Interested to start a baby business and to make and/or sell baby products? Then don’t miss this free seminar that connects you to more than 150 exhibitors and brands.

Children Baby Maternity Industry Expo (CBME South East Asia) will be held at the Sands Expo and Convention Centre from 25 – 27 April 2017.

CBME South East Asia is the only annual B2B trade show in the region specifically for children, baby and maternity products. It gives related industry players such as manufacturers, suppliers, retailers and distributors a unique experience and opportunity to network, exchange ideas and learn.

Whether you are an aspiring entrepreneur or an existing retailer/brand owners, you are invited to South East Asia’s Only B2B Children, Baby and Maternity Products Exhibition.

The secret to starting a successful baby business

Success in the children’s wear market means understanding the industry and your place in it. Attendees to CBME South East Asia 2017 can expect to gain in-depth knowledge on recent trends shaping consumer behaviour across the region, and ways by which retailers can effectively drive retail sales by converting walk-in shoppers to actual buyers, looking beyond footfall.

Free to attend seminars

Key topics you will get to access include:

- Consumer Behaviour in Southeast Asia

Gain insights on the SEA demographic landscape and category trends and drivers of baby products. - Tips on Optimising Retail Space

Learn basic layout tips to boost sales at your retail outlet. - Turning Shoppers into Buyers

Find out about the truth behind shopper decisions. - E-commerce in Southeast Asia

Gain insights on the digital landscape in Southeast Asia and its current challenges. - Market Development and Expansion

Identify new market segments and expand your business with market tips. - Starting Up as a Mompreneur

Learn through case studies on raising a family and running or starting up your business simultaneously

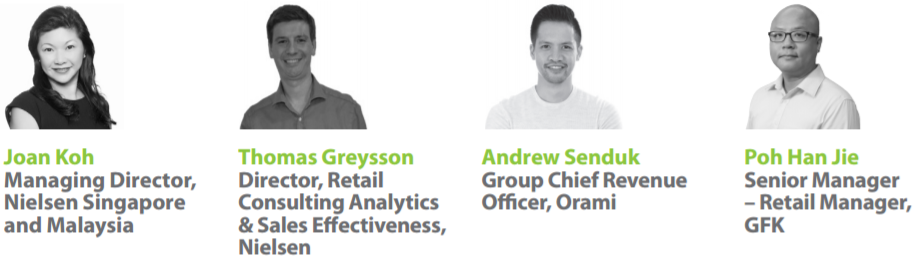

Presenting at the seminar will be Thomas Greysson, Director, Retail Consulting Analytics & Sales Effectiveness (Nielsen), Joan Koh, Managing Director (Nielsen Singapore and Malaysia), Andrew Senduk, Group Chief Revenue Officer (Orami), and Poh Han Jie, Senior Manager – Retail Manager (GFK).

What to expect at the trade show

Besides free-to-attend industry seminar, visitors to the event can expect a number of exciting and industry related side events including an opportunity to meet international exhibitors who will be showcasing their unique and latest products, a private business matching program, on-site tours and products demonstrations.

There will be 150 exhibitors from 250 brands including Worldwide Manufacturers, Brand Owners, Distributors, Suppliers and Service providers covering the following product categories:

- Maternity and Baby Care Products

- Baby Carriages, Car Seats and Furniture

- Food and Health Care Products

- Toys, Educational Products and Souvenirs

- Children, Baby and Teenager Clothing, Footwear (ages 0-16)

- Maternity Clothing, Underwear and Accessories

- Service Organisations

Pre-register here to enjoy free admission to the trade show. Download a free catalogue after registration.

Exhibition Venue:

Marina Bay Sands Expo and Convention Centre, Hall C (Singapore)

10 Bayfront Avenue, Singapore 018956