You probably know how procrastination impacts some areas of your life such as being late for a reunion or getting scolded by your boss because you missed the deadline – again. However, you might not realize that constantly avoiding responsibilities can cost you not only with opportunities but also with money.

There are various reasons why people procrastinate with money and one of them is fear – fear of getting stuck or lost in the path. Then, the “avoider” in you will just make excuses in order to delay the tasks for a while or for a lifetime.

To illustrate how procrastination cause money loss, here are some examples:

1. WHEN PENALTIES PILE UP

Late payment fees, late return fees, reconnection fees, and other penalty charges may seem small at the moment but these things add up. For instance, if you borrowed a book in your school’s library and you failed to return it 1 month after the deadline then, the price you paid for late fees might be more costly than the book in the first place.

Also, being late in paying your credit card can cost you each day. Add that to the interest!

2. NOT TAKING PREVENTIVE ACTIONS

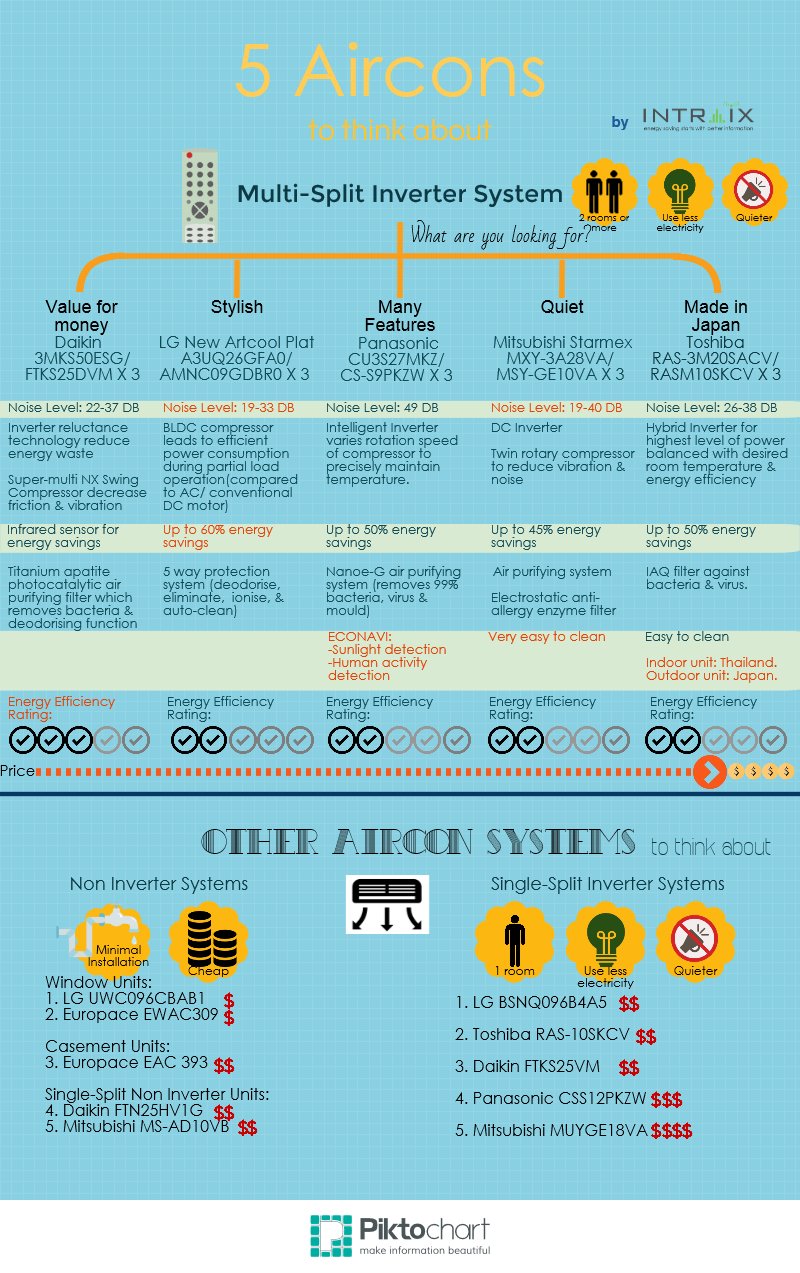

Preventive actions such as regularly going for health screening especially when you are in your 40s, can help detect or treat serious diseases. Waiting will do nothing but cost you for medical bills later. Some expensive repairs that can also be prevented by check-ups are: air conditioner’s filter maintenance and car’s tires maintenance.

3. LAST MINUTE SHOPPING

People are often to be less conscious of the price tag if they are shopping under pressure. Waiting the last-minute to purchase for anniversary gifts or weekend travel tickets can make you opt for the high-priced ones just to get it over and done with!

These examples are just some of the reasons why it is important to beat procrastination with all strength! Do it by following these tips:

1. AWARENESS

Constantly remind yourself that there are tasks to be accomplished and determine what phase you are on. It is easier to track your tasks by making a simple “to-do list” that even includes the tasks you are avoiding to pursue. Then, write the deadlines together with every task.

2. REMOVE THE DISTRACTIONS

The quickest way to stop procrastinating is by eliminating the possible distractions. Learning to reduce, ignore, and remove the unnecessary choices can be beneficial as you are able to make better choices.

For example: if you want others to read your blog, stop distracting them with buttons and ads. Also, if you want stronger arms, stop wasting your energy on Single-Leg Glute Bridge or other exercises that are not in lined with your goals.

3. REWARDS AND PUNISHMENTS

Create a reward and punishment system. Rewards (e.g., eating your favorite dessert) should only be given if you finished a task while consequences (e.g., no access to ice cream for a week) should be given whenever you avoid your task.

4. GET SERIOUS

Ask a your friend or your partner to help you complete the task. They should guide you and warn you when you deter form the task at hand. Focus on the success and happiness you will achieve after you finished your “to-do list”.