Healthy eating is an active choice to improve one’s lifestyle. It is not about total dietary restriction and remaining thin. Rather, it is about having more energy and feeling better about YOU!

If you find it difficult at first, fear not because you are not alone. Taking this healthier road one step at a time will surely go a long way. Once you embraced healthier eating, you cannot only be fitter but also richer. As you cut back the unnecessary, you can save more money for important things such as your child’s allowance. On that note, here are 10 Tips To Eat Healthier And Save More Money…

CONSUME LESS SUGAR AND STARCH

1. Reduce sugar in fruit juices by diluting it with water. Even if it does not contain added sugar such as the pure fruit juices, it is still good to practice this.

2. A bottle of Strawberry Jam at FairPrice retails for about S$3-9.80. You can save that and reduce guar consumption by using minimum amounts of jam or any spread. Apply it thinly and evenly.

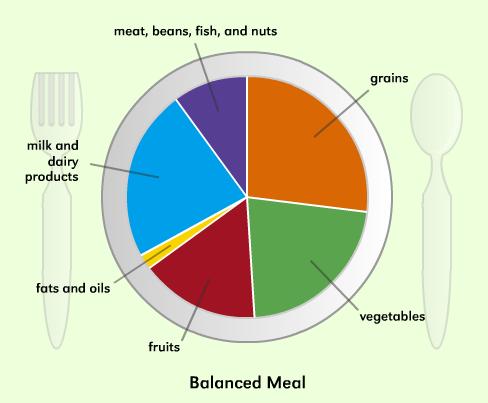

GO FOR REDUCED FATS

3. Did you know that Marigold’s Non Fat Yoghurt is available for S$1.85 while Meiji’s Low Fat Yoghurt is only S$1/pc at FairPrice. Also, milk containing less fat are either the same price or even cheaper than the other types. The point is, you can choose reduced-fat varieties of milk and yoghurt without sacrificing the price.

4. If you are preparing meat, remove the visible fat and the skin off the chicken before you cook.

CONSUME LESS SODIUM

5. You can either reduce or not use salt at all when you are cooking. But, if you want to add more flavors, use iodized salt instead.

6. Want to save more on salt? Gradually reduce the salt you add in your cooking and buy food with lower sodium levels.

INCREASE FIBER INTAKE

7. Eat about 3-4 servings of fruits daily. Banana, orange, and guava are just some of the fruits rich in fiber.

8. It is a known fact that leafy greens are more affordable than lean meat. To eat healthier, eat smaller servings of meat with larger servings of vegetables.

OTHERS

9. Cook more homemade meals instead of buying take-away. For example, cook fish by steaming, grilling, or pan-frying it. Shy away from deep fried food.

10. Lastly, it is no surprise that beer or any alcoholic drinks should be cut down. The recommended consumption should be no more than 3 drinks for men and no more than 2 drinks for women. Reducing your alcohol consumption will not only control your weight but it will also save you more money and lower the risk of cardiovascular diseases.

Source: HeartFoundation.org.nz