ANZ Credit Cardmembers, here’s an exclusive travel deal for you.

From now till 8 Sep 2015, book your travel with Cathay Pacific and enjoy special fares to over 40 destinations, starting from S$248/- all-in. (tax and surcharges inclusive)

Fly to popular destinations such as Bangkok, Taipei, Hong Kong, Seoul, Osaka and many more.

Plus, receive a limited edition luggage strap with a min spend of S$800*

Travel Period: By 30 June 2016

| Destination | Economy | Premium Economy | Business |

|---|---|---|---|

| Hong Kong | $248 | $708 | $1,118 |

| Bangkok | $218 | - | $528 |

| Taipei | $408 | $938 | $1,408 |

| China+ | $418 | $1,038 | $1,518 |

| Seoul | $588 | $1,298 | $1,998 |

| Tokyo, Osaka | $598 | $1,298 | $1,998 |

| Los Angeles, San Francisco | $1,328 | $2,618 | $5,928 |

| Vancouver | $1,348 | $2,728 | $6,408 |

| New York, Boston | $1,378 | $2,908 | $6,758 |

| Chicago, Toronto | $1,458 | $2,978 | $6,758 |

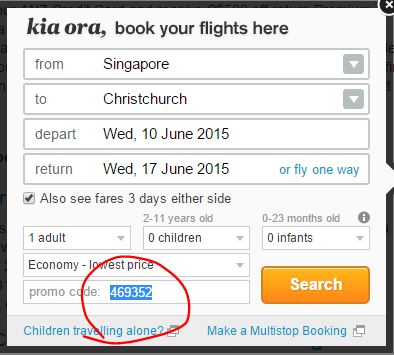

For bookings and full listing of fares, click here.

#ANZ Cathay Pacific Promotion Terms and Conditions

- All-in fares include applicable taxes and surcharges which are correct as at time of publishing, and are subject to change at point of ticket issuance.

- The fares displayed are exclusive to ANZ Credit Cardmembers only, and payment must be made with an ANZ Credit Card.

- Cardmember need not be the traveller. Ticket sales period is from 13 August to 8 September 2015.

- Advertised Economy Class fares require a minimum of two passengers travelling together, except Hong Kong, and are valid for travel from 13 August 2015 to 30 April 2016 for Hong Kong, and 01 March 2016 to 30 June 2016 for other destinations.

- Economy Class fares for travel from 13 August 2015 to 29 February 2016 are also available.

- Advertised Premium Economy Class and Business Class fares are valid for travel from 13 August 2015 to 29 February 2016.

- All-in fares displayed are based on per person basis and include applicable taxes and surcharges which are correct at the time of publishing and subject to change at the point of ticket issuance.

- Cathay Pacific Airways’ blackout period and peak period surcharges apply.

- Premium Economy Class fares to China are applicable to Beijing and Shanghai only.

- Premium Economy Class fares to Japan do not include Hiroshima. Availability of Premium Economy Class seats is subject to aircraft deployment and operational requirements.

- Offers are subject to Cathay Pacific Airways’ reservation system and seat/booking availability.

- +China destinations include Beijing, Changsha, Chengdu, Chongqing, Fuzhou, Guangzhou, Guilin, Haikou, Hangzhou, Kunming, Nanjing, Ningbo, Qingdao, Sanya, Shanghai, Wenzhou, Wuhan, Xi’an, Xiamen and Zhengzhou.

- Other terms and conditions of Cathay Pacific shall apply.

- ANZ is not an agent of the Merchant participating in the promotion.

- Any dispute between the ANZ Credit Cardmember and the Merchant, in respect of any goods and services provided by such Merchant shall be resolved directly between the ANZ Credit Cardmember and the Merchant.

- ANZ shall not be liable to the ANZ Credit Cardmember for any loss, cost of damages of any kind resulting from the Promotion.

*ANZ Luggage Strap Terms and Conditions

- The Redemption Programme is only open to ANZ Credit Cards issued in Singapore and excludes ANZ Corporate Credit Cards. To be entitled to redeem the luggage strap, ANZ Credit Cardmember must purchase a Cathay Pacific Airways air ticket from Cathay Pacific Singapore or any travel agencies in Singapore and/or also fulfil a minimum spend of S$800 on air tickets, hotel room bookings and travel agencies’ services (which must include the cost of the Cathay Pacific Airways air ticket) with their ANZ Credit Cards.

- The original receipt and charge slip must be presented at the Bank’s redemption centre (Short Q: Orchard Plaza #05-10 Singapore 238841 (Wed to Sun from 11am to 7pm)) within a month from the end of booking period in order to be eligible for the Luggage Strap Redemption.

- Luggage Strap Redemption is limited to one luggage strap per receipt, regardless of total amount charged.

- Luggage Strap Redemption is on a first-come, first-serve and while stocks last basis.

- For the avoidance of doubt, there shall be no replacement or exchange of any Luggage Strap that has been redeemed.