We love 1 for 1 deals as nothing beats dining with your partner for the price of one or half if bill is split two way.

Banks know it and it often comes as a perk for signing a credit card with them.

Citibank’s new 1-for-1 dining privileges is packed with a number of restaurants that are worth mentioning for.

They are valid until 30 Jun 2015, so get ready to feast for a one whole month!

63Celcius

Ben & Jerry

Boston Seafood Shack

Carlton Hotel Singapore

Delifrance

dr.CAFE Coffee

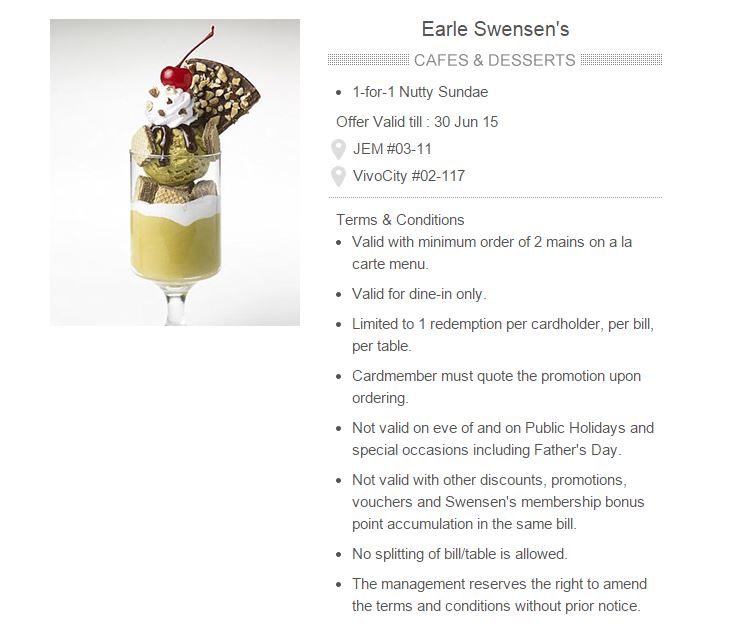

Earle Swensen’s

Ginzawa

Haha Thai

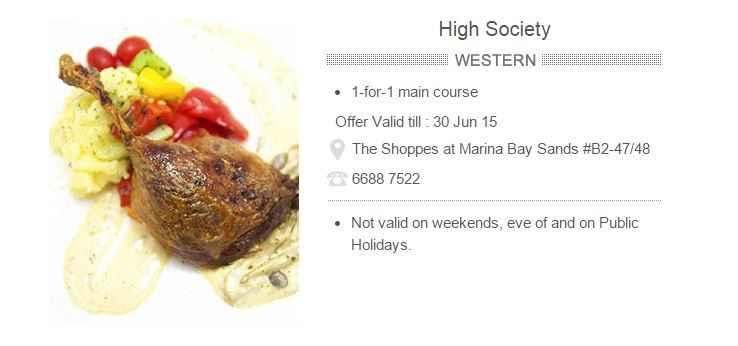

High Society

Hinoki Japanese Dining

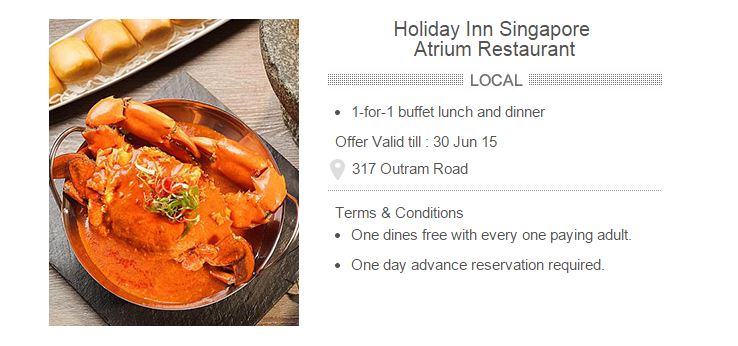

Holiday Inn Singapore Atrium

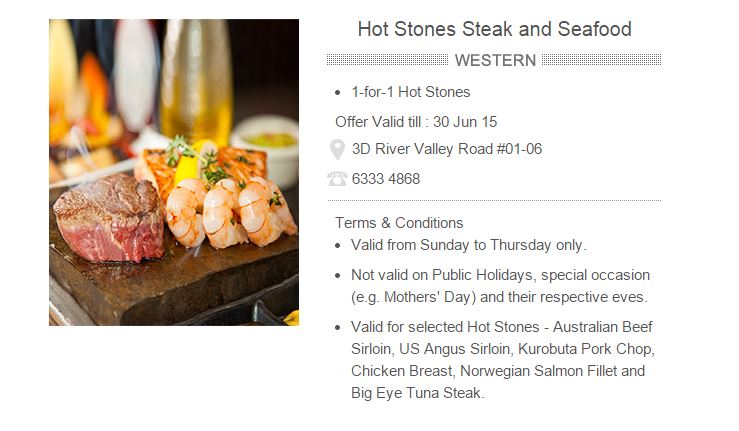

Hot Stones Steak and Seafood

Island Cuisine

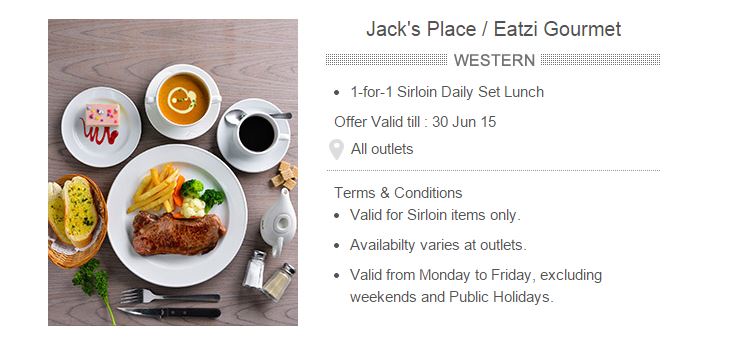

Jack’s Place/Eatzi Gourmet

Ke Zhan

Marble Slab Creamery

Mizo Restaurant and Bar

Orchard Hotel

Outback Steakhouse

Pizza Hut

Pizza Hut

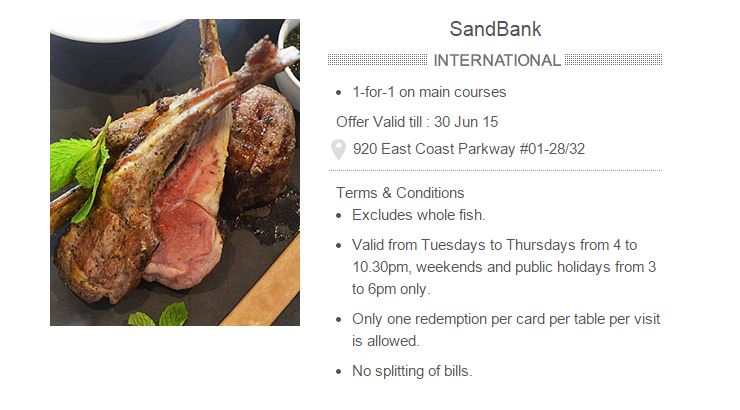

Sandbank

Senjyu

Shin-Sapporo Ramen

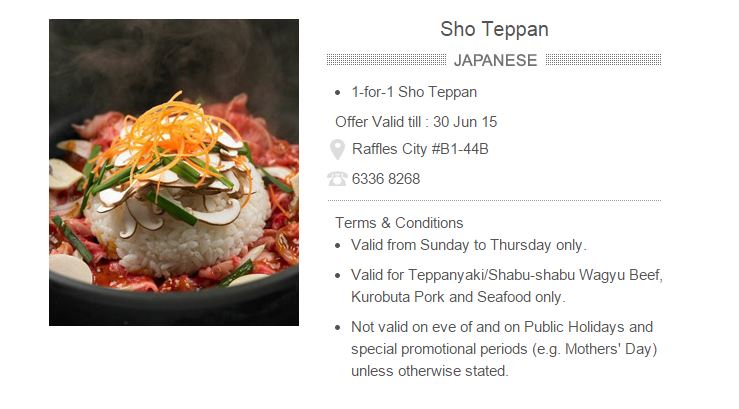

Sho Teppan

Siam Kitchen

Singapore Marriott Tang Plaza Hotel

Skyve Wine Bistro

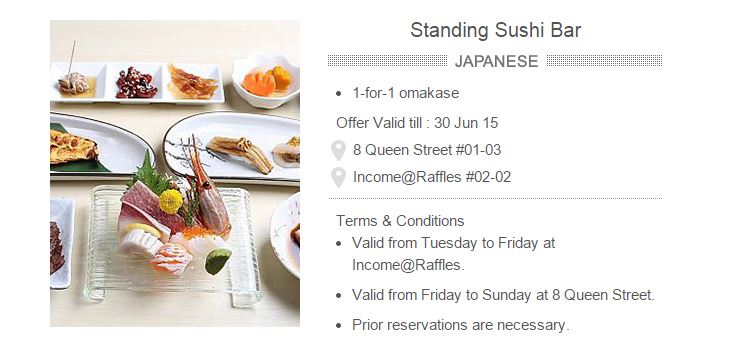

Standing Sushi Bar

TAO Seafood Asia

The Bank Bar + Bistro

The Manhattan Fish Market

Wooloomooloo Steakhouse

1-for-1 terms and conditions:

- All offers are valid till 30 June 2015 unless otherwise stated.

- All payments must be charged to a Citibank Credit or Debit Card to enjoy the offers.

- All offers are not valid with other promotions, discounts, privileges, set menus, special menu, membership privileges, VIP privileges, vouchers and cards, unless otherwise stated.

- All offers are not valid on the eve of and on Public Holiday and other special occasion unless otherwise stated.

- All offers are subject to prevailing government taxes and surcharges.

- Complimentary item must be equal or lesser value than the item purchased.

- All participating outlets reserve the right to replace complimentary item with another item or one of similar value.

- Prior reservation is required and subject to availability.

- Please quote ‘Citibank Gourmet Pleasures 1-for-1 promotion’ prior to order and reservation.

- All offers are on a while stocks last basis.

- All offers are bound by the terms and conditions of the respective merchants.

- Citibank is not an agent of the merchants and makes no representation as to the quality of goods and services provided.

- All disputes about quality or performance of the product and/or services should be resolved directly with the merchant.

- All feedback regarding quality and services provided should be directed to the respective restaurants.

- Citibank and the respective merchants reserve the right to vary the terms and conditions governing the offers.

- Images are for illustration purposes only.

Don’t own a Citibank Credit Card? Sign up here: http://bit.ly/1cHDKVX or share this post to look for a Citibank’s Card member!