Bad news to end the first quarter of 2024 but here’s it:

Hotel room rates in JB are going to be going up a bit starting in March 2024.

This is due to the sales and service tax (SST) which is increasing from 6% to 8%.

And it doesn’t help that Ivan Teo, who is the chairman of the Malaysian Association of Hotels in Johor, reminds us that their member hotels have already raised room rates by 20 to 30% in the middle of last year due to higher electricity bills.

But still, he’s hoping for hotels to focus on getting more customers during the week and non-peak times.

Hotels usually do well on weekends, holidays, and school breaks, which is not a surprise at all.

Mr. Teo doesn’t think the higher room rates will be a problem for most guests, especially those from Singapore, China, Thailand, and Vietnam.

However, explaining it to guests from Indonesia could be tougher since their currency isn’t doing as well against the ringgit recently.

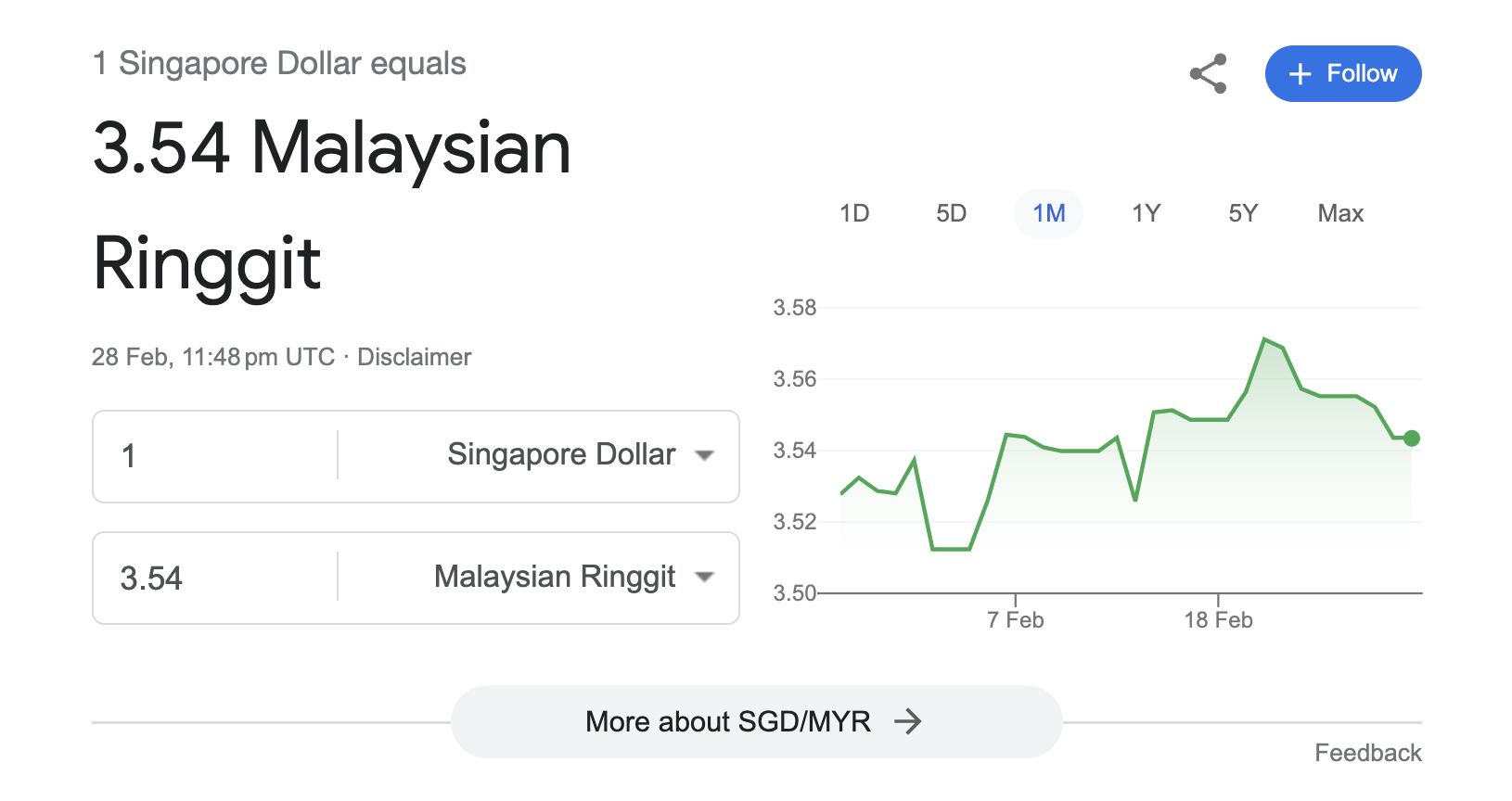

Singaporeans still make up a big part of hotel guests since prices seem significantly lower when compared to our dollar.

The number of South Korean visitors staying in Johor Bahru and Iskandar Malaysia is also trending up, especially golfers and folks trying to escape the cold back home during those winter months and people going to English schools or visiting hospitals there.

There are about 90 three-star, four-star, and five-star hotels total in Johor.

But not all are increasing room rates.

For instance, the CEO of Lotus Desaru Resort, R. Indra Ghandi, said they won’t increase rates but will now include the SST starting 1 March.

She mentioned they currently charge net rates without taxes.

Ms. Indra added that customers pay close attention to prices, so raising rates could backfire on them.

But she doesn’t foresee issues with the tax change since half their guests are Singaporeans with good spending power.

Nonetheless, she proposed that the government offer visa-free entry to more countries besides China and India to attract more visitors.

Ms. Indra also hopes the new Johor leader with the tourism portfolio will organize roadshows to bring in more travelers from South Korea, Japan, and Taiwan.

On the other hand, Mariam Mohd from the Katerina Hotel Batu Pahat said their rates will go up a little in March.

The operations team is still finalizing the details but mentioned the increase depends mainly on which packages guests choose.

So what say you?

Will the increase in room rates in JB deter you from spending that overnight stay or is it sup-sup sui?