Singapore’s healthcare system has often been dubbed as one of the best in the world. Its technologically advanced facilities, first-rate practitioners, and streamlined administrative processes make it highly accessible to permanent residents, and a global health hub for medical tourists. To maintain its superb level of healthcare, it relies on several factors to keep its operations running smoothly. Let’s have a look at five of its key aspects to help you better understand how the Lion City’s healthcare system works.

The Ministry of Health (MOH) Plays a Crucial Role

The Ministry of Health (MOH) is the primary governmental authority responsible for the healthcare system in Singapore. It is tasked with the formulation and implementation of healthcare policies, regulations, and standards. MOH’s functions also extend to healthcare financing, resource allocation, and the provision of a safety net for those who require assistance in paying for medical services. With MOH’s guidance, Singapore’s medical facilities are capable of keeping a high standard of healthcare, whether they’re a private or public hospital.

Singapore’s Healthcare Facilities are Semi-Private, Even Public Hospitals

Singapore’s healthcare system operates via a “semi-private” approach, which allows healthcare providers to coexist with public institutions. This model encourages healthcare providers to continuously innovate, enhance their service quality, and offer a variety of healthcare options to meet their patients’ diverse needs with minimum waiting times. Having this system in place guarantees accessibility to healthcare services for a wide range of individuals, including expats and medical tourists. It also ensures that both private and public facilities deliver world-class care.

Its Health Insurance System Is Composed of the “Three M’s”

The basic structure of Singapore’s public health insurance system is built around Medisave, Medishield, and Medifund. Locally known as the “three M’s”, Singaporeans can use these plans to cover their medical expenses. Each “M” has a different scheme, as follows:

- Medisave. A mandatory healthcare savings scheme that requires permanent residents to contribute a portion of their income to a personal Medisave account. This account serves as a financial safety net for healthcare-related expenses, including hospitalisation, certain outpatient treatments, and approved medical services.

- Medishield. Medishield is Singapore’s universal healthcare insurance program that provides basic health insurance coverage for all Singaporeans. It acts as a shield against large medical bills, particularly for catastrophic illnesses or surgeries. It ensures that individuals are not financially burdened by the costs of extensive medical treatment. Those who have Medishield coverage pay premiums, which are usually deducted from their Medisave accounts.

- Medifund. Medifund is an endowment fund set by the government to provide a safety net for individuals who, for any reasons, are unable to pay for heavily subsidised medical care at restructured hospitals, despite having funds in their Medisave accounts and Medishield. It’s a compassionate and critical element of Singapore’s healthcare system that ensures no one is left without access to essential medical care.

Singapore Boasts World-Renowned Speciality Clinics

Singapore is home to several world-renowned specialty clinics, known for their expertise and advanced medical services. These establishments cater not only to the local population, but also to international patients who seek specialised care. Let’s have a look at three of them:

National Cancer Centre Singapore (NCCS)

NCCS is a globally recognised cancer centre in Singapore, renowned for its comprehensive cancer care, cutting-edge research, and state-of-the-art treatment options. It offers a multidisciplinary approach to cancer treatment and is a leading institution in the fight against cancer.

National Heart Centre Singapore (NHCS)

NHCS specialises in the diagnosis and treatment of heart and cardiovascular conditions. It’s known for its expertise in cardiology, cardiac surgery, and heart transplant services. The centre is a pioneer in the field of cardiac care, serving both local and international patients.

Singapore National Eye Centre (SNEC)

SNEC is a world-class eye care facility that provides patients with a wide range of ophthalmic services. It offers comprehensive care for vision and eye health, which includes treatments for complex eye conditions and refractive surgery.

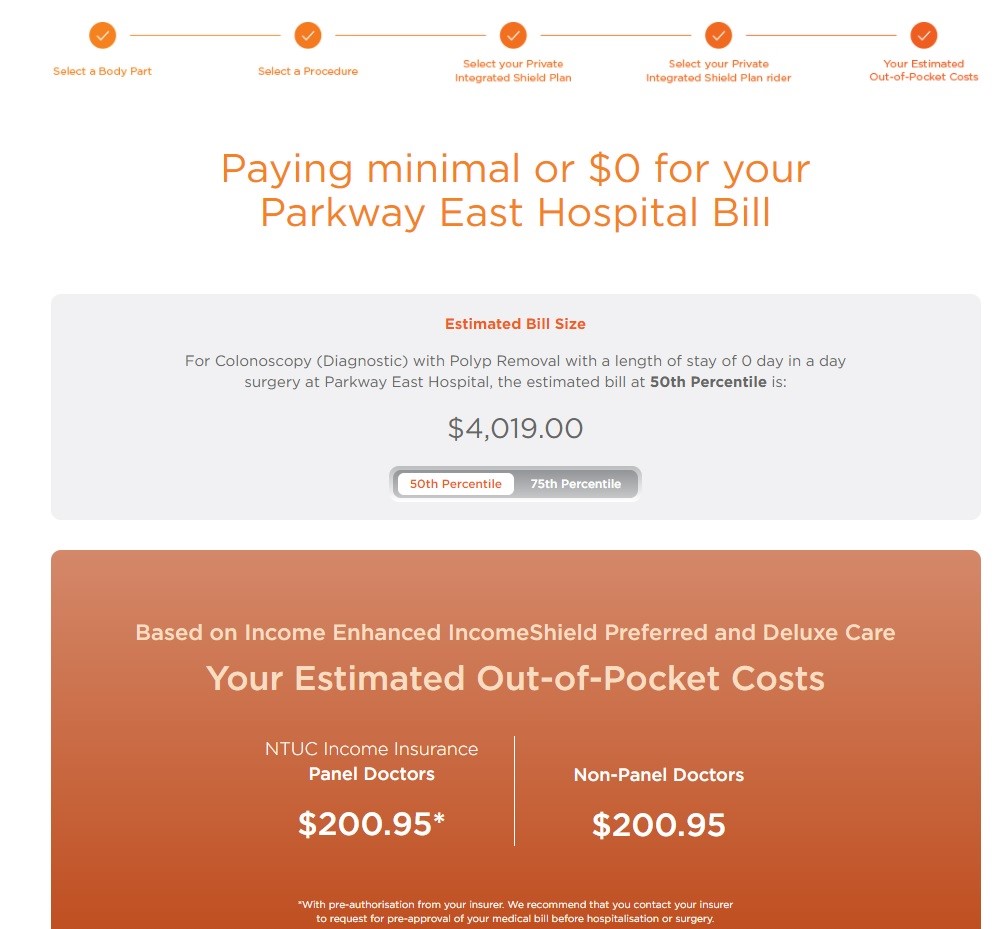

It Offers Premium Services for a Fraction of the Cost

Singapore’s ability to provide its permanent residents with excellent healthcare services at an affordable price for its permanent residents is a testament to the success of its healthcare system. The nation’s healthcare framework is centred on accessibility, quality care, and protection against the financial burden of medical expenses. These benefits can also extend to expats and medical tourists through different channels. Expats with private health insurance can receive quality care and be able to offset their medical costs. Meanwhile, foreign medical tourists who can’t afford healthcare in high-income countries can find cost-effective treatments in a highly advanced private healthcare facility in Singapore.

Now that you have a better understanding of Singapore’s healthcare system, it’s easy to see why it’s the envy of the world. Its ability to deliver exemplary service while keeping things accessible and affordable makes it so everyone can get quality healthcare and ensure Singaporeans can live happy, healthy, and long lives.