In our quest for youthful looking hair, we often do things that damage our hair and scalp conditions. For instance, your straightening habits, frequent hot showers, blow-dry addiction, and regular hair dyes can bring more damage.

Damaged hair is fragile, and it tends to break. Hair breakage can leave us with unhealthy, frizzy hair. Fortunately for you, simple changes can prevent further hair damage.

DANDRUFF

Dandruff is a common scalp condition in which small pieces of dry skin flake off the scalp. The best way to treat your dandruff is to use the herbal mixture with anti-inflammatory properties.

HAIR DAMAGE

Hair damage can manifest itself as having dry hair or split ends. If your hair feels coarse and rough, it might be begging you for protein. Fatty acids such as vitamin B5, Omega 3 and 6 can help replenish dry hair.

Having split ends serves as a cue for a haircut. For split ends, rubbing a dash of oil onto your ends can help minimize the split ends’ appearance and provide nourishment.

CHEMICAL EFFECTS

It is tempting to head over to the nearest hair salon after scrolling through endless hair inspo on your Instagram feed. Whether you opt for root touch ups, bleaching, or highlights, dyeing your hair can make it brittle and dry due to the chemicals that come along with it. If you have dyed your hair, you need to give it extra attention and care. Pamper your hair and scalp with expert hair treatments!

HAIR LOSS

It is normal to lose 50 to 100 strands of hair in a day. However, you will need to act if you experience a sudden increase in your daily hair loss. Hair loss occurs due to several factors including stress, hormonal imbalance, and using harmful hair products.

Some ways to prevent hair loss include eating protein-rich food, staying hydrated, and seeking expert help. Beijing 101 can rescue you from further hair loss and damage!

With over 4 decades of experience, Beijing 101 has been dedicated to helping customers combat their hair issues such as hair loss, hair dye damage, split ends, dry hair, dandruff, oily scalp, and more.

When it comes to reducing hair damage, keeping your scalp healthy, and promoting hair growth, Beijing 101’s Meridian Hair & Scalp Purity Treatment can help!

Designed to deep clean your scalp, unclog hair follicles and promote hair growth to keep hair loss at bay, this effective hair treatment is highly recommended by Beijing 101’s customers.

Best of all? You can get the Meridian Hair & Scalp Purity Treatment at a trial price of $40 (U.P. $532), for a limited time only. Sign up here and receive $10 shopping credit after the treatment! Plus, stand a chance to win a 5-Star Shangri-la Rasa Sentosa Staycation!

Deeply cleanse your scalp and walk out with healthy, youthful looking hair with this treatment that includes the following steps:

1. 1 on 1 Consultation + Detailed Hair & Scalp Analysis

Your hair therapist will start off with a consultation to understand your lifestyle that may affect your hair health. Then followed by a scalp scan to assess your scalp’s health and find out the roots of the hair problems.

2. Customized Scalp Mask

Based on the results of the scan, your hair therapist will customize the herbal scalp mask using premium-grade Chinese herbs to give your hair the best care. The main herbal ingredients used for the Meridian Hair & Scalp Purity Treatment are Ling Zhi, Ginseng, and He Shou Wu. These ingredients are known for their rejuvenating, and anti-hair loss properties.

3. Herbal Tonic with Signature Meridian Massage

After washing off the herbal scalp mask, it is time for you to enjoy the signature Meridian scalp massage. First, a special tonic will be applied to provide more nutrients to the hair and scalp. Then, the meridian massage will begin which helps to stimulate hair growth.

4. Alpha LED Light

Your purifying treatment will cap off with the Alpha LED Light, which is a helmet-like device to place on your head. This improves blood circulation and promotes better hair growth. See improvements in just one session!

What are you waiting for? Repair your hair with the Meridian Hair & Scalp Purity Treatment at $40 (U.P. $532) and be rewarded with $10 Shopping Credit after the treatment. Sign up here!

This limited offer also comes with a chance to win a 5-Star Staycation at Shangri-la Rasa Sentosa. Visit the nearest Beijing 101 outlet now!

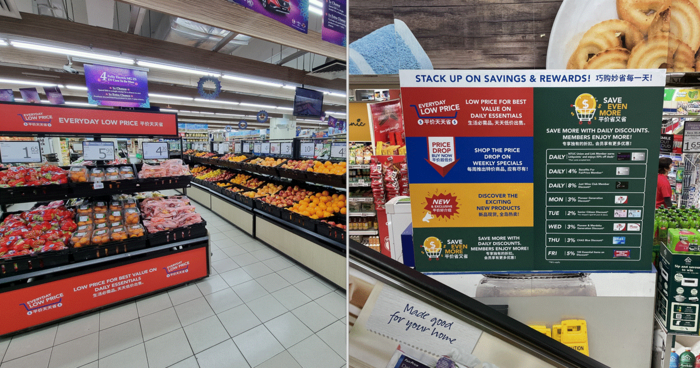

Century Square #04-03

Nex @Serangoon Central #04-08

Northpoint City (North Wing) #03-27

Bedok Mall #B1-55

Causeway Point #05-02A

Funan #B1-18

Jcube #B1-05