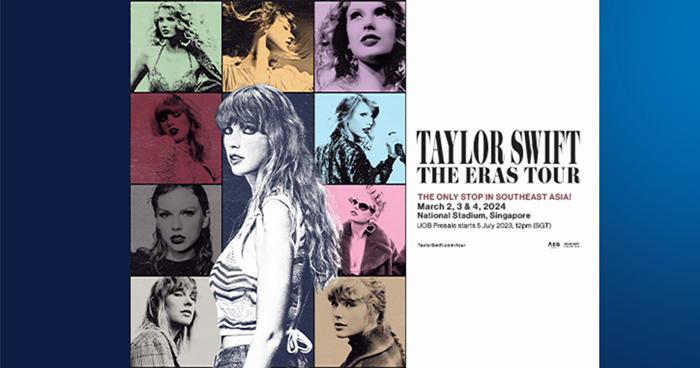

As Taylor Swift’s enchanting Eras Tour in Singapore comes to a close, her music and journey continue to inspire. Amidst the discussions of her performances, lyrics, and personal life, there are valuable financial lessons we can get from her experiences.

While the details of her journey evolve over the years, there are consistent themes of resilience and generosity that can guide us in our financial endeavors.

#1: ALL YOU HAD TO DO WAS STAY

In 2024, Goldman Sachs projects a promising outlook for the S&P 500, predicting a rise to 4,700 by year-end. Echoing Taylor Swift’s advice from her song “All You Had To Do Was Stay” from the 1989 album, Goldman Sachs suggests staying invested.

The launch of Taylor Swift’s “The Eras Tour” represented one of the most notable cultural events of 2023. Its global ticket sales are estimated to exceed US$1 billion (about S$1.3 billion) in 2024. Just as Taylor persists in her pursuit of excellence, staying committed to your investments even during uncertain times can yield fruitful returns.

#2: IT’S TOO LATE FOR YOU AND YOUR WHITE HORSE

In matters of finance, relying on external saviors is futile. Take charge of your finances because no one is riding in on a white horse to rescue us.

Empower yourself by understanding your financial landscape and making informed decisions.

#3: I NEVER SAW YOU COMING

Avoid surprises akin to “I never saw you coming” moments by proactively managing your finances. Automate bill payments to ensure timely settlements and stay vigilant against unexpected expenses, such as those sneaky data charges from streaming Taylor’s latest album, “The Tortured Poets Department,” scheduled for release on April 19.

#4: I KNOW PLACES WE WON’T BE FOUND

Create a safety net for rainy days by discreetly stashing away funds. Taylor’s “I know places we won’t be found” ethos can apply to your emergency fund strategy.

Set aside savings in accounts or investments that are less accessible, reducing the temptation to dip into them unnecessarily.

#5: YOU NEED TO CALM DOWN

Money doesn’t have to be a source of stress. Embrace the journey of financial literacy with a calm mindset. Start from where you are and utilize available resources to navigate the complexities of personal finance.

Remember, impulsive spending rarely leads to financial peace.

#6: SPEAK NOW

Take a page from Taylor’s playbook and advocate for your worth. Whether it’s negotiating a raise at work or standing up for your financial rights, don’t be afraid to speak now.

Taylor’s resilience in reclaiming ownership of her music demonstrates the power of advocating for what you deserve.

#7: KARMA IS A GOD

Generosity breeds success, as evidenced by Taylor’s philanthropic endeavors. Follow her lead by giving back to your community and supporting those in need.

Whether it’s through donations, acts of kindness, or simply spreading positivity, remember that kindness is a currency that never depreciates.

#8: THIS IS WHY WE CAN’T HAVE NICE THINGS

Taylor’s cautionary tale in “This is Why We Can’t Have Nice Things” reminds us of the importance of fiscal responsibility. While indulging in luxury may be tempting, maintaining financial discipline ensures long-term stability. Stick to your budget and prioritize financial health over fleeting extravagance.

Image Credits: unsplash.com

In retrospect, TSwift’s journey offers more than just musical inspiration—it’s a treasure trove of financial wisdom waiting to be unearthed. As we continue to admire her artistry and resilience, let’s also learn from her savvy approach to money management. After all, who knew that amidst the melodies, Taylor was quietly serenading us with invaluable financial advice all along?