Best Burgers in Singapore: Worth Every Dollar Under S$25

Indulging in a mouthwatering meal isn’t just about filling your stomach—it’s about satisfying your soul with pure joy. In Singapore’s bustling food scene, where every dish has a tale to tell, burgers emerge as a cherished comfort food, ready to envelop you in a warm, flavorful embrace.

If you’re on a quest for the ultimate burger experience without denting your wallet, let us lead you through our carefully curated selection of the finest burgers under S$25:

ONE FATTENED CALF

Imagine stepping into a cozy nook where the scent of freshly baked potato flour buns dances in the air. At One Fattened Calf, every element is crafted with care, from the buns to the signature butter burger that tantalizes adventurous taste buds. Yet, it’s the OFC Cheeseburger (S$17) that steals the spotlight—a masterpiece of simplicity that leaves you yearning for more. Here’s a tip: drop by early or in the serene mid-afternoon to relish your burger in peace, away from the hustle and bustle.

Image Credits: facebook.com/onefattenedcalf

Location: #01-31, Galaxis, 1 Fusionopolis Place, Singapore 138522

THE BANK

Embark on a journey back in time at The Bank, a haven of nostalgia reminiscent of 80s American diners. Sink your teeth into succulent Angus Prime beef patties, nestled snugly between soft buns, and quench your thirst with a silky Häagen-Dazs milkshake or a crisp craft beer. And whatever you do, don’t overlook the fully loaded spicy bacon cheese fries (S$14)—it’s a feast fit for royalty. The menu keeps it simple with three burger options: the signature cheeseburger (from S$18.80), the extra-large fried chicken sandwich (from S$18), and the grilled portobello burger (from S$18).

Location: 46 Craig Road, Singapore 089684

WILDFIRE BURGERS

When only the juiciest, most extravagant burger will do, Wildfire Burgers is your savior. Each bite is a symphony of flavors, with USDA-certified black Angus beef stealing the show, dressed in opulent truffle mayo and caramelized onions. Treat yourself to the truffle mushroom burger (from S$16) or spice things up with the smoky sriracha chicken burger—either way, your taste buds are in for a wild ride.

Image Credits: facebook.com/wildfireburgers.sg

Location: Multiple locations including Keppel Road and Bencoolen Street

SHAKE SHACK

Brace yourself for an unforgettable experience at Shake Shack, where quality meets crave-worthy indulgence. Sink your teeth into the legendary ShackBurger (S$9.20/S$12.70), a marvel of simplicity featuring tender beef patties nestled within pillowy potato buns. And let’s not forget the crinkle-cut cheese fries and Shackmeister ale, the perfect companions to your burger escapade. Don’t leave without trying the indulgent Shack Stack (S$14.30)—it’s a game-changer.

Location: Multiple locations including Neil Road and Jewel Changi

HONBO

Making its mark from Hong Kong, Honbo brings its A-game to Singapore’s burger scene, promising a symphony of flavors in every bite. Delve into the ultra-trendy smashed burger (from S$15), where double patties and double the beef grease await, accompanied by a side of sweet potato fries for the ultimate indulgence.

Image Credits: facebook.com/honbo.hk

Location: 30 Victoria St, #01-09 CHIJMES, Singapore 187996

Whether you’re a seasoned burger connoisseur or simply craving a delectable meal that won’t break the bank, these handpicked gems promise an unforgettable culinary journey!

New Guidelines Allow All Employees to Request Flexi Work Arrangements from December

In today’s dynamic work landscape, flexibility is becoming more than just a perk—it’s a necessity. With the release of the new Tripartite Guidelines on Flexible Work Arrangement Requests, effective from December 1st, 2024, all employees who have completed their probation period will have the opportunity to formally request flexible work arrangements from their employers.

Crafted by the Tripartite Workgroup on Flexible Work Arrangements, under the Ministry of Manpower (MOM), these guidelines mark a significant step towards accommodating the evolving needs of the workforce post-pandemic. While not legally binding, they outline a structured process for requesting and handling flexible work arrangements, fostering a more agile and inclusive work environment.

Here are five key takeaways to better understand the implications of these guidelines:

Variety of Flexible Work Arrangements

Image Credits: unsplash.com

Flexibility comes in various forms, including:

– Flexi-place: Allowing employees to work from locations other than the office.

– Flexi-time: Permitting employees to work at different hours without altering total work hours.

– Flexi-load: Adjusting workloads or hours to accommodate personal needs.

Request Process and Timeline

Employees can initiate a formal request through their company’s designated platform or a template provided in the guidelines. Once submitted, employers must respond within two months, either approving or rejecting the request in writing. Rejected requests should include clear reasons, and employers are encouraged to explore alternative arrangements.

Reasonable Business Grounds for Rejection

Rejection of requests must be based on “reasonable business grounds,” which may include factors such as:

– Cost implications.

– Impact on productivity or output.

– Feasibility or practicality considering the nature of the job role.

Purpose and Impact

These guidelines aim to address the evolving needs of Singapore’s workforce, particularly in light of demographic shifts and caregiving responsibilities. By promoting flexible work arrangements, employers can enhance talent attraction and retention, support caregivers, and sustain labor force participation.

Examples of Flexible Work Arrangements

Flexibility extends beyond remote work and alternate hours. Employees may also request reduced workloads or part-time schedules, fostering a healthier work-life balance and increasing overall job satisfaction.

Image Credits: unsplash.com

In essence, these guidelines reflect a proactive approach towards embracing change in the workplace. By empowering employees to seek flexible arrangements tailored to their needs, Singapore’s workforce can adapt and thrive in the post-pandemic era.

3 robot vacuum cleaners under $180 because you’re too busy & lazy to pick up a manual one

Time is a commodity and convenience is king; no one ain’t got the time to do house chores.

That’s why we’ve scoured the market to bring you a list of robot vacuum cleaners under $180 so you can say goodbye to manual cleaning for good.

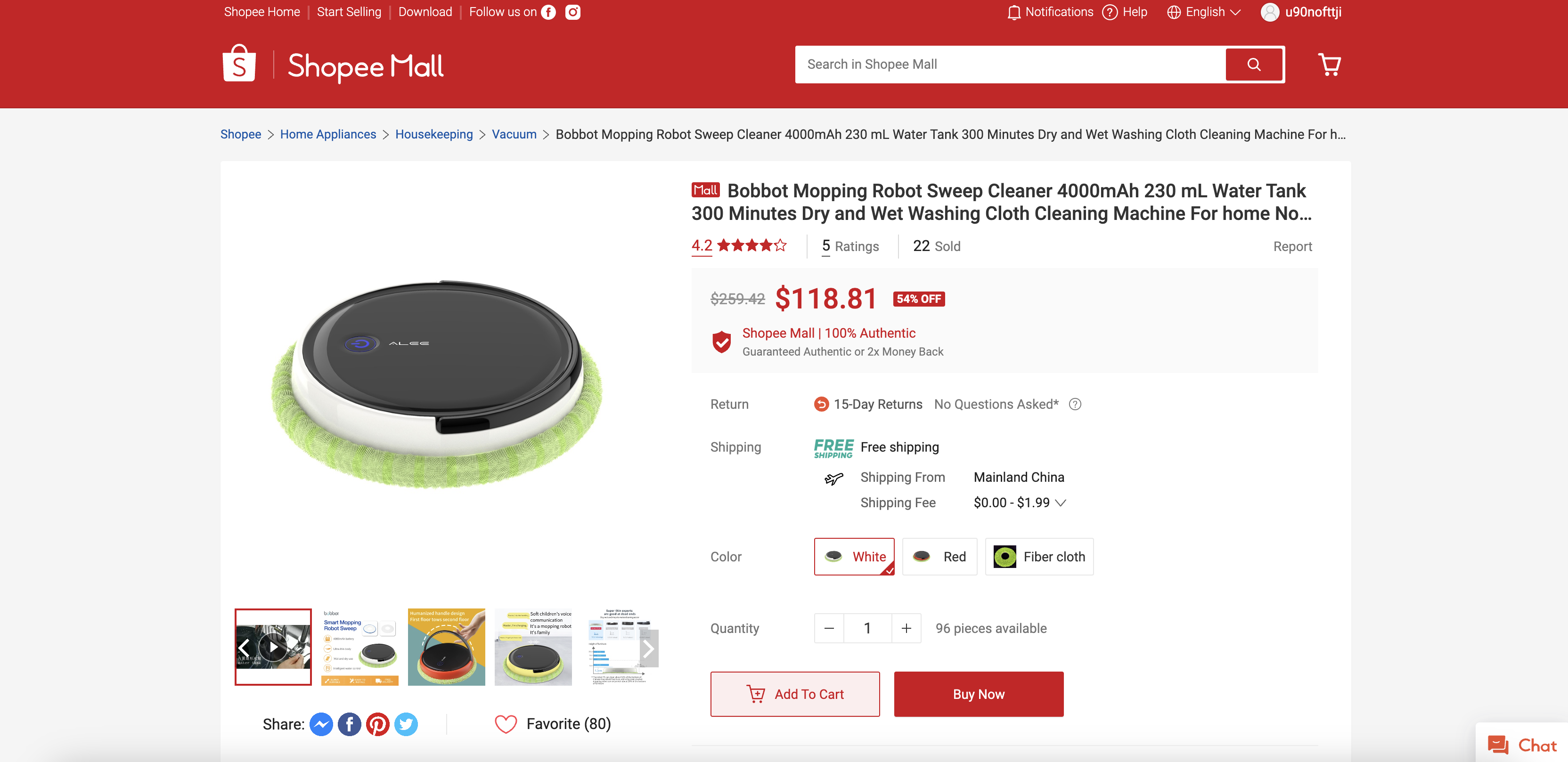

Bobbot Mopping Robot Sweep Cleaner

Promo Price: $118.81

First up, we have this little robot that aims for big results with cleaning.

It has 9 technical innovations that make it thoroughly sweep up dust and debris for up to 5 hours on a single charge.

Choose between wet mopping hard floors or dry sweeping carpets and rugs.

Set it loose and let this automated helper get to work for up to an hour before it automatically pauses.

How handy to come home to sparkling floors, thanks to your new high-tech, hands-free mopping robot.

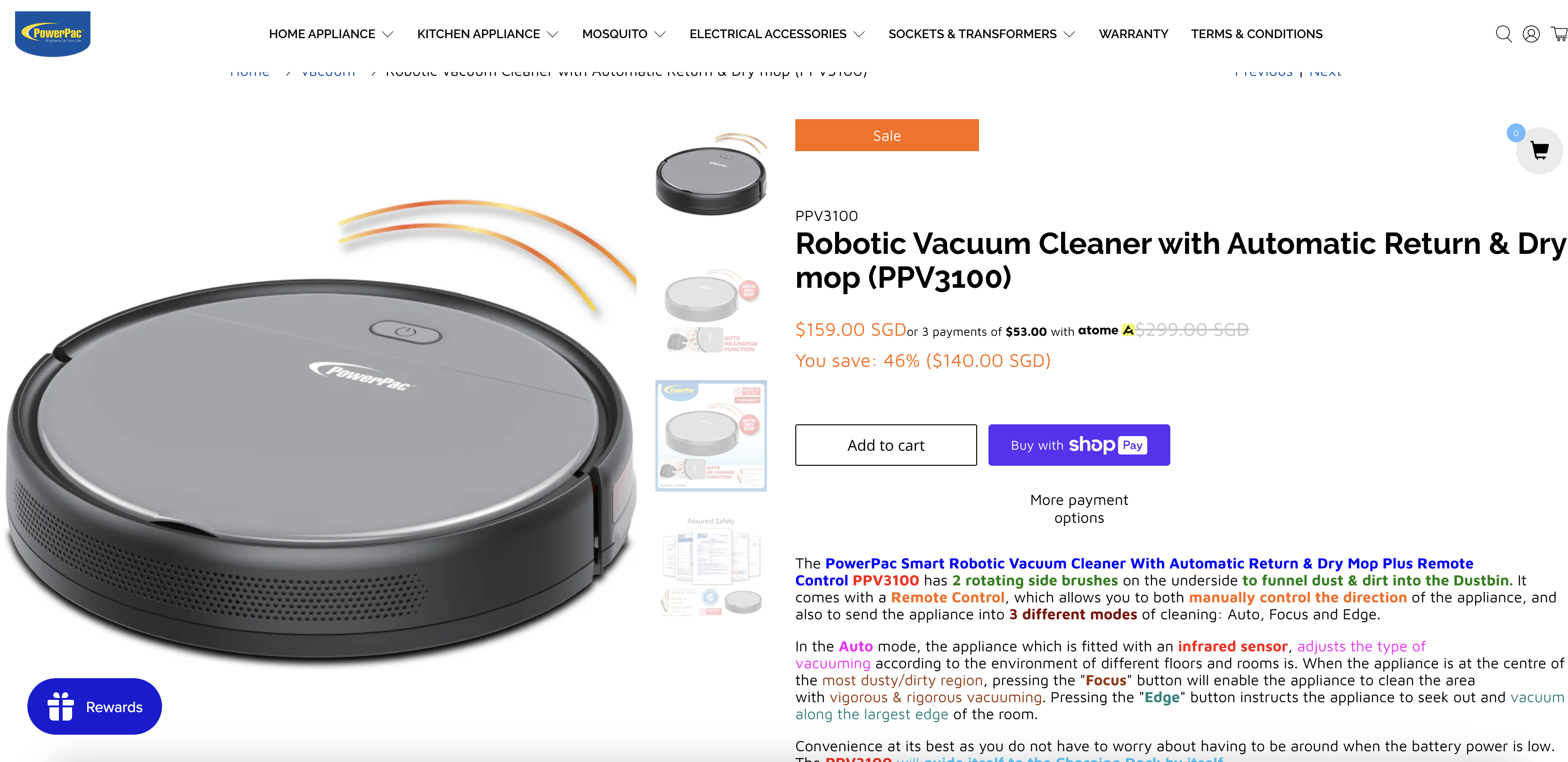

PowerPac Robotic Vacuum Cleaner with Automatic Return & Dry Mop

Promo Price: $159

Or consider this PowerPac robotic vacuum that puts convenience at its fingertips.

With two rotating side brushes and the ability to switch between three cleaning modes – auto, focus, and edge – it adjusts its cleaning power to suit different areas and surfaces.

The auto mode uses infrared sensors to determine the dust level and adjust accordingly, the focus mode concentrates on the dirtiest spots, and the edge mode seeks out room edges.

The 80-minute run time on a full charge gives it the power to clean even larger areas.

And the low noise level means you can get cleaning done without disruption.

Best of all, the automatic return-to-base docking ensures you never have to worry about a dead battery.

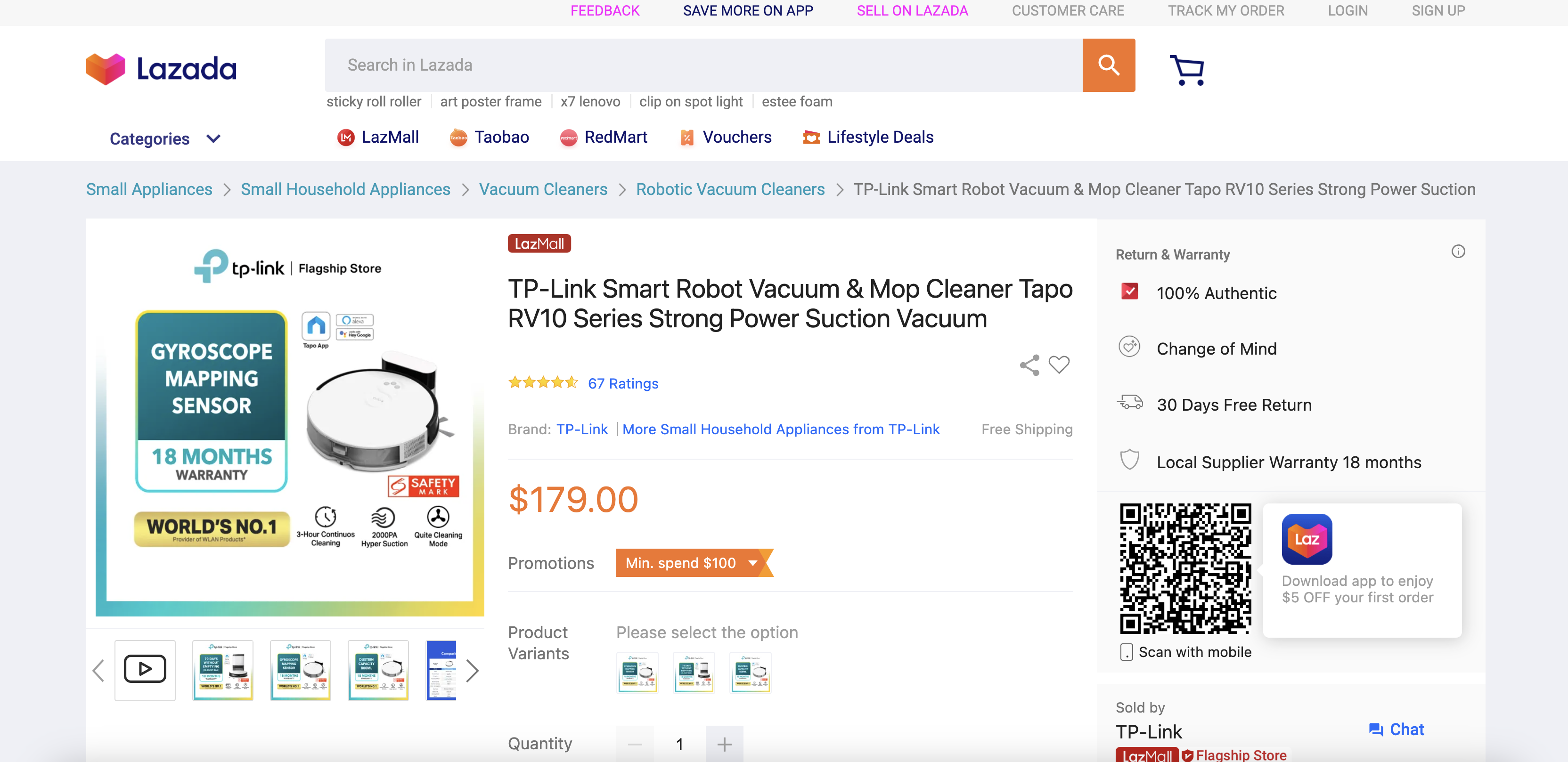

TP-Link Smart Robot Vacuum & Mop Cleaner

Price: $179

Last but not least, this smart robot vacuum and mop combo tackles daily messes with efficiency.

Its zigzag path planning ensures no spots are missed while four suction modes suck up pet hair and debris with ease.

The 3-level electronic mop scrubs away sticky messes and kitchen grease for a deep clean, while the carpet auto-boost function provides extra suction power when moving from hard floors to rugs.

Control the cleaning modes and schedule through the Tapo app from anywhere, and this little robot cleaner will go to work to keep your floors without dirt.

With its clever tech features and ability to vacuum and mop, this robot takes the hassle out of housekeeping.

As we wrap up, it’s clear that keeping a clean home no longer requires sacrificing your precious time or back. With options under $180, there’s a solution for every individual who values ease and efficiency. Now, with your new robotic ally, you can go ahead and put your feet up—your cleaning companion has got the mess under control.

Unlock Massive Savings: Up to 55% Guaranteed Savings on Purchases at Great World and Tanglin Mall – Here’s how!

We have got the insider scoop that there will be a Great Rewards e-Vouchers Sale from 22 Apr onwards that allows you to secure a straight 10% OFF* your purchase over 280 participating retailers in Great World and Tanglin Mall.

Here’s how it works: Great Rewards members can snag $220 e-Vouchers for EVERY $200 e-Vouchers purchased. That extra $20 value is your magic ticket to stacking up the savings. Now picture this – if you are eyeing a big-ticket item that costs, say, $1,000 – you should absolutely take advantage of this sale to purchase $1,000 worth of Great Rewards e-Vouchers to pay for your item!

Why? It’s a savings strategy that’s downright ingenious in its simplicity. Remember, for every $200 spent, you get an additional $20 value – so if you purchase $1,000 worth of e-Vouchers during the sale, you’re not just getting $1,000, but an impressive $1,100 in e-Vouchers! That’s an additional $100 waiting to supercharge your next shopping spree!

And here’s the best part, and we’re not going to gatekeep: use Great Rewards e-Vouchers to stack up with in-store promotions so that you can turbocharge your savings even further!

Let us share some hacks on how to stack these e-Vouchers with in-store discounts for the maximum savings:

OSIM (Great World, #02-123)

Photo: OSIM uThrone V Gaming Chair (MSRP $1,599)

Gamers, rejoice! Exclusively at Great World store, for a limited time only, the OSIM uThrone V Gaming Massage Chair retails for just $949 instead of $1,599. With Great Rewards e-Voucher sale, you can snag the uThrone V Gaming Chair for just $869 in total. Here’s the math: purchase $880 worth of vouchers for $800 to offset your gaming chair purchase and top up $69 of the remainder in cash, and voila – you’re enjoying a jaw-dropping 45% OFF the retail price! That’s what we call gaming in style without breaking the bank!

Sandbar (Great World, #01-158)

Photo: Sandbar

Calling all eco-conscious advocates! You can now play your part and contribute to sustainability and protect our planet Earth. At Sandbar, every piece of swimwear is a green gem crafted from 100% recycled plastic bottles. Every swimwear you buy from Sandbar removes 1kg of plastic from our ocean. And there’s more! Get an exclusive Sandbar tote bag when you pay with Great Rewards e-Vouchers or up your purchase to $350 to get a complimentary name personalization on your swimwear.

Absolute Pilates (Great World, #B2-130)

Photo: Absolute Boutique Fitness

Experience the benefits of pilates while enjoying substantial savings and rewards. Whether you’re a beginner or a seasoned practitioner, Absolute Pilates designed to help you achieve your fitness goals and enhance your overall well-being. And exclusively for Great World, you can now enjoy 30% OFF any Great World Standard Pilates 10, 20, 50 or 100 Class Pack *Package.

Inner Alignment, located at Tanglin Mall #01-102, offers a transformative experience to enhance your well-being through a nature-driven approach.

Get started on your wellness journey with a personalized 1.5-hour Ayurveda consultation, available for $120. This session delves into your nutritional habits and teaches deep relaxation techniques to harmonize and enhance your overall health. In addition to consultations, Inner Alignment provides an array of health supplements designed to improve digestive health and reduce stress and anxiety, with prices starting at $55. Psst….they are also having a limited time only offer with 10% off all supplements.

To make these offerings even more accessible, take advantage of the Great Rewards e-Vouchers Sale which allows you to have extra savings!

Here’s a fantastic example of the incredible savings you can unlock:

20-Class Package Details:

- Usual Price: $930

- Enjoy 30% OFF: Now $651

- Pay $400 for $440 Great Rewards e-Vouchers + Top up $211

- Save $40 with Great Rewards e-Vouchers

- Final Price after discounts and e-Vouchers: $611

- Total Savings: $319 (34% OFF usual price)

Inner Alignment (Tanglin Mall, #01-102)

Photo: Inner Alignment

Inner Alignment, located at Tanglin Mall #01-102, offers a transformative experience to enhance your well-being through a nature-driven approach.

Get started on your wellness journey with a personalized 1.5-hour Ayurveda consultation, available for $120. This session delves into your nutritional habits and teaches deep relaxation techniques to harmonize and enhance your overall health. In addition to consultations, Inner Alignment provides an array of health supplements designed to improve digestive health and reduce stress and anxiety, with prices starting at $55. Psst….they are also having a limited time only offer with 10% off all supplements.

To make these offerings even more accessible, take advantage of the Great Rewards e-Vouchers Sale which allows you to have extra savings!

Our Music Studio (Tanglin Mall, #03-113)

Photo: Our Music Studio

Our Music Studio (OMS) is a premier destination for young children, from babies to six-year-olds, to explore the world of music through an engaging and educational music-and-movement program. The program includes vocal play, instrumental activities, and creative movement, all facilitated by experienced musicians, composers, and music arrangers in a colorful, clean, and safe environment.

OMS offers a series of 12 lessons with its course fee at $432. Taking advantage of the Great Rewards e-Voucher sale, parents can make substantial savings while investing in their child’s early musical education.

Be sure to visit Great Rewards website to discover more promotions from participating Great World and Tanglin Mall retailers, allowing you to maximize your savings even further!

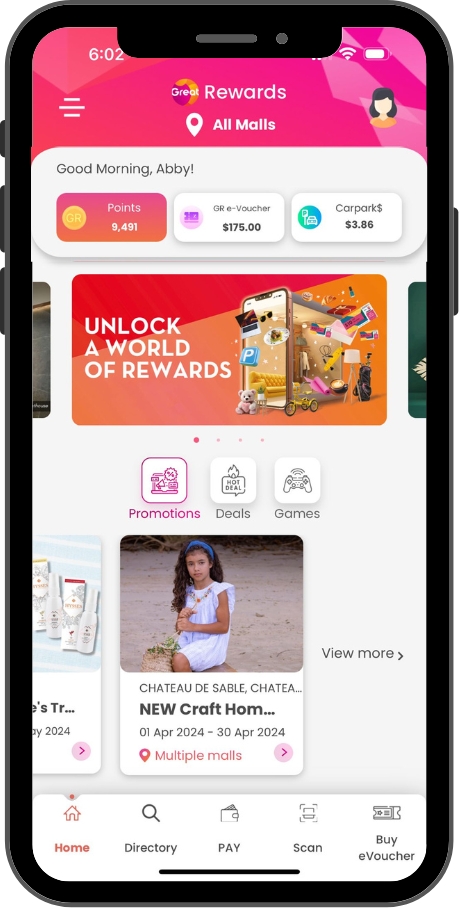

Great Rewards App

While you are out busy shopping at Great World and Tanglin Mall, do not forget to utilize the Great Rewards App to score more discounts. This is a fully digital loyalty programme that rewards shoppers for shopping and dining at these malls.

Once the receipts of participating retailers are scanned and uploaded, Great Rewards Points will be awarded to your account within a day. Simply accumulate Great Rewards Points to be exchanged for more e-Vouchers and Carpark Dollars. It is that simple and convenient! In addition, Great Rewards members can look forward to double points on their birthday, score invites to exclusive events, exclusive e-deals and many more.

So what are you waiting for? The clock is ticking, and the savings are waiting for you! Rev up your savings engine and seize this golden opportunity to stretch your dollars further with the Great Rewards e-Vouchers Sale that will run from now till 31 May 2024 or while stocks last. Whether you’ve been eyeing that luxurious big-ticket item or simply want to stock up on essentials, now is the moment to act!

Don’t have the Great Rewards App? Scan QR or download their iOS or Android app to enjoy more savings!

Get a $5 Great Rewards e-Voucher when you sign up as member on the Great Rewards Mobile App with promo code GRMD24 (available for the first 100 new sign-ups)

For more information, visit Great Rewards

Latest WFH internships posted from 15 to 18 April 2024

Hope your job-searching week has been good!

If it wasn’t that smooth sailing, allow us to lend a helping hand.

Here are the latest WFH internship opportunities this week.

#1: Odyssey Wellness – Mental Health Marketing Intern

Website: odysseywellness.co

Allowance / Remuneration: $8 hourly

Job Qualifications

- Keen interest in mental health issues.

- Proficiency in using video editing software as well as graphic editing software (Canva).

- Systematic and detail-oriented with strong time management skills.

- Strong communication and collaboration skills.

- Initiative to learn and adapt to new challenges.

Key Responsibilities

- Assist in the creation and editing of engaging video content for various marketing channels – Instagram, TikTok, Facebook & LinkedIn.

- Collaborate with the marketing team to brainstorm, plan, and execute video projects.

- Support SEO efforts through keyword research, content optimization, and other on-page and off-page strategies.

- Contribute to social media management, including content creation, scheduling, and monitoring.

- Assist in tracking and analyzing social media and website metrics.

- Assist in any other digital marketing work when required

How to apply?

View the job post in full here and write to Sharmishtha Gupta via this link.

#2: AFON IT Pte Ltd – SEO & Content Marketing Intern

Website: afon.com.sg

Allowance / Remuneration: $1,000 – 1,200 monthly

Job Qualifications

- Excellent writing and editing skills in English

- Prior experience in SEO or writing is preferred, though not a must

- Have some experience in, or are willing to create and collaborate using generative AI

- Quick learner and able to work well with others

Key Responsibilities

- Provide content writing and editing for SEO

- Do research and write/edit on business and software topics using various tools

- Optimize past content using new information gathered in research

- Prospect and negotiate with webmasters to acquire links

- Assist with search marketing performance tracking

- Help monitor ongoing performance and ensure results are satisfactory

- Assist with digital content creation for campaigns

- Generate a collection of diverse and professional social posts for regular posting

- Contribute to other miscellaneous duties when necessary

How to apply?

View the job post in full here and write to Alythea Ho via this link.

#3: Mighty Jaxx – Investor Relations And Corporate Communications Intern

Website: mightyjaxx.com

Allowance / Remuneration: $800 – 1,200 monthly

Job Qualifications

- Enrolled in a finance-related program, communications program, or related field in an institute of higher learning

- Excellent communication skills, both written and verbal

- Highly organized with excellent time management skills

- Ability to work independently, as well as part of a team

- Ability to commit to a full-time internship from May onwards, for a minimum of 3 months

Key Responsibilities

- Advocate positive strategic media coverage for Mighty Jaxx across a variety of global, regional, and local media outlets with our agency partners

- Participate in meetings with external agencies to develop and support integrated brand strategy and campaigns, keeping Mighty Jaxx’s core values consistent across all messaging

- Assist in drafting written material for press releases, speeches, media briefing documents, spokesperson bios, and more

- Assist in the development and preparation of all external investor communication materials, meetings, information requests, investor reports and performance updates through various communication channels

- Participate in the fundraising process with both existing and new investors

- Participate in the development of new M&A opportunities with synergistic companies

- Assist the Investor Relations and Corporate Communications Team in consolidating and organizing all Investor and public relations (PR) material

- Conduct market research on the competitive landscape in various regions

How to apply?

View the job post in full here and send an updated copy of your resume to [email protected].

#4: Stacktribe Pte. Ltd. – Operations Intern

Website: tribex.co

Allowance / Remuneration: $1,000 monthly

Job Qualifications

- Must be fluent in English

- Able to start in May 2024, full-time internship preferred but part-time internship (min. 3 days per week) will also be considered.

- Enrollment in an undergraduate or graduate program or recent completion of a degree in any field.

- Excellent communication and interpersonal skills to work collaboratively with cross-functional teams and external stakeholders.

- Ability to work independently and take initiative in identifying areas for improvement and implementing solutions.

- Strong organizational skills to manage multiple tasks and priorities in a fast-paced environment.

- Attention to detail and the ability to maintain accurate records and data.

- Proficiency in Microsoft Office Suite and experience with project management tools and software.

- Familiarity with event planning and logistics is a plus.

- Prior experience in working with platforms such as Airtable, Notion, Discord, Slack, Eventbrite, etc. is a plus

Key Responsibilities

- Gain a clear understanding of the organization’s strategic goals and operational processes, and identify areas for improvement to streamline processes, optimize operational efficiency, and reduce costs.

- Work closely with the Operations team that will be working collaboratively with project managers, team members, and stakeholders to ensure operational initiatives are aligned with overall project goals, objectives, and timeline throughout the project lifecycle.

- Assist in building successful events that deliver a seamless and enjoyable experience that meets the needs of stakeholders.

- Assist in the development and maintenance of event registration systems and attendee databases, ensuring accurate, timely registration and communication with attendees.

- Assist in event operations such as responding to participants’ inquiries, preparation of participants-related materials (eg. participants guide, event calendar), etc.

- Assist in the retrieval, organization, and cleaning of project data to enable actionable insights to be made by the Operations team.

- Support the management of vendor relationships and negotiation of contracts to ensure cost-effective and timely delivery of goods and services.

- Assist in the coordination of in-person event logistics, including the order of tasks and activities, to ensure the smooth execution of all aspects of the event.

How to apply?

View the job post in full here and submit your CV to [email protected].

#5: Park Hotel Group Management Pte Ltd – Finance Intern

Website: parkhotelgroup.com

Allowance / Remuneration: $800 – 1,000 monthly

Job Qualifications

- Currently studying Accounting or Finance or any relevant major

- Candidates who graduated from junior college or polytechnics are welcome to apply

- Committed and motivated individuals who are meticulous and have an eye for detail

- Good communication, analytical, and interpersonal skills

Key Responsibilities

- Assist in performing 3-way matching on the purchase invoices for the Group’s F&B outlets

- Updating the purchasing transaction in the accounting system

- Preparation of monthly payments

- Assist in accounting administration in reviewing expenditure claims from associate

- Ensure accuracy and completeness in Revenue posting to the Accounting System

- Assist in verifying sales collection and AR billing for F&B Business

- Other ad hoc from the finance department from time to time

How to apply?

View the job post in full here and write to Genevieve Lee via this link.

Editor’s note: These positions are selected based on the “remote” tag, but some are hybrid ones and you may need to report physically to the office. For more deets, do contact the employer directly.