There are many different areas to look at when performing fundamental analysis. One of the important things to look out for are the financial ratios of the company. These ratios provide a very quick overview of a company which I feel is great especially when filtering out companies! Ratios are easy to understand and it’s a very good place to start off for beginners trying their hands on fundamental analysis! There are many ratios out there and I have chosen a few that are easy to understand and meaningful to talk about which new investors can try their hands on!

Debt Ratio

Debt ratio can be obtained by taking Total Debt/Total Asset or Debt/Total Equity. This shows you how leveraged a company is. Depending on the type of company, business cycle, and the industry the company is operating in, the debt ratio varies from industry to industry. For example, a company in the growth stage might have a high debt ratio because they need to borrow money to expand their business. Therefore, you need to take into account at what stage of the business cycle is in before you deem it over-leveraged.

Why I like to look at the debt ratio of a company first is because if I don’t feel comfortable with the sort of risk they are taking, then I don’t think it’s a business worth being in my portfolio. Every portfolio has a different risk tolerance and depending on your strategy, put in only the companies that you like and can understand.

Generally, my favourite types of companies are companies that have low to zero debt levels and remaining profitable. There are however, pros and cons to very low debt levels. The pros are obvious, the business is self-sustaining without need for additional cash to finance operations. The cons is that the company is not growing at it’s full potential. Debt is a leverage, a double-edged sword. If used right, it magnifies the gains. If used wrongly, it can potentially be the downfall of the company.

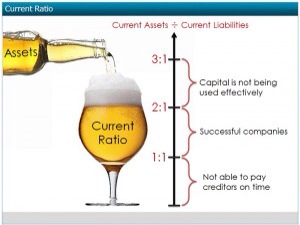

Liquidity Ratio

Liquidity ratio of a company can be found by looking at either the company’s Current Ratio or Quick Ratio. Why these ratios are important is because they give you a sense of the company’s liquidity. When considering liquidity of a company, it’s all about the cash and cash equivalent. As we all know, cash is the lifeblood of any company. Without cash, a business simply cannot operate efficiently or pay off it’s debts. What results after is the potential liquidation of the company or having to resort to financing their short-term debts with high interest rates. This would then have a direct impact on the share price.

A ratio of >1 is generally good because if you look at the formula to calculate Current Ratio, Current Ratio = Current Asset/Current Liabilities. This means that the company likely has the capability to pay off their short-term obligations. What you need to look out for when considering companies to invest is when Current ratio is <1. It is an indication that the company has more obligations than it has in it’s current assets. However, always do look further into the numbers and balance sheets if you really think the company has potential. These ratios are more for preliminary scanning only and to be used only as a guideline.

Returns Ratio

You may have always heard about people saying things such as ROA and ROE. These numbers are categorized as efficiency ratios. These ratios depicts the efficiency of the manager running the company. It shows how well the company is at generating returns in terms of it’s Assets(ROA) and Equity(ROE). Generally, the higher these ratios are, the better. Because if an efficient manager can utilize what they have so well, they can do so much more when more money is given to them to invest in the company’s assets and further growth of the company as well as maximize returns for investors.

My eyes would open up whenever I see a company having double-digit ROA and ROE because it speaks well of the people running the company. They must have been soon something right. Of course, always take note if these ratios are sustainable or not and not simply a one-off occurrence. Again, these ratios can be very easily retrieved from SGX’s website which helps greatly when you are doing your research.

Concluding

I hope this post would help you to start off your first fundamental analysis of your investment journey. There are many ratios out there but I felt that these are the few easier ones to understand and to apply. Keep reading, find out more information and understand in greater detail the things you already know! As they say, “Knowledge is power” and it is the same knowledge that will make you profitable as well!