The haze is back, and you know what it means: harmful effects to your health. Haze pollutants, which are usually fine particulates, are small enough to be inhaled and penetrate the lungs, causing different respiratory problems and even premature death.

While the government works to reduce the impact of haze, you can keep safe with these tips:

Know your risks

The haze pollutants are bad for the health, but they’re more dangerous for certain people. These include:

- Children

- Pregnant

- Elderly people

- People diagnosed with heart or lung disease

- People who are prone to respiratory problems like asthma

Use the chart below to help you plan your 24-hour activities:

Source: http://www.e101.gov.sg/

If you have been feeling unwell especially since the beginning of the haze, seek medical help as soon as possible.

Monitor the haze

The Pollutant Standards Index (PSI) measures the level of pollution in the atmosphere based on 6 factors. In normal conditions, PSI is moderate or between 51 and 100. However, when there’s haze, it can go up to more than 200.

To know whether it’s a good time to put on the mask, go outdoors, or do certain activities, keep track of the PSI readings. The readings may vary from day to day, depending on other weather-related factors such as wind direction and speed as well as presence of rain. It can also be different in terms of location.

Invest in an air purifier

One of the safety precautions you can take if there’s a serious haze is to stay indoors, but sometimes particulates can still get inside your home, not to mention your own house can have plenty of pollutants from dust, mould, and pet dander. To control the ill effects of indoor pollution, buy a good-quality air purifier, which filters and cleans air more effectively than carbon or UV filters.

Air purifiers, depending on factors such as brand and features, are more expensive than filters. To save on costs or to get rewards points, charge this purchase to your credit card. If you don’t have one yet, you can apply for a credit card now and start saving money.

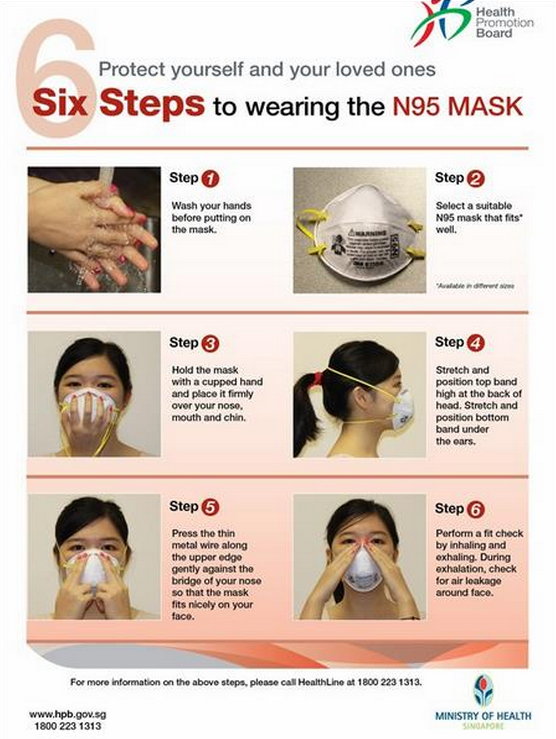

Wear a mask

A mask is your best option if you need to be outdoors and the haze level is unhealthy or critical. The Ministry of Health (MOH) recommends an N95 mask, which is available in major supermarkets and pharmacies such as FairPrice, Cold Storage, and NTUC. They are considered to be at least 95% efficient against particulates from 0.1 to 0.3 microns and 99% against 0.75 microns and above.

There are different types of N95 masks based on comfort, design, and size. Regardless of your choice, these masks must fit your face properly. Below is a guide on how to wear your mask:

Prolonged mask use may cause discomfort and sometimes difficulty in breathing. If this happens, remove the mask and rest. You can also choose not to wear them if you’re indoors or travelling only short distances. These masks can be reused, but they need to be changed if they are already soiled or the shape has been distorted.

Although many sell masks to children, N95 masks are not generally designed for them, so you may want to adjust the length of the cord and carefully pick the right size. Lastly, N95 masks are not surgical masks as the latter cannot offer the same protection against particulates that N95 masks do.

Consider working from home

Ask your boss if you can do your work at home while the haze is still actively present to limit your outdoor movements.

When it comes to fighting the haze, it’s always best to put your safety and health first above everything else.

(This article is brought to you by SingSaver.com.sg)

Resources

http://haze.asean.org/?page_id=249

http://www.e101.gov.sg/haze/psi.htm

http://www.haze.gov.sg/haze-updates/psi-readings-over-the-last-24-hours

http://thehoneycombers.com/singapore/the-haze-is-back-bring-out-the-air-purifier-singapore/

http://www.singsaver.com.sg/blog/7-ways-the-haze-in-singapore-is-costing-you-money