Some useful tips for you not to fall prey to jewellers’sales tactics

Shopping for diamonds is an art. Diamond shopping is a test of meticulousness. All diamonds may look equally impressive in jewellery stores, but only when viewed under natural daylight will it reveal its true brilliance. In a bid to make your diamond shopping a wiser one, JannPaul highlights 5 of the most common marketing tactics.

- There can be GIA triple Excellent diamonds that are poor performers.

When a diamond is said to have a triple excellent rating, it refers to the rating of the diamond’s cut grade, polish and symmetry. Often, this is how a salesperson would benchmark their diamond, by saying a “triple Excellent diamond is the best.”

However, there is much more to this. A more reliable way to determine the quality and performance of a diamond, is by measuring the light performance (measured with an Ideal Scope or ASET Scope) and symmetry of the diamond (measured with a Hearts and Arrow Scope).

The Ideal Scope reveals the amount of light return and light leakage in a diamond. Through the scope, the greater the red areas, the more intense the light return. What this means is a lot of light is coming into the diamond and reflected out, giving the diamond a brighter look. The white areas you see on the Ideal Scope represents the amount of light leakage, which you want to minimize.

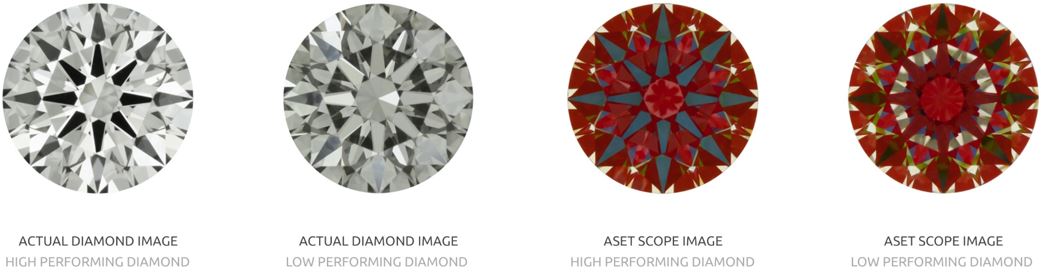

A more advanced version of the Ideal Scope is the ASET Scope. The ASET Scope determines the strength of a diamond’s light return. Red areas are indicative of strong light, while green areas represent weak light return. White areas show full light leakage, which is regarded as poor light performance in a diamond. The blue areas are a diamond’s contrast, which gives an idea of where the colourful sparkles you see on the diamond are. It should ideally have sharp and crisp arrows.

Both the Ideal Scope and ASET Scope are not commonly found in local jewellery stores, but it can be easily found online.

Although these two diamonds have different light performances, they can cost the same! This is because diamonds are sold based on what is shown on the GIA certificate, and GIA does not grade the light performance of a diamond.

- “The diamond is GIA-certified.”

Gemological Institute of America (GIA) is the world’s oldest, largest, and one of the most respected independent laboratories. Their laboratories are regarded as one of the most respected laboratories in the diamond industry, simply because of their consistency and unbiased diamond grading systems. As such, most of the diamonds manufactured now are graded according to the GIA standards, making it one of the most popular diamond certification in the industry.

GIA grades a diamond on according to the 4 “C”s – Carat, Colour, Cut and Clarity. That being said, there are other facets of a diamond that determine the quality of the diamond, which the GIA certificate does not take into consideration. For instance, two diamonds with the same GIA certification grades may differ greatly in terms of their light performances.

- “The diamond is a ‘’Super Ideal Cut’’.”

The term Super Ideal Cut is used to label a diamond that is cut to the maximum light performance. The Super Ideal Cut standard was introduced into Singapore by Paul Hung from JannPaul in 2010.

In order to prove that a diamond has high light performance, various tools are needed, such as the HCA tool, Ideal Scope, ASET Scope and Hearts & Arrows scope. Without these analytical tools, a jeweller cannot label their diamond as a Super Ideal Cut.

Unfortunately, there is no regulation for this type of grading in the industry. That is to say, any jeweller can brand their diamonds as a “Super Ideal Cut” according to their own parameters. Hence, it is important not to fall into these marketing labels, and to learn how to check if the diamond you’re purchasing is truly a Super Ideal Cut.

In other words, no scopes, no talk.

- The Hearts & Arrows scope does not measure a diamond’s brilliance

The Hearts and Arrow Scope reveals the symmetry of a diamond. A good diamond appears symmetrical and crisp under the scope, with no clefts or visible flaws. This scope is most commonly found in most jewellery stores, but is by no means the most representative way of determining the cut of a diamond.

What this scope does not reveal is the amount of light leakages in a diamond. Light leakage is indicative of poor light performance in a diamond, as the light leaks out instead of being reflected out. A diamond with poor light performance can still look good under the Hearts & Arrows scope, as all it means is that the diamond is symmetrically cut or it has symmetrical light leakages.

- “The greater the carat size, the bigger the diamond.”

Carat size is the weight of a diamond, but it does not tell you anything about a diamond’s brightness or how well it sparkles, much less its cut and size.

For the same carat weight, a diamond can be cut deeper, making it look smaller. A deeply cut diamond can affect its light performance as well, causing it to appear darker and duller. Hence, a well cut diamond will appear larger, brighter and more brilliant compared to a poorly cut diamond of the same carat weight.

The next time you shop for diamonds, equip yourself with this common language to defend yourself and your pockets from harm. With the appropriate tools for accessing a diamond’s quality, it is not as difficult as one might imagine to pick out one that’s worth the price tag attached to it.

Special thanks to Casey Lai from JANNPAUL for these useful tips.