Too often we hear of people or even peers who have not begun to explore the idea of investing because they’ve been told that it is ‘risky’. Wait, did you say ‘they’ve been told’? Does that mean that they never even tried their hands on it and come to the false conclusion that investing is risky? Sure, investing entails risk because there’s the possibility of losing money doing it. But do you really know what ‘risky’ mean? Does not losing necessarily equate to ‘no risk’? No.

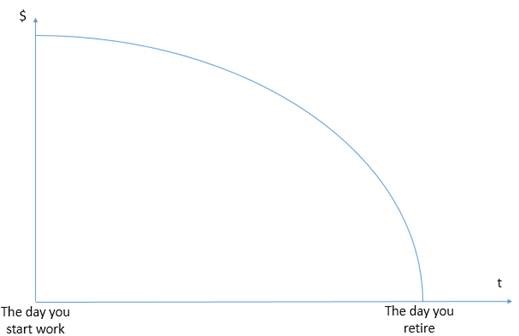

True risk lies behind what is seldom seen. Having only one source of income is a really big risk. While the money is coming in from your monthly salary, it’s easy to feel safe and secure because you can settle your credit card debts, mortgages and bills. However, it’s this very framed up mindset, that money only comes from working (1 Income Source) that blinds us. We become so comfortable with receiving one paycheck per month that we fail to see the possibility of having multiple paychecks coming in.

Have you ever thought about “What happens if I got fired?” With layoffs becoming more and more common these days, it is a very real question. Is it simply just a time to go look for a new job to fix that broken stream of income? Or is it time to think about a greater issue at hand? This is the kind of risk I’m talking about, unforeseen risks. Who knows if another massive labour cut happens and you’re one of the unlucky victim? What would you do without 3-6 months of income? How are you going to pay for the bills now? Now, is having a job truly risk-free?

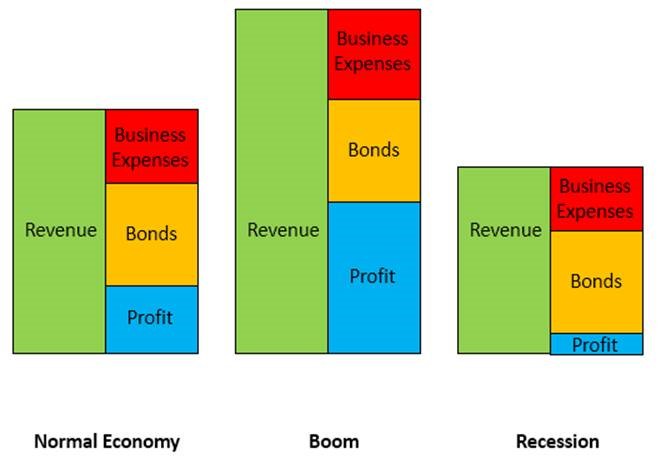

Consider this, what if you had a job while your investments were paying you cash dividends (Sharing profits with shareholders). Now you would have multiple streams of income, depending on how many different companies that pay out dividends consistently you have invested in. Even if you had lost your job, you still have a couple of income streams that does not even require you to do anything to make sure that money keeps coming in. This in turn creates a buffer for if in the unfortunate event you lose your job temporarily. On the even brighter side, you could have income from your job while your investments continue to pour even more income into your bank account!

Is investment still ‘risky’ when you see this side of the picture? Wouldn’t the risk of having only one source of income be even greater?

Just because you don’t know how to invest, doesn’t mean you can’t learn how to invest! There are many articles here on MoneyDigest and on the internet that can teach you how to invest. Just remember, which is more risky? Having only one source of income or spending some time to learn how create multiple sources of income.