Alternative investments are gaining popularity due to the high returns that they potentially yield. One such alternative investment that is worth looking at is peer-to-peer(P2P) lending or commonly known as debt-based crowdfunding.

The concept is simple – small and medium business owners looking for funds to expand their businesses take up business loans which are crowdfunded by investors. The interest paid back by the businesses is the return on investment for the investors.

Funding Societies is a licensed and approved P2P lending platform in Southeast Asia. It is the industry leader with over 30,000 investors in Singapore, Malaysia and Indonesia. As the only P2P lending platform to win the MAS FinTech Award (SME category, 2016), Funding Societies has also won global recognition, being recognised amongst the Top 250 FinTech companies globally by CB Insights and winning the prestigious SME Global Excellence Award by United Nations’ ITU Telecom.

Here, Funding Societies explains why and how you can invest in P2P lending, a unique investment asset class that is complementary to traditional investments:

LOW BARRIERS OF ENTRY & POTENTIAL HIGH RETURNS

As an Investor, you can read the easy to understand factsheet prepared for each loan and invest only if you like the loan. The minimum investment amount is just $100 and you can earn interest up to 14% p.a.!

If you are too busy and do not have enough time to read the factsheet then you can invest via the Auto Invest feature. Just set your parameters and let the system invest for you.

On the platform, you can invest in two types of investments: Term Loans and Invoice Financing. The investment periods for both investments are relatively short, 1 – 12 months for Term Loans and up to 3 months for Invoice Financing.

MONTHLY REPAYMENT TO RE-INVEST EASILY

Suppose you invest into a term loan of 12 months this Christmas, you’ll receive part of your principal and interest paid back on a monthly basis until next Christmas.

Here’s an illustration:

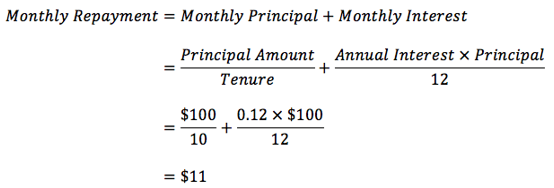

Assuming an investor invests $100 in a loan of 10 months at 12% p.a. interest rate. The monthly repayment is calculated below.

Therefore, the total interest earned by the investor is $10 at the end of the 10 months.

Assuming that the same investor invests 10 of such loans (10 x $100 per loan), he gets $110 in monthly repayments. The total interest earned will be $100.

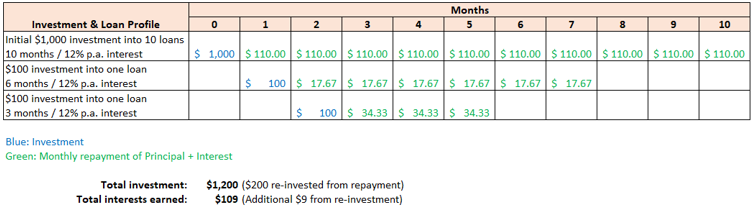

Furthermore, the investor can reinvest his interest and principal multiple loans to achieve a compounding effect. Here’s another illustration:

As shown in the above illustration, the investor re-invested his monthly repayment into new loans and was able to get $109, instead of $100 without re-investing.

LICENSED AND COMPLIANT

Funding Societies holds a Capital Markets Services license issued by the Monetary Authority of Singapore.

They have also gone through multiple internal and external audits to ensure that all processes are compliant.

Funding Societies is also one of the first peer-to-peer lending platforms to use an independent escrow account to handle all investor funds. What this means to you as an investor is, Funding Societies does not have direct access to your funds and the funds and investments are safeguarded by the 3rd party trustee (which is also licensed by MAS).

STRINGENT IN CREDIT RISK MANAGEMENT

The key risk in this investment is businesses defaulting on the loans. However, Funding Societies does thorough due diligence on the company to minimize this risk, which is why the default rate is also one of the lowest in the region at just 1.4% as at 30th November 2017. The returns are priced based on risk, amongst multiple factors. As an investor, you have full autonomy to choose which loans you want to invest in, based on your risk/return appetite.

Funding Societies advocates the “skin in the game” concept. The company and members of the management team invest their own money in every loan to not only co-share the returns but also risks with all the investors.

SMART FEATURES TO MAKE THINGS BETTER FOR YOU

Auto-invest feature reduces the time required to monitor opportunities. Simply input your preferred parameters and the system will do the rest.

Live chat with Miyu the chatbot on Funding Societies’ website and get your queries answered 24/7!

Even though Funding Societies is an online platform, they offer a personal, offline experience for investors. Investors can email, call or visit their office for a no-obligation chat. Funding Societies is also a winner of the Best in Customer Experience for Alternative Financial Services this year, awarded by Retail Banker International. Try out the platform for yourself to experience it!

SIGN UP NOW TO BE AN INVESTOR WITH FUNDING SOCIETIES

Join more than 30,000 other investors on Funding Societies’ platform, and earn returns of up to 14% per annum. Make your $100 (or more) work harder for you this year and collect your ‘bonus’ next Christmas! Sign up as an investor with Funding Societies now.

Disclaimer

This article is contributed by Funding Societies.

It should not be construed that Moneydigest is endorsing this article or any of the products and services provided by Funding Societies.

Nothing in this article should be construed as constitute or form a recommendation, financial advice, or an offer, invitation or solicitation from Funding Societies to buy or subscribe for any securities and/or investment products. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any company or investment. The content and materials made available are for informational purposes only and should not be relied on without obtaining the necessary independent financial or other advice in connection therewith before making an investment or other decision as may be appropriate.