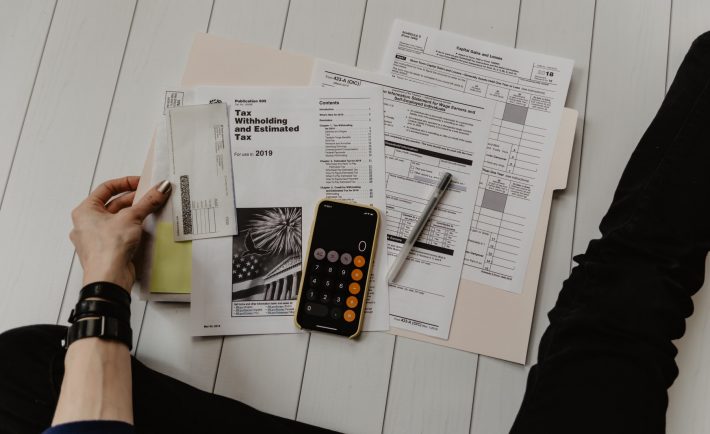

As you gloss over the pages of old personal finance books, you will realize that they stress on the importance of creating a budget and sticking to it. Poof! All your financial problems will be solved in a snap. However, life is not as simple as that.

Budgeting is the process of creating a financial plan based on your estimated revenue and expenses over a period. It is a complex task that takes your entire financial profile into account. It is up to you to embrace the process!

On that note, here are the fundamental rules of budgeting.

#1: BE HONEST WITH YOURSELF

Awareness of how much money comes in and how much you spend will enable you to pinpoint your spending habits. Be honest with yourself! You will be surprised that everything adds up, once you keep track of your money on a regular basis. Start by writing down your expenses for a week and continue. Include your daily coffee runs and Netflix subscription. You can use online budgeting tools to help you monitor your money.

#2: BE PREPARED TO CHANGE

The only permanent thing in this world is change. Your efforts of controlling your environment will be put to waste because change is inevitable. If you reached the end of the month and noticed that you are struggling to pay bills, something needs to change. Alter your budgeting strategies and identify which categories you can cut down on. Fortunately for you, small changes can make a big difference.

Your income, expenses, and priorities will change over time. You must adjust your budget accordingly.

#3: LEARN SELF-CONTROL

Within my immediate social circles, my partner is the primary model for self-control. He steers away from luxury and focuses on strategies that make him a savvy spender. He practices delayed gratification too. Learning self-control can help you accomplish your realistic budget.

If you are lucky, your parents or teachers taught you this skill when you were a child. If not, you will learn the importance of delaying gratification. Despite the tempting nature of credit cards, it is better to wait until you have saved up the money for a purchase. You do not want to spend the rest of your years paying for your credit cards alone!

#4: USE CASH WHEN NEEDED

Notice your spending habits. If you are constantly overspending on a budget category, consider having an envelope system. Use the allocated cash from the envelop and stop spending once it runs out. It is the ultimate accountability strategy.

#5: CREATE GOALS

Be realistic when it comes to your budget and your priorities. Whether you are paying off student loans or building an emergency fund, you need to focus on the goal. Knowing the reasons behind why you are saving and why you are making sacrifices will help you sustain your budget.

#6: PROTECT YOUR WEALTH

Ensure that your hard-earned money does not vanish by taking some safety measures. IF you are renting a flat, consider getting an insurance to protect your belongings from fire or burglary. If you just bought a laptop, sign-up for the warranty. This will help you cushion the costs of repairs.

Image Credits: unsplash.com

You must educate yourself on budgeting and handling money. The more you learn about handling money wisely, the more concrete your reasons for budgeting will be. Good luck!