You are a responsible adult living in the most expensive city in the world. With this in mind, how much money should you have in your savings account? This may sound like a basic financial query, but it is hard to extract a straight answer from it. Make things simple by aligning your goals with the volume of your savings.

Here are just some goals that you may tap with:

GOAL #1: BUILDING A SAFE NEST FOR THE GOLDEN YEARS

To shed a light to the path of many Singaporean retirees, a social security savings plan has been put into place. This savings plan is none other than the comprehensive Central Provident Fund (CPF). You can use your CPF Ordinary Savings account for important purposes such as purchasing an HDB flat or financing your retirement years.

Image Credits: pixabay.com

The amount of your retirement fund must be based on your estimated future spending or your predicted lifestyle. This is why it is challenging to quantify a singular retirement fund. It is best to save on a regular basis with the knowledge that all will add up as you age. For instance, many financial experts recommend to save at least “10% to 15% of your income for retirement as early as your 20s“.

GOAL #2: ESTABLISHING A REALISTIC EMERGENCY CUSHION

As the name suggests, an emergency fund is established to cushion unforeseen events. There are many ways to arrive at a specific amount for an emergency fund. First, you may follow the advice of the renowned Personal Finance Adviser Suze Orman. She suggests to have eight months’ worth of your salary because it is the average period before a person finds a job.

Image Credits: pixabay.com

Second, you may save up a five-figure emergency fund in an investment account with relatively safe allocations in order for it to grow. Doing so will allow you to save more money than by leaving your cash in a savings account.

Lastly, you may save up based on your living expenses. Add up the cost of all your current essentials (i.e., rent, grocery, and utilities) and work from there. For example, you need S$2,000 per month to survive. Prioritize getting about S$6,000 in your emergency fund.

GOAL #3: CONQUERING SHORT-TERM VICTORIES

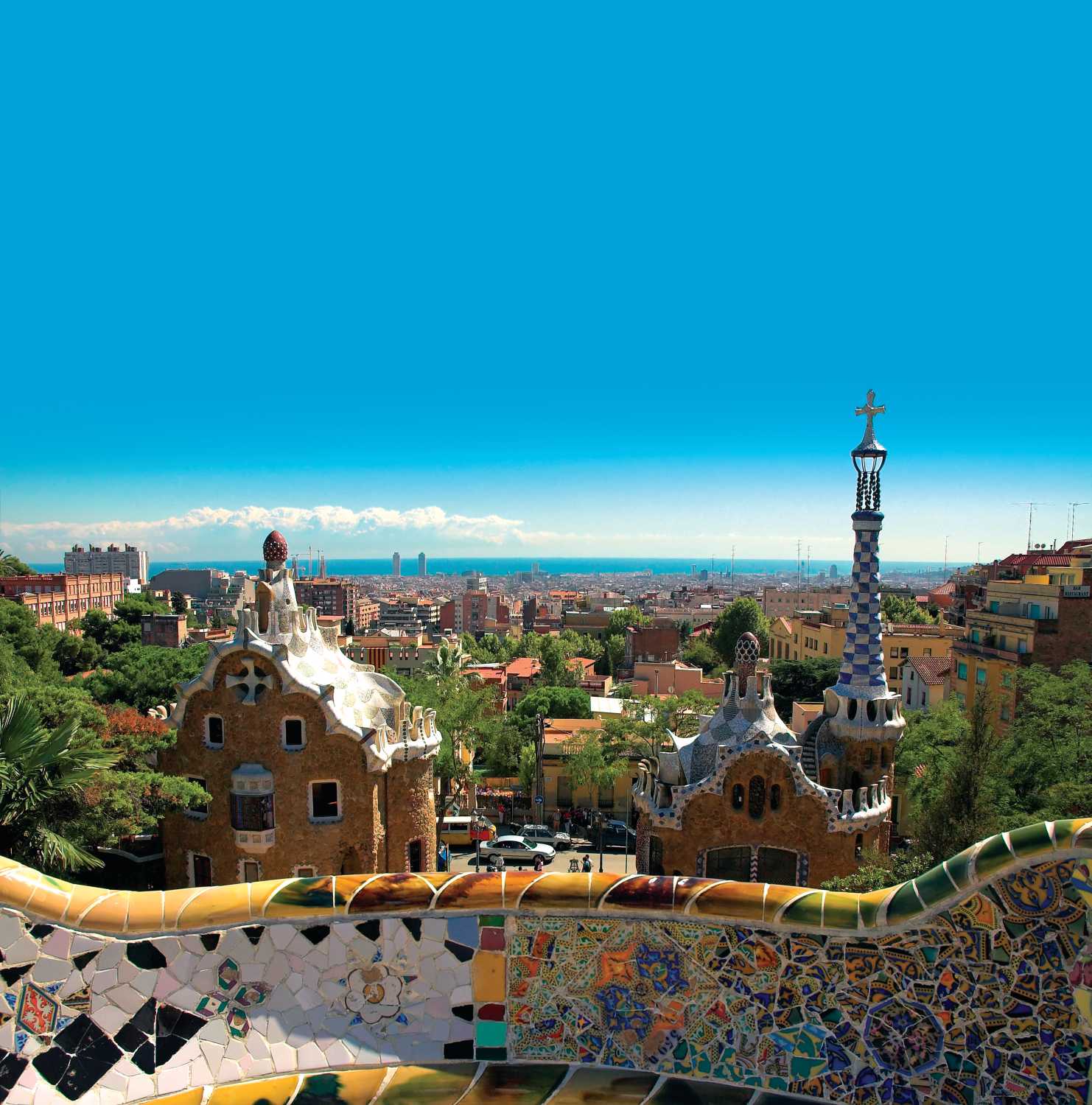

In a list of financial priorities, chances are, your specific goals reside at the bottom. Specific goals include purchasing a car, backpacking around Europe, and buying a new phone. Do not limit your savings just to suit your specific goals.

Image Credits: pixabay.com

Remember that starting your savings is the initial step and that you must plan to raise it over time.