Infection with the monkeypox virus causes the rare disease called Monkeypox. Monkeypox virus belongs to the Orthopoxvirus genus, which includes variola virus (which causes smallpox), vaccinia virus, and cowpox virus. This disease, which can cause serious skin rash, appears to be spreading via direct contact with the skin or saliva of an infected person.

LOCAL SPREAD

On July 8, the Ministry of Health (MOH) reported one more imported case of Monkeypox in the country. This brings the total number of confirmed cases to four since June. The country’s Monkeypox cases consist of one local infection and three imported ones. The fourth case is a 30-year-old patient who lives in Singapore and had recently returned from Germany.

The man experienced rashes in the groin area last June 30 and had a fever a week later. He sought medical treatment and was taken to the National Centre for Infectious Diseases on July 7. He tested positive for monkeypox on July 8 and is currently in a stable condition, according to MOH. Contact tracing is ongoing.

CURRENT SITUATION IN AFRICA

Health authorities in Africa are treating its expanding Monkeypox outbreak as an emergency. To avoid the immense problems seen during the COVID-19 pandemic, they are exhausting their resources and are asking for other leaders to share the world’s limited supply of vaccines.

Monkeypox has been spreading in parts of Central and West Africa for decades, however the weak surveillance and the lack of laboratory diagnosis contribute to many cases being left undetected. Currently, countries in Africa have reported more than 1,800 suspected cases including 70 deaths with only 109 of them being lab-confirmed.

Ahmed Ogwell, the acting director of the Africa Centers for Disease Control, said:

“This particular outbreak for us means an emergency. We want to be able to address monkeypox as an emergency now so that it does not cause more pain and suffering.”

GLOBAL UPDATES

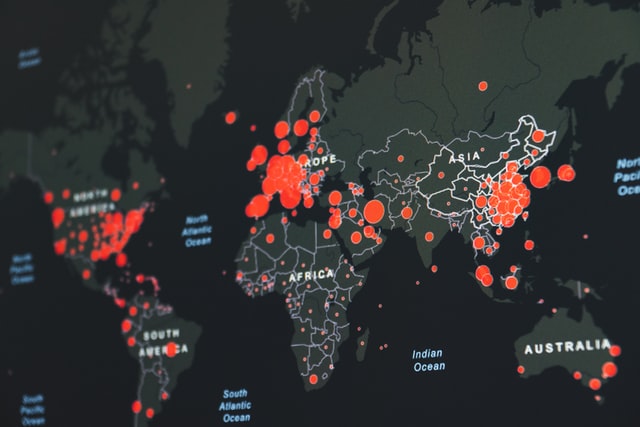

The World Health Organization said that the expanding monkeypox outbreak was worrying but did not yet warrant being declared as a global health emergency. The U.N. health agency said it would reconsider its decision if Monkeypox continued spreading across more borders, began infecting vulnerable groups, and showed signs of increased severity.

Image Credits: unsplash.com

Worldwide, more than 5,000 cases of Monkeypox have been reported in 51 countries (in time of writing). The majority of these cases are in Europe and no deaths beyond Africa have been reported.