In my years as a consultant, I have advised and been mentored by many brilliant individuals including the CEO of major corporations and household names. Risk / return ratio was always the centrepiece of major decisions. While regulators and financial institutions are taking up more responsibility in the post-crisis world with Dodd-Frank and Basel III, we as individual investors should view investment return with a risk lens too, for risk is the shadow of return, the two sides of the same coin.

Many are attracted by the idea of “guaranteed investment return” or “maximum return minimum investment.” A Google search of these keywords gives us 3.2 million and 216 million results respectively. However, these pursuits are inspirational but not aspirational. In financial markets and many commercial activities, if one wants to achieve higher returns on average, one often has to assume more risk. The key question is then not “How can I make the most return?” but rather “How can I make the most return at a risk I’m comfortable with?”

Four Common Approaches in Risk Management

In the practice of risk management, there are 4 common approaches towards risk i.e., avoid, transfer, mitigate and keep. Most would inadvertently take the approach of avoid or keep i.e., avoid investment risk and not invest at all, or invest and face the full risk. In fact, based on an internal survey Funding Societies has conducted with 500 members of the public, 50% of the respondents across all segments keep their funds in saving accounts and do not invest. 19% of respondents consider returns but not safety of capital as critical investment criteria. Avoid and keep are common not because of ignorance, but because of convenience.

Importance of Diversification

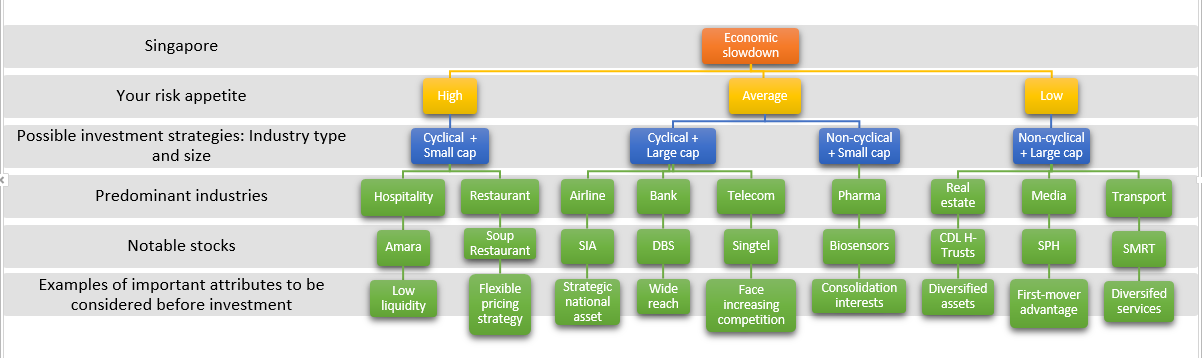

Investing has to be deliberate. For most, we believe the right approach is to mitigate risk by systematically diversifying investment. While a focus strategy may be suitable for experts who dedicate hours into analyzing and monitoring investments, diversification is tremendously valuable for regular investors who prefer to “invest and forget”. Effective diversification is not only about making more investments, but also investing in areas less correlated with each other by geography, industry and asset class etc. This is especially true in a weak economic environment that is fraught with uncertainty.

I have personally invested in equity, investment fund, real estate and alternative investment, with of course always 6 months of savings as contingency. I began with Asia equity and bond investment funds to achieve diversification even with limited capital. As I accumulated more capital, I ventured into US equity and Singapore real estate for further diversification. Diversification has helped me through many financial crises. By strategically allocating funds into a portfolio suitable for me, I only have to check my investments once a month and still enjoy reasonable returns.

P2P Lending Platform – A New Way to Diversify Your Investments

The recent rise in alternative investments such as peer-to-peer (P2P) lending in US, UK, Australia and China provides a new, proven opportunity for higher return and diversification. While higher return clearly comes with higher risk, it is at a level suitable for working professionals like me, especially given the shorter term and hassle-free nature of P2P lending. Investing on P2P lending has become my new favorite. A few P2P lending platforms have since launched in Singapore. An example is Funding Societies that focuses on small-medium enterprise (SME) loans.

Of course, diversification takes capital, cost and effort. Undue diversification could spread us too thin across investments. The key is to select uncorrelated investments. The less correlated the investments are, the better the diversification effect. One may ask: how do we know whether the investments are correlated? Without going into a statistical model or correlation matrix, basic intuition is a good start.

As risk guru Michel Crouhy aptly summarized, “The future cannot be predicted. However, the financial risk that arises from uncertainty can be managed.” We need to be deliberate in our risk / return decisions and be diligent in diversification because if we don’t decide them for ourselves, the market will decide for us.