. INCREASING YOUR NETWORK

When looking for professionals to provide hair, makeup, floral, or catering services, there are many individuals with competent skills and elaborate marketing strategies. How should you begin your search? A good wedding planner would have the best network of suppliers that would suit your requirements. For couples who have a tight budget, wedding planners can help you avoid getting ripped off by vendors.

3. EXPANDING YOUR LOCAL GRASP

Having a Singaporean wedding planner will allow you to reap the benefits of their local expertise. There are many beautiful indoor and outdoor locations for holding a wedding ceremony, and Singaporean wedding planners would know the good places to do so.

3 Singapore Wedding Planners

Here is a list of skilled wedding planners in Singapore.

Image Credits: pixabay.com

1. CHÈRE WEDDINGS & EVENTS

Chère has left a mark on over 100 happy clients that have trusted their planning to a team of experts. Whether you are planning a gala dinner with thousands of guests or an intimate wedding reception, you can seek their help.

Website: www.chere.com.sg/

2. SPELLBOUND

Spellbound has over 18 years of experience. With its years of experience in event management and planning, you can expect that Spellbound has the right set of networks to help you plan for your wedding. You can even ask their team to help you plan for a destination wedding.

Website: www.spellbound.com.sg/

3. TE PLANNER

Te Planner provides an abundance of different packages, allowing the clients to select the best option for them. Couples can choose from an all-inclusive wedding package or a venue décor package. Te Planner will help you to design your wedding, exactly how you envisioned it.

Website: teplanner.com.sg/