Get covered for COVID-19 and personal accidents for less than $0.30/day

Protect yourself and your family members from the impact of the novel coronavirus. The ongoing pandemic has means uncertainty for a lot of people. To cope with the health and financial challenges, SingSaver has launched a personal accident insurance policy with FWD to extend coverage for COVID-19.

The new and exclusive insurance product will cover infectious disease including COVID-19, Dengue, Zika and more at only $98/year — one of the cheapest in the market.

One of the highest limit/coverage for COVID-19

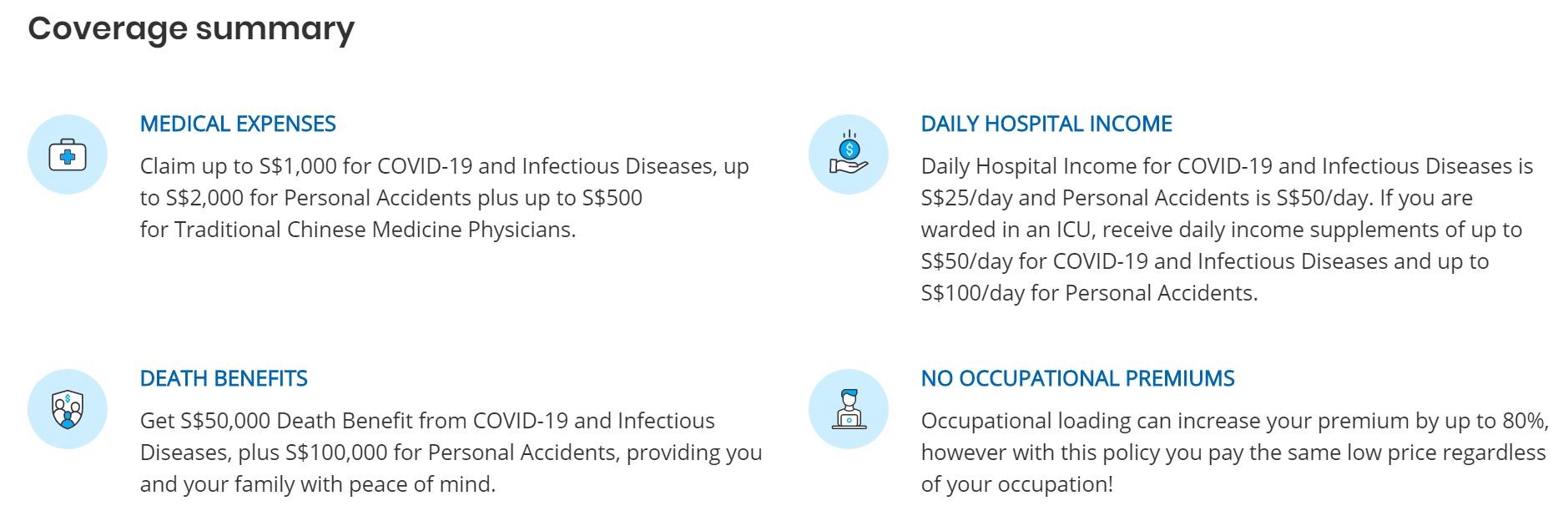

The policy offers coverage for the highest number of Infectious Diseases in the market. It also has the highest Death Benefits of $50,000; plus Guardian Angel Benefits and Funeral Expenses Benefits at $50,000 and $2,500 respectively.

That is not all. You will be covered with a $1,000 limit for inpatient and outpatient expenses and $25/day in hospital income for up to 365 days! ($50/day if you are admitted to ICU) Yes, you see it right. Insurance coverage for the entire year. (Most insurer has a higher daily hospital cash payout but has a cap of around 14 – 30 days)

With unlimited medical evacuation, you enjoy a peace of mind if you contract an infectious disease or met with a accident overseas.

No occupation loading

Working in an environment that carries more risk? Most insurers in the market impose occupation loading which increases the price by as much as 80%! You’d be glad to know that FWD does not impose occupation loading. (Yay, for frontline healthcare workers)

The plan also covers all personal accidents

The personal accident plan also covers all accidents. In the unfortunate event that there is an accident i.e. your Grab ride gets into a collision or a GrabFood rider on e-scooter knocks into you, you are well covered with this policy.

Frequently Asked Questions

- For hospitalisation due to accidents and COVID, cost of ward stay is excluded right? (i.e. I’ll need to have medical insurance for that instead)

Covid19 – SG govt covers the hospitalisation ward stay, so the $1K medical expenses is additional $ for you. For other infectious diseases and Accidents, your ward stay can be reimbursed via medishield life/ integrated shield plan (the $1K medical expenses is additional $ for you). - The plan covers me for 1 year. Anything to note if I want to renew?

Usually renewal or buying a PA policy will ask some questions like Age below 65, never excluded from any PA insurance

applications previously, etc. - Does it cover accidents arising from car accidents? i.e. my Grab ride gets into a collision, or a GrabFood rider on e-scooter knocks into me

Yes, it covers ALL ACCIDENTS – as long as it is an accident.