You may think you are getting smarter with your grocery budget. You plan your meals, wait for sales, use loyalty apps, and even buy in bulk. But quietly and consistently, your money is slipping away. And it is not just because of rising prices.

Grocery shopping in Singapore, whether at NTUC FairPrice, Sheng Siong, Cold Storage, or online via Shopee and RedMart, is filled with unseen pitfalls that are easy to overlook but costly in the long run. From clever packaging tricks to misleading promotions, the system is designed to make you spend more while thinking you are saving.

THE DISAPPEARING QUANTITY

One of the most common traps is shrinkflation, where products shrink in size but retain their original price. In the past year, a number of shoppers have reported that a 500g tub of yogurt is now just 450g, still priced at S$5.20. A bottle of cooking oil that used to be 2 liters now comes in a 1.8-litre bottle, selling for the same S$8.90.

Even staple items like rice and instant noodles are affected. A bag that once weighed 5kg might now weigh 4.5kg, repackaged to look identical. Unless you are carefully checking labels and unit pricing, you are paying more for less without even realizing it.

PROMOTIONS THAT MISLED

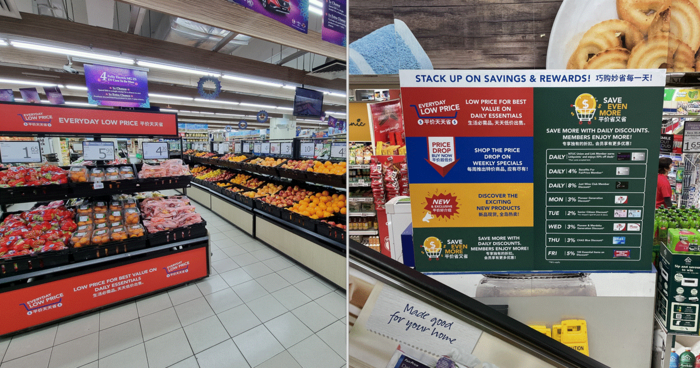

The psychology of discounting is powerful. A promotion that says “now S$9.95, was S$13.50” looks like a bargain, but several readers have reported that the “original price” was never actually charged.

Image Credits: unsplash.com

One consumer documented how a popular brand of rice was sold for S$27.90 on Shopee with a “limited-time offer” sticker, yet just days earlier it was listed at S$25.30 without any fanfare. At a supermarket, a shelf label advertised “Buy 1 Get 1 Free” toothpaste, but the single pack had been quietly marked up by 20% compared to the previous week.

Another example involved imported fruits like blueberries and cherries. While the label screamed “Special Price,” the per-gram cost was actually higher than at wet markets or smaller grocers in areas like Yishun or Bukit Merah. The discount looked convincing, but the reality was not.

HIDDEN COST OF CONVENIENCE

Grocery delivery platforms have boomed in Singapore, especially since the pandemic. While they offer undeniable convenience, they often come with hidden charges that quietly add up.

Users who signed up for RedMart’s delivery subscription found themselves paying S$5.99 monthly for “free delivery” but some only ordered once or twice a month. In practice, that convenience came at a steep price per trip.

More subtly, prices of fresh produce and everyday items tend to be higher on online platforms. A user who compared prices found that a dozen eggs listed at S$3.30 in-store was S$4.10 on Shopee, even before delivery charges. A pack of Japanese cucumbers was S$1.50 more expensive on a grocery app compared to its shelf price at FairPrice. You are not just paying for convenience. You are also paying for markups that are easy to miss.

IN A NUTSHELL

Even without splurging or making impulse buys, shoppers are quietly losing money to subtle strategies built into the grocery system. Smaller product sizes, misleading sale tags, and hidden online markups all add up.

Image Credits: unsplash.com

Smart shopping now means more than sticking to a list. It means staying alert, comparing prices, and questioning deals that look too good to be true.