BTO VS RESALE

If you are planning to buy a flat in Singapore, chances are you are considering an HDB Build To Order (BTO) flat. These are brand new homes that are only built once demand reaches about 70%, with a waiting period of around three and a half years. The appeal? A fresh, never-before-lived-in home at subsidized prices.

Unlike resale flats, which are ready for immediate move-in, BTO flats require some patience. But for many Singaporeans, they offer better long-term value and appreciation potential.

JULY 2025 BTO LAUNCH

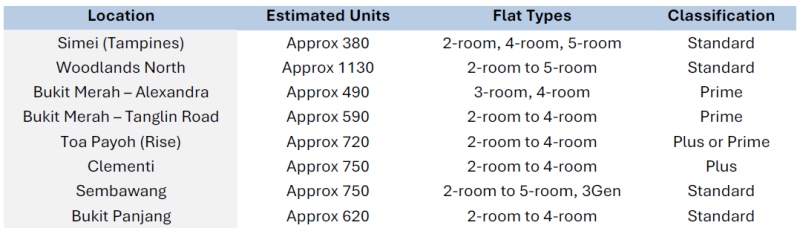

The July 2025 BTO launch is one of the largest in recent years, with about 5400 flats across 7 locations, offering a range from 2-room Flexi to 5-room units, including 3Gen options for multigenerational families. Both mature estates like Bukit Merah and Toa Payoh and non-mature towns like Woodlands and Sembawang are in the lineup.

And yes, Simei is finally back on the map after over a decade! For East-side fans, that is big news.

WHERE ARE THESE FLATS LOCATED?

While official prices for the July 2025 BTO launch have yet to be released, past launches offer useful benchmarks. In Toa Payoh during the February 2023 exercise, prices started at around s$90,000 for a 2-room Flexi flat, approximately S$351,000 for a 3-room unit, and from S$395,000 for a 4-room flat.

Over at Tanjong Rhu Parc, which was classified under the Prime model, a 3-room flat was estimated to start from S$309,000, while a 4-room unit began at roughly S$493,000. In Yishun, buyers could expect lower entry prices, with 3-room flats from about S$140,000, 4-room flats from S$236,000, and 5-room units starting from S$392,000.

These figures are based on previous exercises and should be viewed as general guides. Final prices for the July 2025 BTO launch may differ, so always check the official HDB website for the latest information.

WHAT DRIVES BTO PRICES?

Common factors that affect pricing include:

a. Location: Mature estates like Bukit Merah, Clementi, and Toa Payoh tend to cost more due to their amenities, transport links, and schools.

b. Flat Size: Bigger flats like 5-room units come with higher price tags.

c. Lease Length: This applies more to resale flats as shorter leases typically mean lower prices.

d. Grants: First-time buyers can qualify for schemes like the Enhanced CPF Housing Grant, which can shave off a significant amount from the total cost.

WHICH ESTATES STAND OUT?

a. Bukit Merah and Toa Payoh

Expect high demand here. These mature estates offer great access to the city, popular schools, and public transport. Projects in these areas may fall under the Prime or Plus classification, which means longer minimum occupation periods and stricter resale conditions.

b. Simei

After over a decade without a launch, Simei is back. Located near Upper Changi MRT, SUTD, and Changi General Hospital, it is ideal for families and East-siders looking to stay in a familiar zone.

c. Woodlands and Bukit Panjang

More affordable, with room for growth. These estates are increasingly attractive to younger buyers who want value and space.

d. Clementi and Sembawang

Clementi continues to appeal to families due to top schools and mature estate convenience. Sembawang, meanwhile, offers rare 3Gen flats, perfect for bigger households.

CHECK THESE OFF BEFORE YOU APPLY

Image Credits: unsplash.com

- Confirm your eligibility: citizenship, income ceiling, and household structure

- Understand the classification of your preferred project: Standard, Plus, or Prime

- Look into transport, schools, and workplace distance

- Sort out your finances: CPF Ordinary Account, HDB loan eligibility, and housing budget

- Stay tuned to HDB announcements for application dates and official price lists

IN A NUTSHELL

Whether you are looking for your very first home or aiming to move closer to family, the July 2025 BTO launch is packed with potential. From familiar mature estates to under-the-radar growth towns, now is the time to shortlist your picks and prepare for the ballot.