Savings Account is an account managed by the bank, which provides principal security and a moderate interest rate. This account lets the client set aside a portion of his or her liquid assets while earning a monetary return. Personally, I value this financial tool because it serves as an accessible shield to cover the immediate expenses with its facilities such as Internet banking and online transactions.

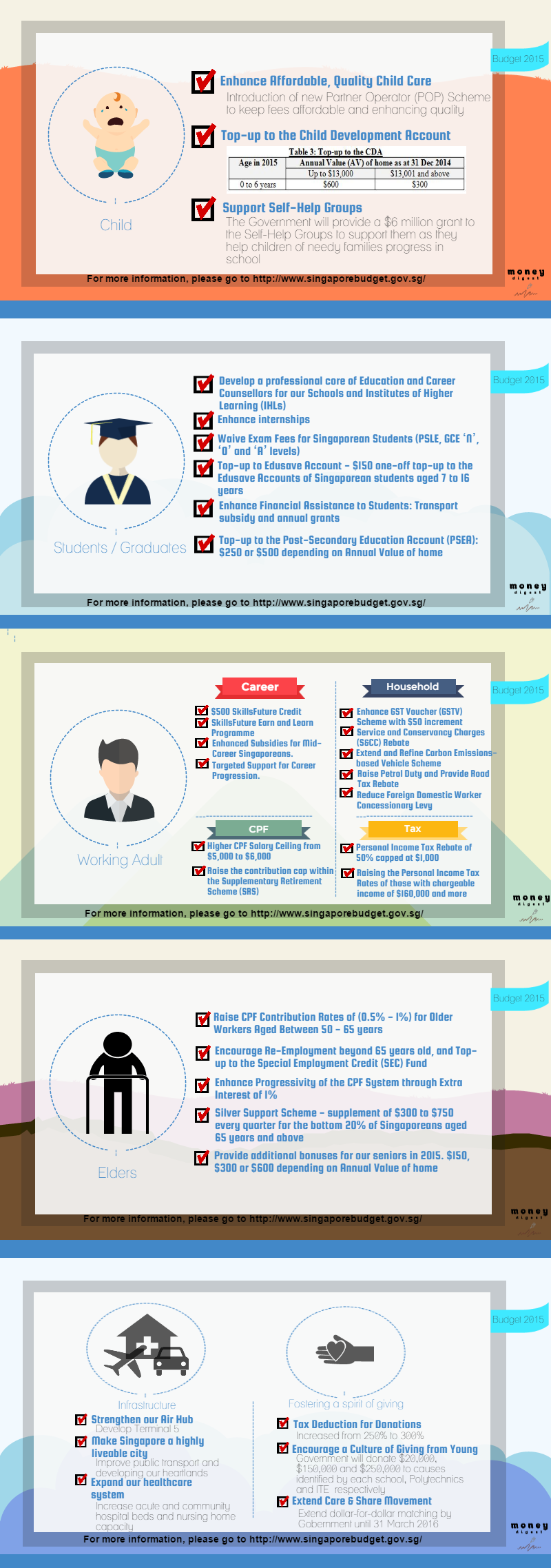

In Singapore, savings accounts predominately require a minimum amount of deposit. The amount ranges from S$0-1000. To get most of the benefits of your savings account some encourage you to transact more while others encourage you to withdraw less. That being said, here are the Most Profitable Savings Accounts In Singapore To Date as they offer the highest interest rates…

4. CIMB STARSAVER SAVINGS ACCOUNT

CIMB StarSaver Savings Account requires a minimum deposit of S$1,000 with S$0 maintaining balance. With this savings account you can get up to 0.8% of interest per year as long as you deposit at least S$100 more to your account every month. On the other hand, you will get an interest of 0.5% per year for balance under S$100. There is more! Funds transfer to CIMB Malaysia is free. Also, there are no withdrawal fees from CIMB Group ATMs across ASEAN countries.

But wait, there is still more…sign-up for CIMB StarSaver Savings Account from now until June 30, 2015 online to be rewarded with S$20 worth of shopping vouchers. Apply here.

3. MAYBANK ISAVVY SAVINGS PLUS ACCOUNT

For people who are very diligent and disciplined savers, Maybank iSAVvy Savings Plus Account is the perfect partner for you. With this savings account, you will not only earn an interest of 0.38% a year but you will also be rewarded with additional interest with every dollar you save. You see, an additional interest rate of 1.56% per year will be rewarded as long as the average daily balance increases every month. The base interest rate, depending on how much money you have, ranges from 0.19% and 0.38% per year. That is not all! Being a super saver with a minimum account balance of S$100,000 will get you a free insurance coverage.

All you have to do is to deposit a minimum amount of S$500 and apply here.

2. DBS MULTIPLIER PROGRAMME

In contrast of Maybank’s iSavvy, DBS Multiplier Programme rewards you for regularly using your account. The more you use your account for transactions, the higher interest you shall receive. Specifically, if you’re banking transactions adds up to S$7,500 a month then, you are eligible for an interest up to 2.08%. It offers a starting rate of 1.08% per annum. Enjoy the flexibility to withdraw and deposit anytime, as there is no lock-in period.

With a minimum balance of S$3,000, you can apply here.

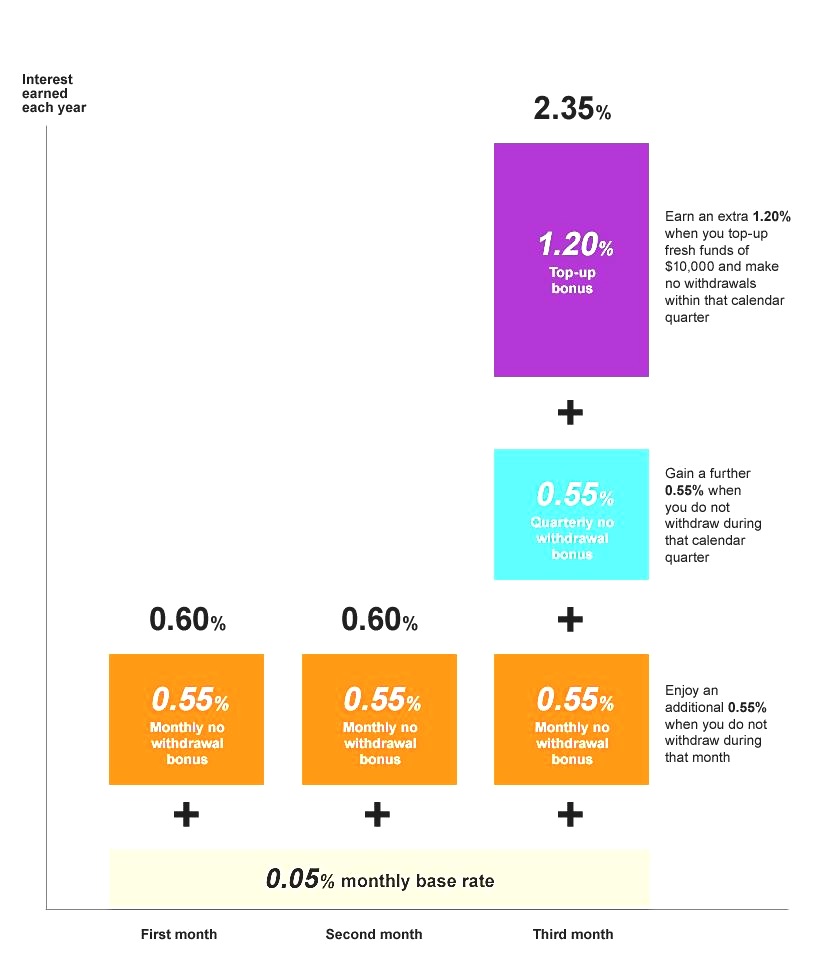

1. OCBC HIGHER-INTEREST DEPOSIT ACCOUNT- BONUS PLUS

As the name suggests, OCBC Higher-Interest Deposit Account – Bonus Plus offers its clients the higher interest rates for up to 2.35% a year. But, there are conditions attached to it. First, the initial deposit required is a fresh fund of S$10,000 with a minimum balance of S$3,000 every month. Second, you will earn higher interest rates if you do not make any withdrawals every month or every quarter. Here is a detailed illustration of how the system works:

Image Credits: www.ocbc.com.sg

Nonetheless, they offer secure online banking or mobile banking, and no lock-in period for your transactions. Apply here.

Sources: Investopedia and iMoney

As you park your money inside the bank, consider the savings account that suits your lifestyle and needs. 🙂