Whether you are known to be the quiet or reserved one, you most likely belong to a special group of people who are known as the INTROVERTS.

A common misconception of introverts is that the dislike socializing. Contrary to the popular belief, introverts are drained by social interaction. Many introverts can socialize easily…they just prefer not to.

In fact, you can be more interpersonally connected and emphatic than others. Use these and your other magnificent qualities to your advantage as you enhance your financial life.

To get started, here are some things you can do:

1. ACTIVELY LISTEN

Introverts, in general, tend to be great at listening. This skill can make you a good investor. Before investing your wealth, you must actively listen to what others have done or will do. Analyze the results of their strategies and actions. Then, make your own strategy based on the successful predecessors.

2. STUDY WHAT YOUR ARE SELLING THOROUGHLY

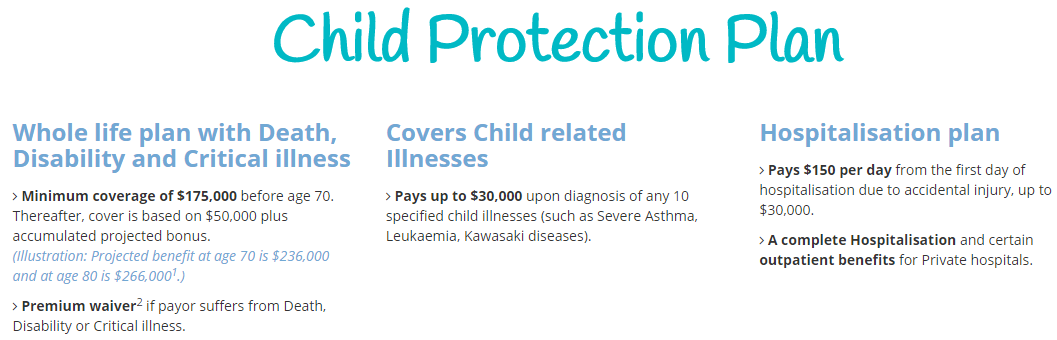

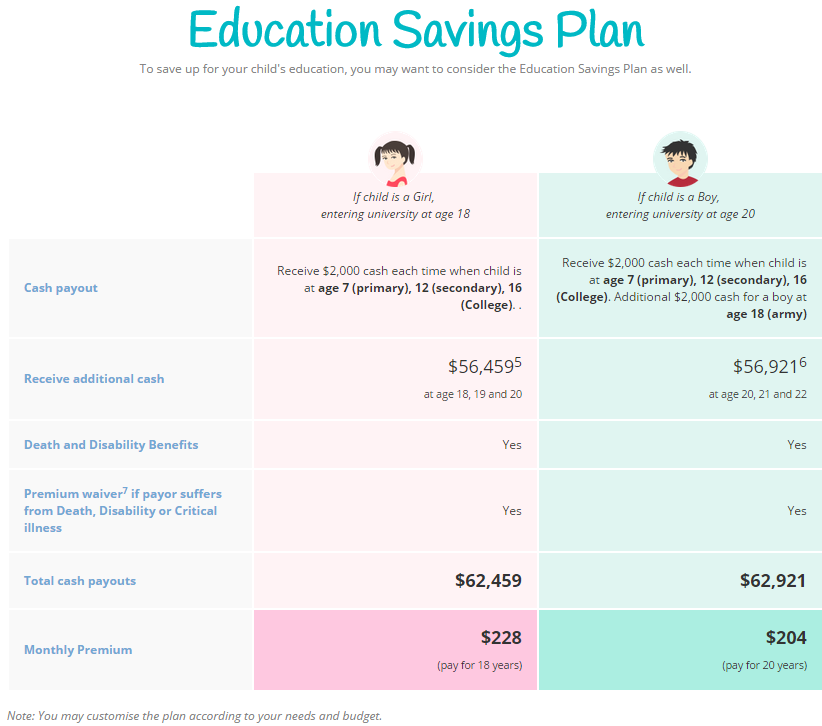

In order to increase your profits in sales, you must know what you are selling in a deeper level. Study your products and services thoroughly so that you can efficiently aid in the client’s needs. And if someone new approaches you, determine if he or she is a potentially good client. As an introvert you understand that it takes more than a wallet to make the sales flowing.

3. REMAIN CALM

Aside from being great at listening, introverts are usually among the calmest people in the world. This quality can be applied in different financial events, especially the unforeseen ones.

So when an unexpected bill arrives, use your natural calm then, come up with a way to pay it. When the market tumbles down, do not sell it right away because of fear; use your innate calmness to contemplate on the situation. As others panic to the unfortunate monetary events, you make levelheaded decisions.

4. WELCOME THE SOCIAL MEDIA

For an introvert, social media is a brilliant manner to communicate with other people in the safety of their own home. Embracing social media can help you to save cash in many ways such as selling your unused or underused items through Facebook, Instagram, or Carousell. You can also browse free tutorials to learn new skills so you would not have to ask a bunch of people in real life.

The downside to social media is that it can overwhelm you. This is why it is important to spend a minimum amount of time (e.g., 10 minutes/day) so it does not take over your wonderfully humble life!