Ask us questions, discover the latest offers & more on Telegram.

We’ve got some thrilling news for you! SingSaver and SCB are teaming up to bring you an exciting Lightning Deal!

From 28 March to 7 April 2024, you have the chance to seize fantastic prizes like the PlayStation 5 Disc Version (worth $799) or the Dyson Airwrap (worth $859). Act fast, as the deal kicks off on 28 March at 3 pm!

Here’s what you need to know:

- The first 500 applicants for the Standard Chartered Simply Cash Credit Card from 28 Mar, 3pm, will have the privilege to choose between these amazing rewards.

- To qualify, spend a minimum of S$500 within 30 days of card activation and approval.

Winners will be announced on SingSaver’s contest winners page by September 2024.

Don’t worry if you are not the first 500! You can still choose from exclusive SingSaver gifts, such as:

- Dyson SuperSonic (worth S$699)

- Nintendo Switch OLED (worth S$549)

- Apple iPad 9th Gen 10.2 Wifi 64GB (worth S$508.30)

- S$330 cashback and up to S$90 e-Capita Voucher upon activating and spending a minimum of S$500 within 30 days of card approval.

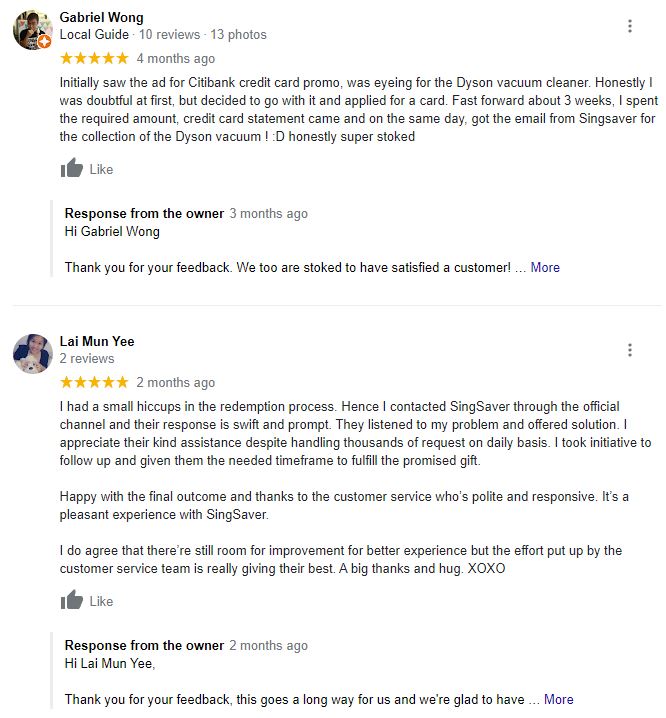

For those who are unfamiliar with SingSaver, you can check out their reviews on Google:

Apply Now

Standard Chartered Simply Cash Credit Card

Elevate your financial journey with the Standard Chartered Simply Cash Credit Card, a gateway to a world of exciting possibilities and unbeatable rewards. Imagine earning a generous 1.5% cashback on all your expenditures, transforming your everyday transactions into a treasure trove of savings. But the benefits don’t stop there – this card is designed to revolutionize the way you manage your finances. Whether it’s settling your IRAS dues, investing in education, securing insurance coverage, or managing rental payments, the Simply Cash Credit Card showers you with not just cashback, but also reward points and even bonus interest.

First 500th applicant: Receive a PlayStation 5 Disc Version (worth S$799) or Dyson Airwrap (worth S$859) or S$500 e-capita Vouchers

501th applicant onwards: Receive a Dyson SuperSonic (worth S$699) or Nintendo Switch OLED (worth S$549) or Apple iPad 9th Gen 10.2 Wifi 64GB (worth S$508.30) or S$330 and get up to S$90 e-capitaland voucher

Requirements: Activate and spend a minimum S$500 within 30 days of card approval. New-to-bank customers.

How to redeem your rewards:

- Search for any of the cards that matches your spending habits

- Click on Apply Now and Enter your email address on the new page (SingSaver will be sending the redemption instructions here. Check SPAM folder if you don’t receive any emails)

- Click Apply via SingSaver’s unique link

- Complete the application form from the bank and remember to take a screenshot upon completion so you can take note of the application reference number (ARN). Here’s where to find it.

- Submit your Rewards Redemption Form and Choose your preferred rewards and submit the form.

- Important: If you did not received the Rewards Redemption Form, please check your SPAM folder in your email OR drop and email to [email protected] with your application details.

- Once you fulfill all the requirements (i.e. meeting the $500 mininum spend in 30 days from card approval), please allow some time for SingSaver and the bank to validate. Click here to understand more about the process.

You may also click here to check on the rewards redemption status.

For redemption follow-ups and enquiries, drop an email with your details to [email protected]

This promotion is not affiliated, associated, authorized, endorsed by, or in any way officially connected with Sony, Apple, Dyson, Nintendo or any of its subsidiaries or its affiliates. The names Sony, Apple, Dyson, Nintendo as well as related names are registered trademarks of their respective owners.