Do you believe that one of the foundations of achieving wealth is saving as much money as you can? A highly effective method of building your savings is to live below your means, and we can’t emphasise that enough in our articles.

Just in case you get us wrong, this doesn’t mean taking a vow of poverty and selling all your possessions away. It just means actively monitoring your spending and watching for ways to spend less.

Watch out for these red flags that may indicate you’re spending way too much money.

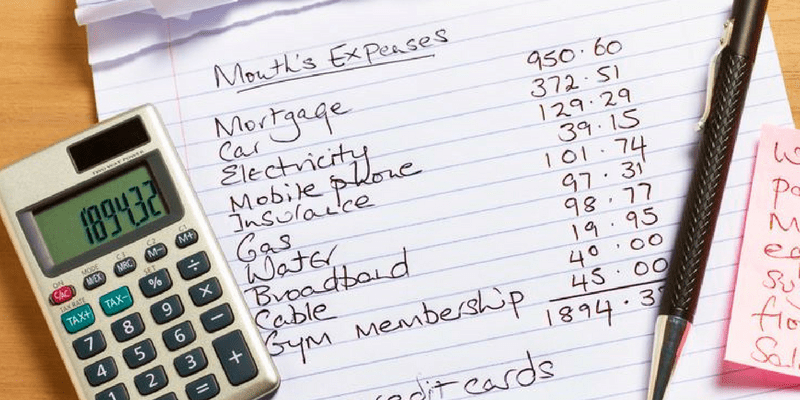

#1: Spending above your salary

Spending more money than you make is a bad habit. Overspending can put you in debt, which is incompatible with your aim for financial freedom.

To better evaluate your spending, make a list of all your monthly expenses – housing, food, bills, memberships, and subscriptions – and compare it to your monthly income. If your expenditure exceeds your salary, you must find ways to increase your earnings or decrease your spending.

For freelancers with variable incomes, this can be challenging. One strategy is to calculate your average monthly payment over a rolling 12-month period and use that number to budget. You may also use a more conservative approach by taking your lowest-earning month as a baseline to account from.

#2: Budgeting based on your pre-tax income

Image Credits: wincofoam.com

Constructing your budget on your pre-tax earnings can be a huge mistake. If you’re a Singapore Citizen (SC), Singapore Permanent Resident (SPR), or a foreigner who has stayed for 183 days or more, you would be well aware of Singapore’s income tax requirements.

The more money you earn, the more you pay in taxes. This means our take-home pay is less than our hourly rate or our salary would suggest. It is, therefore, unwise to craft your budget on your pre-tax income since you do not get to keep everything you earn.

Build your budget around your take-home pay minus the taxes for a more accurate financial review.

#3: Oustanding balances on your credit accounts

Having credit cards to supplement your income can be highly attractive. However, unpaid debt on your credit lines is detrimental to your financial health.

According to some local findings, the average interest rate on a credit card on our sunny island is about 25%. If you do not pay off your credit card in full every month, the remaining balance will begin accruing interest, and this may grow out of hand if not kept in check.

Debt can increase rapidly even before you realise it. Be sure to pay off your credit balances in full at the end of each month, and if you can’t, at least go past the minimum sum required to “get by’. This is because merely making minimum payments every month is a dangerous practice.

Should you find yourself unable to do so, it means you are spending too much on credit.

#4: Having a negative net worth

Image Credits: corporatefinanceinstitute.com

Investopedia defines net worth as the value of all of your assets minus your liabilities. If your net worth is negative, you owe more money than you own. Makes sense? If not, read that again.

This is not a desirable state of affairs for sure. To know your net worth, you can calculate it using Moneysense’s Net Worth Calculator. The numbers will help you take stock of your current financial situation.

For those who are severely indebted, with a net worth of – S$15,000 or less, you may wish to consider examining Singapore’s bankruptcy laws to help you repair your finances and start afresh.

#5: Housing expenses over 40% of your gross income

Experts suggest that your housing expenses should not exceed 30% to 40% of your monthly income. For example, if you bring home S$4,000 a month, your monthly housing budget should be somewhere between S$1,200 and S$1,600.

To find out your ideal housing expenses, simply multiply your monthly income by 0.3 or 0.4 to see what your monthly budget for housing expenses should be. If your rent exceeds this number, you may need to try and find a less expensive apartment and not survive just on your savings.

#6: Spending to keep up with social influences

Image Credits: motors.hongsehgroup.com

In our current age of Instagram and TikTok, it is easy to get swirled into the world’s neverending wants. We may see influencers, friends, or family members buying new items or taking expensive staycations and begin to wonder if we should do the same.

But before we buy that latest device or spend money on an extravagant restaurant date, we must ask if we’re doing this for ourselves or to impress someone else on the worldwide web? Is it worth finding money in the budget to keep up with appearances?

Spend your money wisely and avoid the trap of wanting the latest of everything because that will only lead you down the point of no return.

#7: Your savings are literally zero

An absence of savings is a common-sense indicator of excessive spending.

A healthy savings account can help you survive unexpected expenses medically related and help you prepare for significant life events like starting a family or even early retirement.

If your savings account is empty or underfunded, you are spending too much and saving too little. Finding small opportunities to save money will help get your spending under control and your savings back on track.