You have a stable job right now, but since you’re thinking of embarking on a new business soon, you’ll need to acquire a loan. You need the money to purchase your supplies, to hire people and to market your business’ existence. And while you’re certain that you need a loan for this endeavour, you still don’t know how to actually to find the right loan for your needs. In your mind, you think this decision is crucial because the success of your business relies on it – and you’re right. To help you out with your dilemma, consider the essential tips below to find the right loan for you:

- How much do you really need?

Just because a lender offers you a loan worth thousands of dollars, doesn’t mean you should take it immediately. Keep in mind that the bigger amount you borrow, the bigger your payments will be – and this can become an issue if your business isn’t as successful as you’d like it to be. On the other side of the coin, if your loan is too small, it might not help you in any way, and you’ll end up paying for high-interest rates. To avoid being placed in this kind of situation, carefully think how much you need for your business and look for a lender which can give you that amount.

- What is the interest rates?

Aside from the loan amount itself, you should also consider the interest rates associated with it. Is the lender offering you the amount you need but has very high-interest rates? Are there any lenders in the market who can give you a lesser interest rate? Think about these things first before choosing a loan. It’s also essential to ask the lender if there are any other fees or penalties to be paid after you received the loan. All of the processes involved in the loan should be transparent to you to avoid problems in the future.

- What’s the term?

Different loans have different terms. Some loans can be paid for six months while others, in ten years. Since you’re still starting a business, it might be best to settle for a loan which will require you to repay within an extended period of time. This will allow you to save up for the interest rates and the loan, without putting your business’ operations at risk.

Aside from the things you’ve read from this article, it’ll also help if you can actually work with experts when it comes to finding the right loan for your needs. Places like oinkmoney.com may be a good starting point.

Be A Responsible Borrower

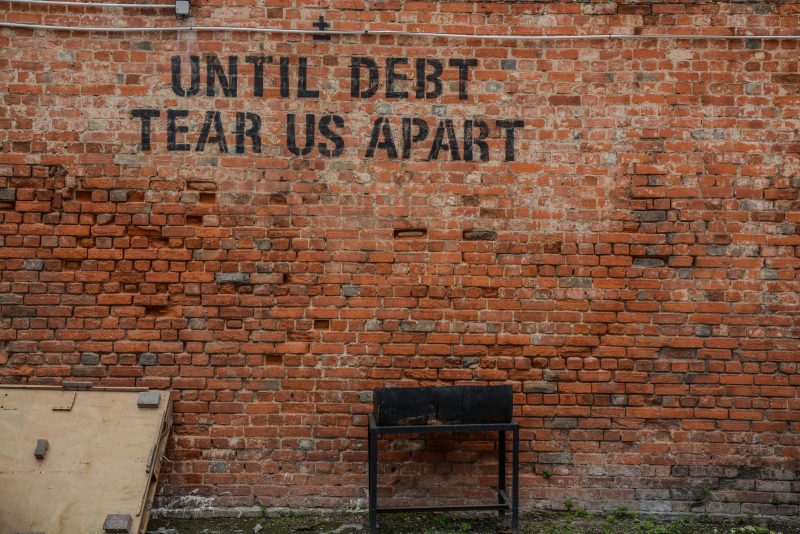

Finding the right loan for your needs is never easy. There are several things to think about to come up with the best possible decision. You also have to keep in mind that your responsibility as a borrower doesn’t end the moment you receive the money – you should pour in your time and effort in order to pay all of these in time. If not, your life may be affected negatively. Remember all the things presented in this article, and for sure, you’ll come up with a decision on which loan to get without compromising your financial health in the long run.

Sarah Porter

Sarah Porter is a money-savvy writer and mum of two based in Manchester, UK. She is the Brand and Marketing Manager at the UK loan website Oink Money (oinkmoney.com), as well as the founder of a well known money-saving website. Sarah is originally from Edinburgh where she studied Business and later worked in finance for a FTSE 100 company. She left her career in finance to pursue her passion for writing, a move which allowed her to travel the world with her laptop while running her blog.