Our attitudes toward money affects our financial circumstance. I am not saying that your mere fondness over money will lead you to earning more. Your money attitudes dive beyond your wants. Money attitudes influence how you approach a situation and make your financial decisions.

On that note, here are 4 money attitudes that can potentially cost you:

#1: I HAVE POOR MONEY MANAGEMENT SKILLS

As a finance columnist, I noticed how people differ in handling money. Others write down every little detail of their spending. While, some people believe that they are not good with handling money. This negative attitude towards money shuns opportunities to learn about money management.

Educating yourself about the dynamics of money is important. Your eagerness to wide your knowledge will fuel improvements. Start by reading books and articles on Personal Finance.

Replace Your Negative Attitude With: “I have the ability to learn more about money management.”

#2: MY SELF-WORTH DEPENDS ON MY NET WORTH

It goes without saying that our fast-paced society welcomes symbols of status. When a woman shuffles between different designer bags in the workplace, spectators perceive her as someone with sophistication and wealth. When a woman carries “lesser known” bags, she is seen as someone who is less wealthy.

Why is this skewed ideal so prevalent in our society? Perhaps, modern technology has something to do with it. Nonetheless, this tendency to match self-worth with net worth can potentially harm one’s mental health.

Replace Your Unhealthy Attitude With: “My self-worth depends on the acceptance and understanding of myself.”

Image Credits: unsplash.com

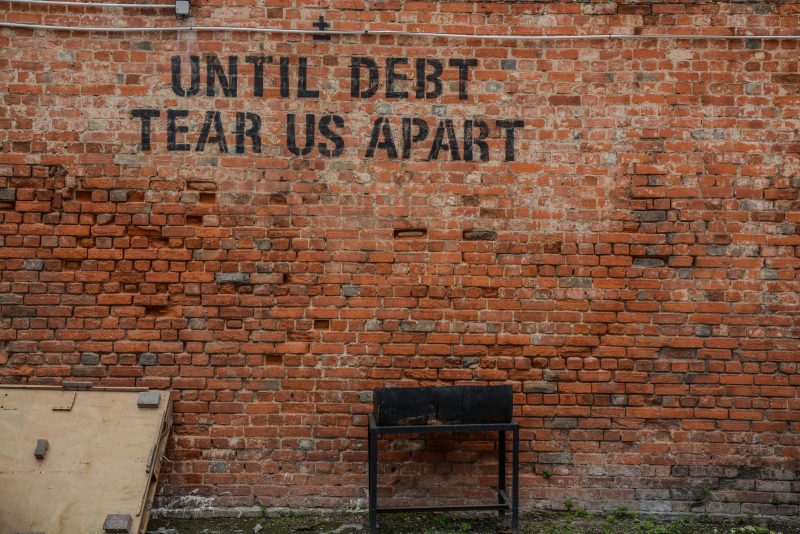

#3: MONEY IS SOLELY FOR SPENDING

Believing that money’s sole purpose is for disposal can lead to mindless spending or debt! Spending your hard-earned cash on lavish or delightful things every once in a while is acceptable. However, you must not overdo it! Make room for savings and investments.

In order to create financial abundance, you must save and allocate your money efficiently. Spending beyond your means will never lead to financial abundance!

Replace Your Exaggerated Attitude With: “The money that I do not spend increases my wealth.”

#4: THE RICH GET RICHER

“The rich get richer and the poor get poorer” is an aphorism that highlights our economic inequality. Let us be honest! Some people are not born with a silver spoon. But, they can do something about it!

Boxing yourself to a certain economic stature limits what you can achieve. You have a choice to take control of your life. You can improve your financial situation as long as you do not give up.

Replace Your Magnified Attitude With: “My financial present and future is entirely up to me.”