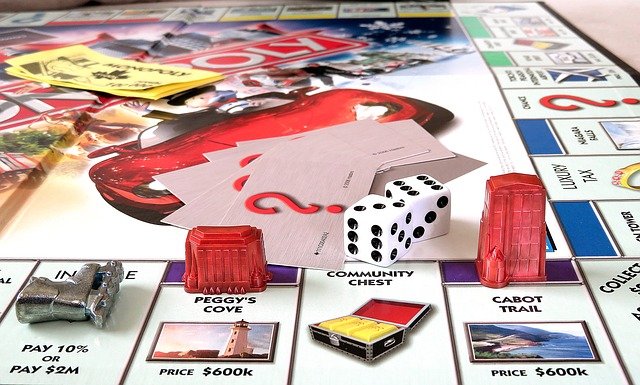

Monopoly is a board game that has been causing family feuds since 1935. Monopoly was first marketed in 1935 during the Great Depression. It was an instant success and became a best-selling game in United States. Since then, over 275 million game sets were sold worldwide.

What is amazing about Monopoly is its ability to mimic financial scenarios in real life. On that note, here are four valuable real-estate and finance lessons that you can reap from the game.

#1: ALWAYS HAVE CASH ON HAND

In Monopoly, having cash enables you to purchase properties and pay fees for unlucky turns. You may need to shell out some cash to pay an opponent or to pay for a “Chance” card. It is important to always have cash on hand whenever you play. Do not spend all your money in one go!

In a similar way, you must spare some cash for unforeseen situations. The game teachers us about the importance of budgeting and saving money. You need to save enough money to cushion the blow of rough times, such as during this pandemic. Establish your emergency fund by identifying your current financial standing. It is best to build a fund that can cover about six months’ worth of your living expenses.

#2: DIVERSIFICATION IS IMPORTANT

Let us go back to the game itself. If someone lands on your property, you will earn money. Players usually buy multiple spaces or properties around the board to increase their chances of earning money. Chances of earning are slimmer if you only have a few properties on the board. The same can be applied in real life.

You need to diversify your portfolio and scatter it throughout the different possibilities in order for you to maximize your earnings. Instead of putting everything in a single basket, make sure to diversify your portfolio with bonds, stocks, and so on.

#3: PLAY THE LONG GAME

Being patient is essential whenever you play Monopoly. You see, the game continues until there is a last man standing (i.e., the other players have gone bankrupt). Much like the game, you are playing for the long haul. Meeting your financial goals is a journey and not a sprint.

Whether you are saving up for your 2021 vacation or your upcoming retirement, you need to be patient. There will a be a few bumps and celebrations along the way. For instance, you may pay off your student loans first before purchasing a car. Setting up a new business venture will also take time and involve a lot of ups and downs. Ultimately, your hard work will help you achieve your goals.

#4: EXPENSIVE IS NOT ENTIRELY THE BEST

The most expensive assets may not always be the best decisions. Most Monopoly players want to earn the Park Place and the Boardwalk since they have the biggest payouts. However, they are also the most expensive pieces to maintain. Many people lose at Monopoly by using this strategy because they do not pay attention to the overall cost. Instead, they only pay attention to the cash flow.

Image Credits: pixabay.com

Those who win at Monopoly are the ones who focus on the value gained for the price paid. You will not win by merely owning the most expensive assets. You will win by making the most money. In investing your money in the real world, you will win by selling high and buying low. Zeroing your attention to the most expensive assets may set yourself up for losses.