All of us will likely end up making an investment decision that we will regret in the future. Despite how calculated your moves are, no investor is perfect. However, there are some errors that people have made in the past that you can learn from and avoid.

On that note, here are five critical investing mistakes to avoid at all costs.

#1: INVESTING WITHOUT ESTABLISHING AN EMERGENCY FUND

Having a sense of financial security in case your investment and other life choices go awry is important. Before you begin investing, ensure that you have established an emergency fund. To get an idea of how much you should set aside, you should first calculate your monthly expenses.

If you are single and primarily responsible for your own well-being, you can have at least three months of expenses saved up. If you have a family, you must aim to have at least six months’ worth saved up to be on the safer side.

#2: PUTTING ALL YOUR SAVINGS INTO CRYPTO

The buzz about cryptocurrency can attract both aggressive and conservative investors. Reports of incredible gains in the crypto sector dominate the financial news, with uniquely named tokens such as Shiba Inu posting returns of forty-three million percent in 2021 alone. Hearing these types of returns can tempt the investors who are looking for a quick buck and are drawn to cryptocurrency.

While there is nothing wrong with investing a portion of your wealth in cryptocurrency, putting your savings into a single investment comes with elevated levels of risk. What will happen to you if cryptocurrency plunges down?

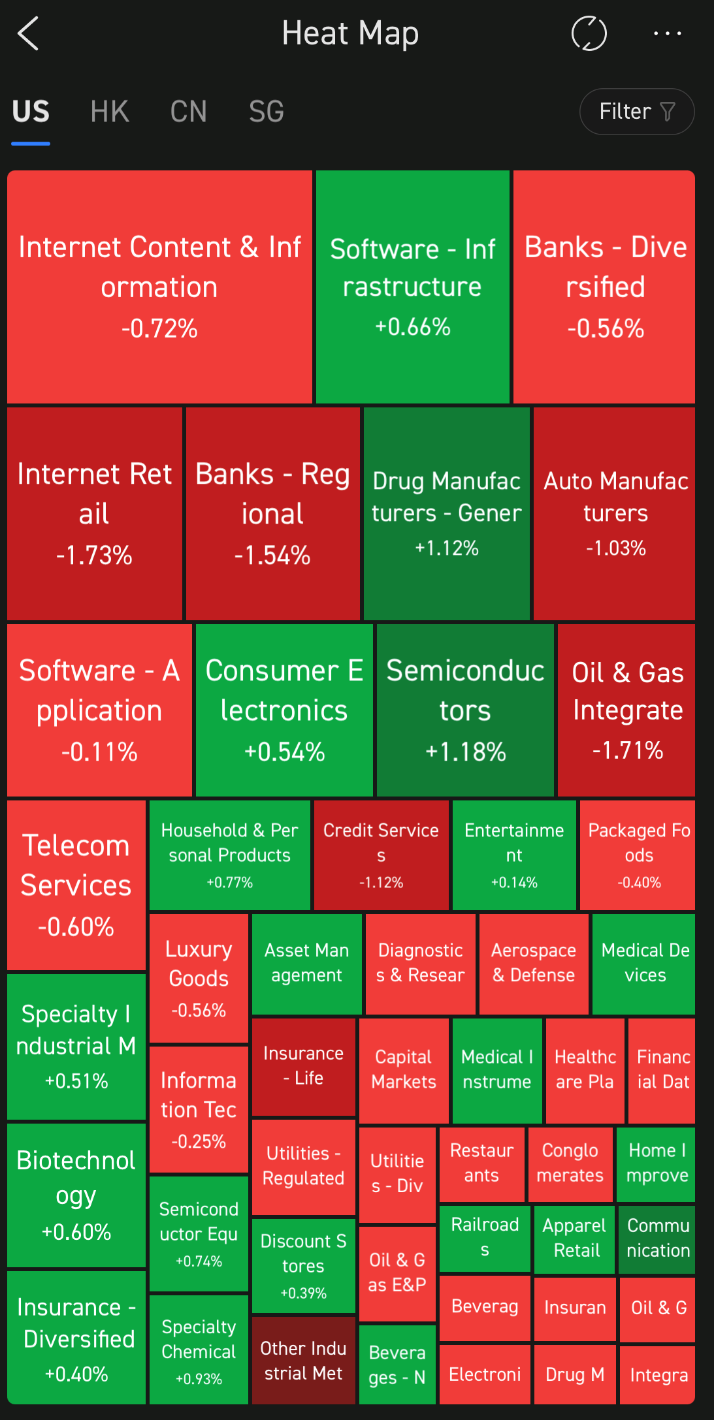

#3: TRYING TO TIME THE MARKET

Timing the market consistently over the long run is close to impossible. Investors may think that they can always time the market, but you must be realistic. As the saying goes: “Time in the market is more important than timing the market.” Instead of timing the market, you can take a dollar-cost averaging approach.

The dollar-cost averaging approach will enable you to invest at set, regular intervals regardless of the prices of your stocks at the time. You can take emotions out of the situation and stick to your schedule with this investment approach.

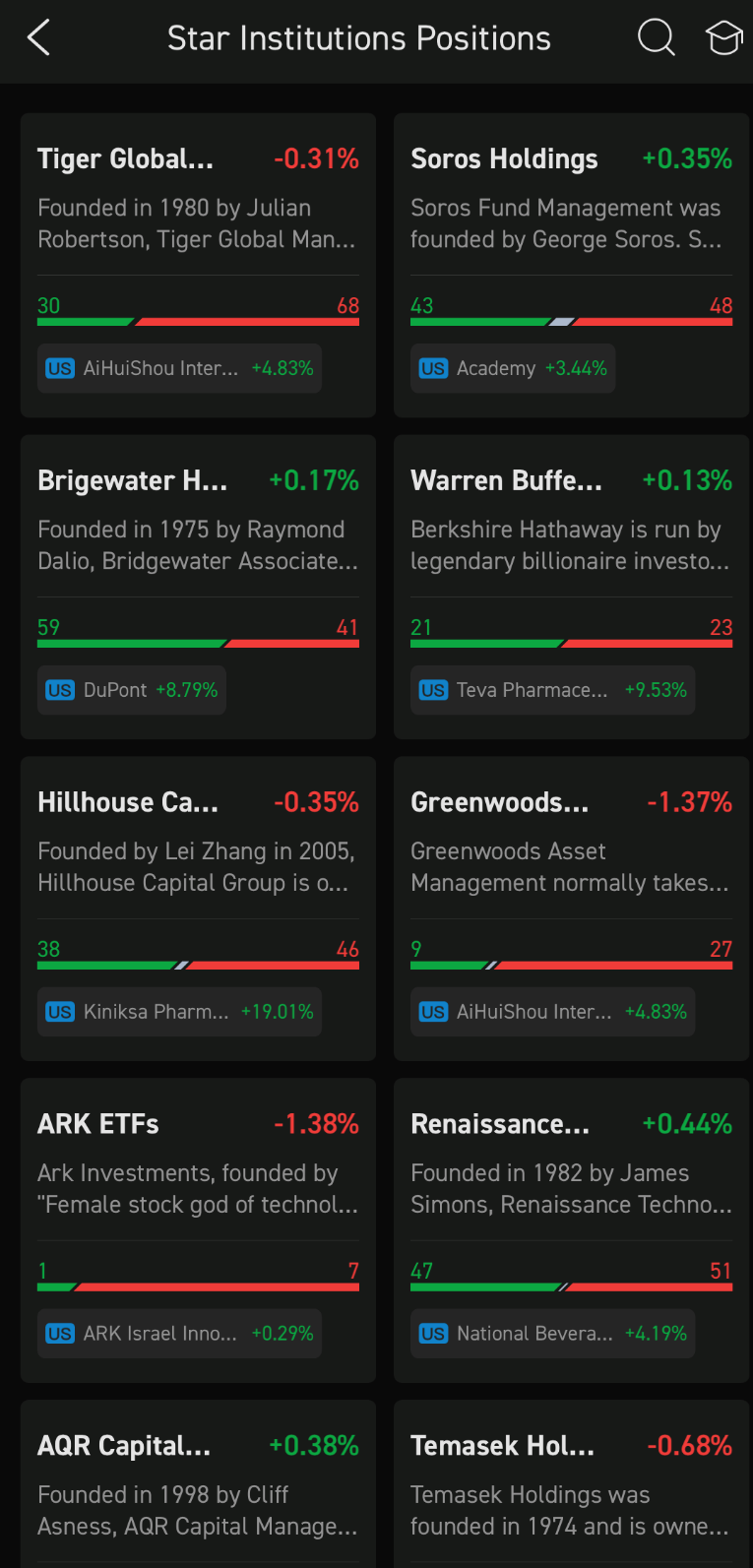

#4: FOLLOWING THE FAD

Keeping up with the investment trends can be a dangerous investment “strategy”, but it can be even riskier as we head towards the end of 2022. For instance, many investors were drawn to cryptocurrency as they were the most prominent highflyers in 2021. You must assume that others will continue to buy and push the prices up even higher, but it is difficult to decide when to sell.

Be cautious when it comes to investment trends. If you feel the need to follow the fad, just invest a small percentage of your overall portfolio.

#5: INVESTING WITHOUT A WRITTEN PLAN

Step towards 2023 with a plan on hand! As an investor, it is easy to think that investing resembles a casino. In reality, the long-term returns of the stock market are relatively reliable. To attain reliable returns, however, you will need to develop and follow an investment strategy.

Image Credits: pixabay.com

Investors are wired to be in the market when it is making new highs, but no one wants to buy if it is dropping to new lows. Having a written investment plan can help you prevent investing based on your emotions. Sticking to the written investment strategy will help you guide your decisions and follow the path of long-term financial success.