6 best-rated accommodations in Hanoi, Vietnam, to book a stay in H2 of 2025

How about a trip to Hanoi for the rest of 2025?

Top sights like Hanoi Opera House, Thang Long Water Puppet Theatre, and more are begging you for a visit.

If you’re planning to fly to the capital of Vietnam, you will need a place to stay, so why not consider your options from this list?

Hanoi Le Chateau Hotel & Spa

Agoda Rating: 9.7 (2.8K+ reviews)

We will start the ball rolling with one of Hanoi’s newest gems in the Old Quarter.

Fresh from its 2024 build, the Hanoi Le Chateau Hotel & Spa is a five-star hotel with an exceptional 9.7 guest rating.

This accommodation puts you a 10-minute drive from Ngoc Son Temple and 21.1 km from the airport.

Spread out in the 65-square-meter Premier Suite if you value space; families will appreciate the connecting suites, while travelers can cozy up in the studios.

CLASSYC Hotel

Agoda Rating: 9.6 (2K+ reviews)

This newly minted CLASSYC Hotel has already caught the attention of travelers, earning top choice from Agoda guests in 2024.

You will find yourself positioned just 1.5 km from the Hanoi Opera House, while the airport is about 21 km away.

The hotel’s premium connecting rooms make group stays more enjoyable.

For those seeking space and comfort, their Duplex Suite offers two bedrooms and a separate living room.

Meritel Hanoi

Agoda Rating: 9.5 (5.3K+ reviews)

If you book a stay at this 5-star hotel, the Hanoi Train Street would be just a 5-minute stroll away.

The hotel’s family connecting suites make group stays easy, and kids 11 and under stay free when using existing bedding.

The airport is about 21.5 km away.

FYI, this accommodation opened in 2022, so it’s fairly

Carillon Boutique Hotel

Agoda Rating: 9.5 (4.8K+ reviews)

Tucked away in Hanoi’s Old Quarter, this boutique hotel proves that stars don’t tell the whole story.

Despite its 3-star rating, the Carillon Boutique Hotel has won the hearts of over 4K travelers with an impressive 9.5 rating, earning it a spot as Agoda’s top choice for 2024.

Banh Mi lovers will be glad to know that they will be just 3 minutes away from Vietnam’s original Banh Mi at Banh Mi #1 Bon Mi.

Their Deluxe Double or Twin Room options are suitable for solo/buddy travelers, while their Suite Queen and Junior Suite with Terrace options offer more spacious stays.

Salute Premium Hotel & Spa

Agoda Rating: 9.5 (4.7K+ reviews)

The Salute Premium Hotel & Spa has snagged a top choice award for Agoda travelers in 2024.

It’s less than 2 km from the Imperial Citadel of Thang Long, anyway.

Families can go for spacious rooms and suites designed for group stays, while solo budget adventurers can go for their Superior Double Room (while windowless), a more wallet-friendly option.

Scent Premium Hotel

Agoda Rating: 9.4 (7.7K+ reviews)

The Scent Premium Hotel sits approx. 400 m from the Lotus Water Puppet Theater.

Solo adventurers and traveling buddies will feel right at home in the Superior Room or Deluxe with Window options, while families can consider the 40-square-meter Family Room.

Speaking of which, little travelers 5 years old and under stay free when using existing bedding.

SG60 Must-Haves: Top Freebies, Vouchers, & Collectibles

Singapore’s 60th year of independence brings more than just fireworks. From vouchers to nostalgic collectibles, establishments are offering thoughtful perks that reflect both heritage and innovation.

Start with this roundup of the top SG60 redemptions and promotions worth your attention!

FREE NDP PACKS AT GARDENS BY THE BAY

On 9 August, Gardens by the Bay will be giving away specially designed National Day packs from 4:15 PM to 7:00 PM at The Meadow. These packs include snacks, eco-friendly items and artwork created in collaboration with persons with disabilities. Registration through the Gardens Rewards platform is required.

Image Credits: gardensbythebay.com.sg

Each pack is limited to one per Singapore resident aged 13 and above, and must be collected in person.

PRATA FOR S$0.60 AT SPRINGLEAF PRATA PLACE

To mark the SG60 celebration, Springleaf Prata Place is offering selected Prata dishes at just S$0.60, with Murtabak options available at S$6. These deals are available until 4 August across participating outlets (T&Cs apply).

SG60 VOUCHERS FOR ELIGIBLE SINGAPOREANS

Singaporeans aged 21 to 59 can start claiming S$600 worth of CDC vouchers from 22 July 2025. Half the amount can be used at heartland merchants, with the other half available for supermarket purchases. Seniors aged 60 and above have already begun redeeming S$800 in benefits. All vouchers are valid until 31 December 2026. This is part of the Assurance Package to help with cost-of-living pressures and to support local spending.

In addition, every Singaporean will receive a commemorative postcard by mail, featuring one of six unique designs.

Image Credits: gov.sg

UNIQLO & YA KUN KAYA TOAST’S CULTURAL CAPSULE

Uniqlo is teaming up with Ya Kun Kaya Toast to release a series of UTme T-shirts featuring prints inspired by Singapore’s coffee shop heritage. The collection launches on 1 August, and from 1 to 10 August, shoppers who spend at least S$100 at Uniqlo can receive a complimentary keychain set. Ya Kun will also offer these keychains from 6 August for S$6 each.

STARBUCKS’ LOCAL GAME WITH A TWIST

Beginning 23 July, Starbucks customers can purchase exclusive game sets inspired by classic local childhood games such as Five Stones and Slides and Ladders. These SG60 edition items are available for an additional S$6 with any purchase, and are expected to sell out quickly given their limited release.

Image Credits: facebook.com/StarbucksSingapore

This year’s SG60 promotions reflect a deliberate mix of culture, community and consumer value. What are you waiting for? Mark the dates to enjoy the celebration in your own way!

Disclaimer: All deals, redemptions, and promotions mentioned are accurate at the time of publication but may be subject to change at the discretion of the respective establishments, merchants, or organizers. Terms and conditions apply. All offers are available while supplies last.

How You’re Losing Money on Groceries Without Realizing It

You may think you are getting smarter with your grocery budget. You plan your meals, wait for sales, use loyalty apps, and even buy in bulk. But quietly and consistently, your money is slipping away. And it is not just because of rising prices.

Grocery shopping in Singapore, whether at NTUC FairPrice, Sheng Siong, Cold Storage, or online via Shopee and RedMart, is filled with unseen pitfalls that are easy to overlook but costly in the long run. From clever packaging tricks to misleading promotions, the system is designed to make you spend more while thinking you are saving.

THE DISAPPEARING QUANTITY

One of the most common traps is shrinkflation, where products shrink in size but retain their original price. In the past year, a number of shoppers have reported that a 500g tub of yogurt is now just 450g, still priced at S$5.20. A bottle of cooking oil that used to be 2 liters now comes in a 1.8-litre bottle, selling for the same S$8.90.

Even staple items like rice and instant noodles are affected. A bag that once weighed 5kg might now weigh 4.5kg, repackaged to look identical. Unless you are carefully checking labels and unit pricing, you are paying more for less without even realizing it.

PROMOTIONS THAT MISLED

The psychology of discounting is powerful. A promotion that says “now S$9.95, was S$13.50” looks like a bargain, but several readers have reported that the “original price” was never actually charged.

Image Credits: unsplash.com

One consumer documented how a popular brand of rice was sold for S$27.90 on Shopee with a “limited-time offer” sticker, yet just days earlier it was listed at S$25.30 without any fanfare. At a supermarket, a shelf label advertised “Buy 1 Get 1 Free” toothpaste, but the single pack had been quietly marked up by 20% compared to the previous week.

Another example involved imported fruits like blueberries and cherries. While the label screamed “Special Price,” the per-gram cost was actually higher than at wet markets or smaller grocers in areas like Yishun or Bukit Merah. The discount looked convincing, but the reality was not.

HIDDEN COST OF CONVENIENCE

Grocery delivery platforms have boomed in Singapore, especially since the pandemic. While they offer undeniable convenience, they often come with hidden charges that quietly add up.

Users who signed up for RedMart’s delivery subscription found themselves paying S$5.99 monthly for “free delivery” but some only ordered once or twice a month. In practice, that convenience came at a steep price per trip.

More subtly, prices of fresh produce and everyday items tend to be higher on online platforms. A user who compared prices found that a dozen eggs listed at S$3.30 in-store was S$4.10 on Shopee, even before delivery charges. A pack of Japanese cucumbers was S$1.50 more expensive on a grocery app compared to its shelf price at FairPrice. You are not just paying for convenience. You are also paying for markups that are easy to miss.

IN A NUTSHELL

Even without splurging or making impulse buys, shoppers are quietly losing money to subtle strategies built into the grocery system. Smaller product sizes, misleading sale tags, and hidden online markups all add up.

Image Credits: unsplash.com

Smart shopping now means more than sticking to a list. It means staying alert, comparing prices, and questioning deals that look too good to be true.

Why More Singaporeans Are Calling Johor Bahru Home

For years, Johor Bahru (JB) has played the role of Singapore’s unofficial backyard, a place for weekend getaways, late-night suppers, and budget shopping. But what was once a short escape is fast becoming a long-term strategy. An increasing number of Singaporeans are making the move across to JB, not for novelty, but out of necessity.

With the cost of living in Singapore rising at a steady pace, the idea of relocating to JB is gaining mainstream attention. In a 2024 poll reported by The Independent Singapore, 55% of respondents said they would consider moving to JB to cope with growing financial pressure. The attraction is clear: significantly lower housing prices, reduced everyday expenses, and the chance to enjoy a larger living space with fewer financial constraints.

The disparity in property values is striking. According to 99.co, landed homes in popular JB areas such as Bukit Indah, Horizon Hills, or Eco Botanic are priced at around RM800,000, which is approximately SGD230,000. At this price point, buyers can expect multiple floors, a car porch, and a backyard. In Singapore, the same amount might only cover the initial down payment for a small condominium.

Cost savings extend well beyond housing. Monthly expenses such as groceries, petrol, and dining are often up to 50% lower in JB compared to Singapore. For young families, retirees, and those working remotely, this opens the door to greater financial flexibility. Instead of being burdened by rent and rising utility bills, many now redirect their income toward travel, personal development, or long-term investments.

Lifestyle factors are equally compelling. Singaporeans who have relocated to JB often describe the change as liberating. Many report enjoying a slower pace of life, larger homes, and more quality time with family. One working mother even described the experience as gaining back her life after office hours, a sentiment that resonates in today’s high-pressure environment.

Naturally, there are challenges. The commute across the Causeway remains a hurdle, especially during peak hours. Digital payment systems in JB are still catching up to Singapore’s seamless cashless ecosystem. Healthcare access and public services may also differ in quality or efficiency. However, for those who have made the move, these issues are considered manageable trade-offs compared to the overall improvement in lifestyle and cost of living.

Image Credits: unsplash.com

Perhaps most telling is the shift in perception. Moving to JB is no longer seen as a compromise or fallback option. Increasingly, it is viewed as a smart and intentional decision. It reflects a broader movement among Singaporeans who are redefining success and quality of life on their own terms. JB is emerging as a viable and even aspirational home base for individuals seeking more space, more value, and a better balance in everyday life.

CPF Changes in 2025: What Young Singaporeans Should Know

As Central Provident Fund (CPF) marks its 70th anniversary, several key policy changes are being rolled out in 2025 to strengthen long-term financial security for Singaporeans. While many of these updates target older workers and retirees, younger adults are encouraged to understand these changes early to plan effectively for the future.

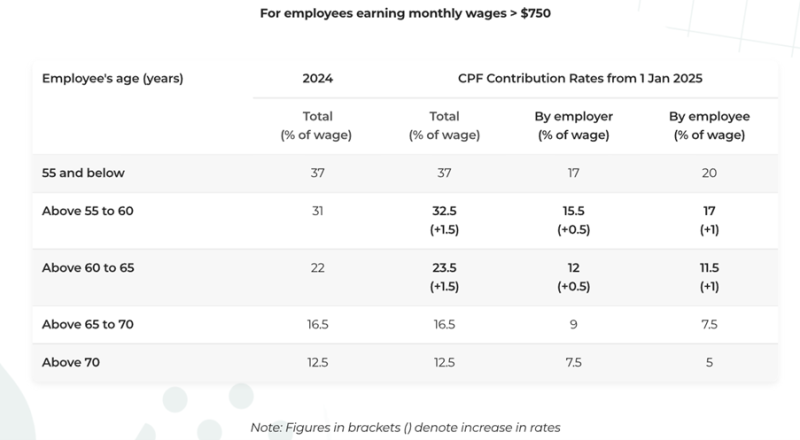

CPF CONTRIBUTIONS FOR SENIOR WORKERS INCREASED

Since earlier this year, CPF contribution rates for employees aged above 55 to 65 have gone up by a total of 1.5 percentage points. This includes an additional 1% from employees and 0.5% from employers. The aim is to help senior workers build stronger retirement savings as more choose to work beyond age 55. For younger workers, this underscores CPF’s commitment to retirement adequacy for all age groups.

Image Credits: cpf.gov.sg

CPF SALARY CEILING HAS INCREASED

The CPF monthly salary ceiling has increased to S$7,400, up from S$6,800 previously. This change means that a larger portion of higher earners’ wages is now subject to CPF contributions. The ceiling will be raised again to S$8,000 in 2026. Although this change primarily affects those with higher salaries, it benefits long-term savings by increasing CPF contributions over time. This is something younger professionals can factor into their career and income growth.

SPECIAL ACCOUNT CLOSURE AT AGE 55

CPF members turning 55 this year will see their Special Account (SA) automatically closed. Funds are first transferred to the Retirement Account (RA), up to the Full Retirement Sum (FRS), where they continue to earn attractive long-term interest. Any remaining withdrawable balance is moved to the Ordinary Account (OA) and earns a lower interest rate.

Members can still transfer OA savings to their RA, up to the Enhanced Retirement Sum (ERS), to enjoy higher CPF LIFE payouts. Investments under the CPF Investment Scheme-Special Account are not affected and can be retained. Upon maturity or sale, the proceeds will first go to the RA, and any excess will be credited to the OA.

ENHANCED RETIREMENT SUM NOW S$426,000

The Enhanced Retirement Sum (ERS) has been increased to S$426,000, or four times the Basic Retirement Sum. Members who top up to this new limit at age 55 could receive CPF LIFE payouts of approximately S$3,300 per month from age 65, compared to around S$2,500 previously.

Even for those still far from retirement, it’s useful to understand how topping up early can maximize compound interest. CPF’s online tools like the Retirement Payout Estimator and Retirement Dashboard help members plan based on their age and financial goals.

EXPANDED MATCHED RETIREMENT SAVINGS SCHEME

Improvements have also been made to the Matched Retirement Savings Scheme (MRSS). There is no longer an age cap, and eligible members can receive government matching grants of up to S$600 per year for five years, totaling S$2,000.

Young adults can also support older family members by topping up their RA, helping them qualify for these matching grants while enjoying personal tax relief.

70TH CELEBRATION OF CPF

At CPF’s 70th anniversary celebration on July 5 and the launch of its commemorative book “Save & Sound: 70 Years of CPF”, Senior Minister Lee Hsien Loong reflected on CPF’s key role in every Singaporean’s life (i.e., from home ownership and family support to retirement). He also noted that Singapore’s CPF system is internationally recognized as one of the most effective in the world.

Image Credits: unsplash.com

For younger Singaporeans, this is the time to stay informed, track contribution limits, plan top-ups early, and help family members maximize their CPF benefits. To learn more, visit cpf.gov.sg or follow CPF’s official platforms.