In order to decide on how much you shall save, first you must be aware of how much you are spending.

Expenses can be categorized as either fixed or variable. Fixed expenses remain the same every month or year due to Singapore’s laws and Company service-provider terms (e.g. Hand Phone Plan, or HDB Rent). Variable expenses include food, entertainment, clothing, and other expenses that may change every month or year. The challenge now is for you to choose on which expenses you can reduce.

Recording all your expenses, no matter how big or small they may be, can help you plan your budget wisely. This is why; here are the 5 Money Management Apps for all your devices. Best of all? These are handy and FREE!

- EXPENSIFY

(Available on IPhone, IPad, Android, and Blackberry)

Expensify app helps you record your daily transactions, hourly rate, mileage, and generate expense reports. Its SmartScan feature allows you to upload photos or capture your receipts for easy bookkeeping. It also helps you minimize information errors that you may encounter when writing everything down. - EXPENSE MANAGER

(Available on Android)

Another top rated money tracker in Google Play store is the Expense Manager app. It is raved to be simplistic and very easy to use. You may record the type of purchase, the type of payment, the purchasing price, the company the item was purchased from, and the date. The app also allows you to manage multiple accounts in various currencies, to email account activities, and to save it on your SD card. - MONEYWISE

(Available on Android)

MoneyWise app combines minimalist design with powerful functionality. It may seem minimal but it can do a lot! It allows you to generate charts or graphs, track budgets or spending, and create regular account backups. Conveniently, you may export data in CSV or HTML formats that you may send to others via email. - POCKET EXPENSE PERSONAL FINANCE

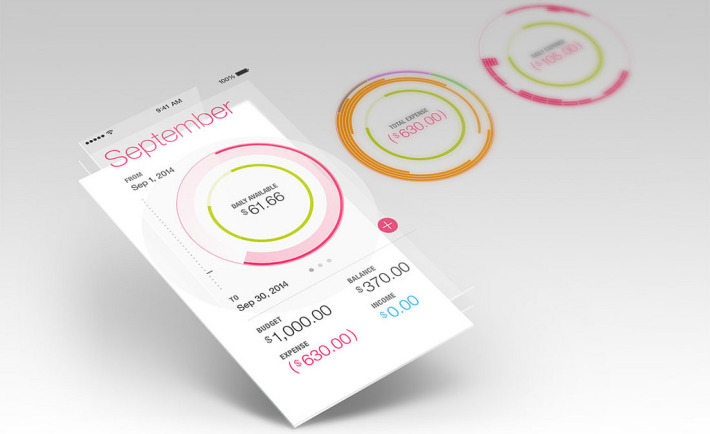

(Available on IPhone and IPad)

Pocket Expense Personal Finance app combines all your financial accounts together so it can track all your bills and set your budgets. This app lets you categorize your transactions through its calendar view. It is the perfect way to organize your income and expense because of its user-friendly and simplistic interface. But most importantly, it is password protected. - MINT

(Available on IPhone, IPad, and Android)

Mint app manages your personal finance accounts (credit cards, loan and investment) on one place through your fingertips. With Mint, you can track your spending, develop a monthly budget, receive bill reminders, and save more money. It is also accessible online through its website. What’s more? It sends online alerts if you’ve gone over your budget.With all these awesome money management Apps, the power to budget and save money is in your fingertips! Make wise money tracking a habit! You won’t regret it.