* Update 27 April 2021: The crediting rates for new Dash PET sign ups with effect from 27 April 2021 will be 1.3%* p.a. for the first year for the first $10,000, and 0.3%* p.a. for the first year for amount more than $10,000. Crediting rate is non-guaranteed.

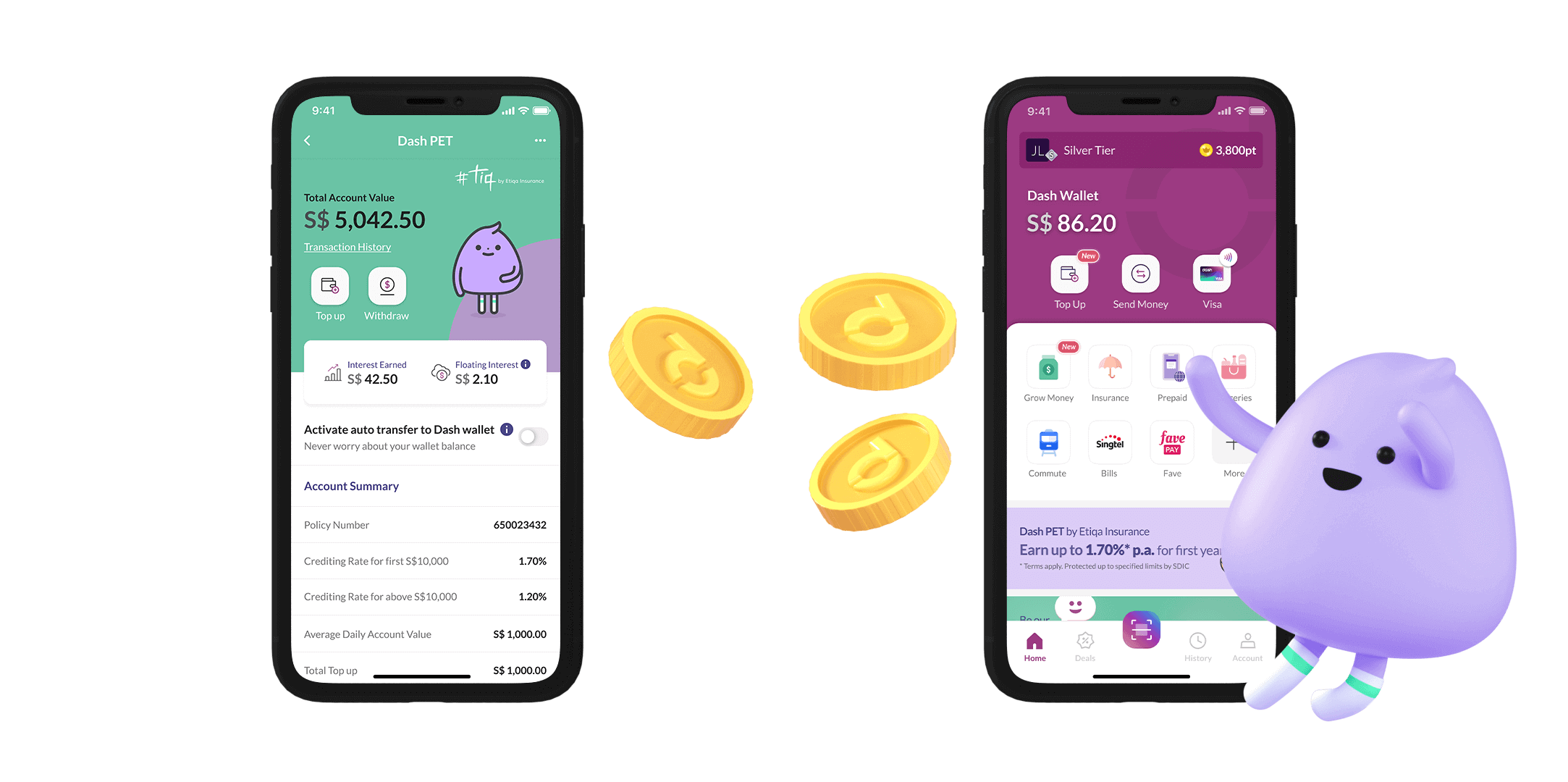

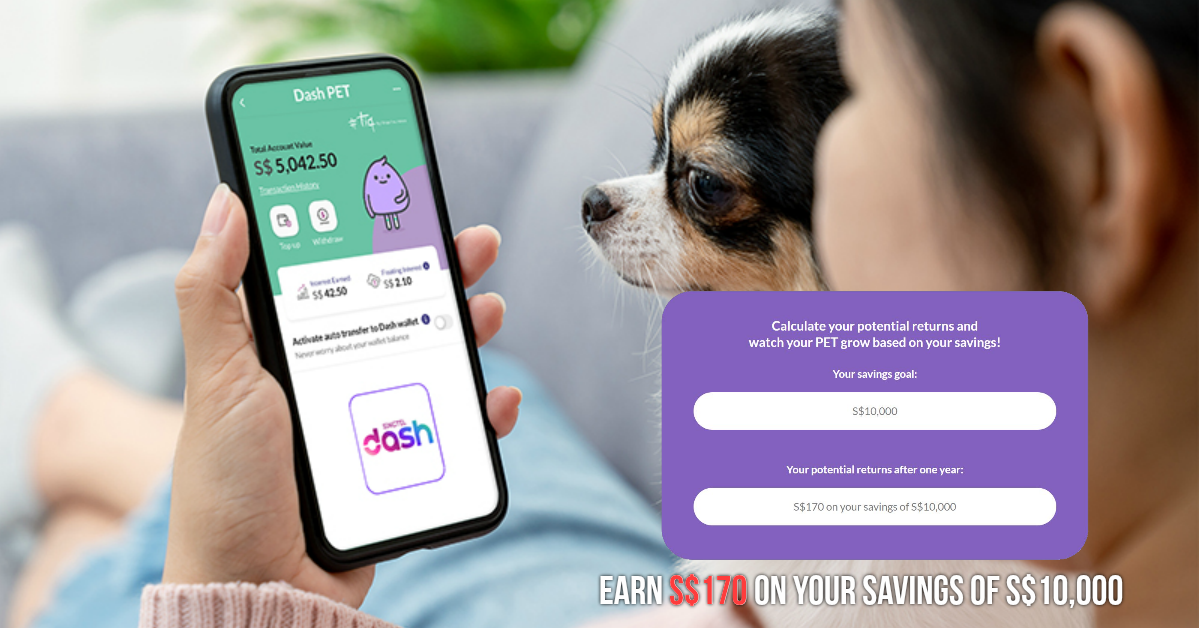

Dash PET by Etiqa Insurance, the latest insurance savings plan available on Singtel Dash, allows users to Protect, Earn and Transact – basically taking care of you! You can earn up to 1.7% p.a.* with no additional criteria required, making it absolutely hassle-free! At 1.7% p.a.*, this makes Dash PET highly attractive especially given the current climate of uncertainty and falling bank savings interest rates. Here’s how Dash PET can take care of you.

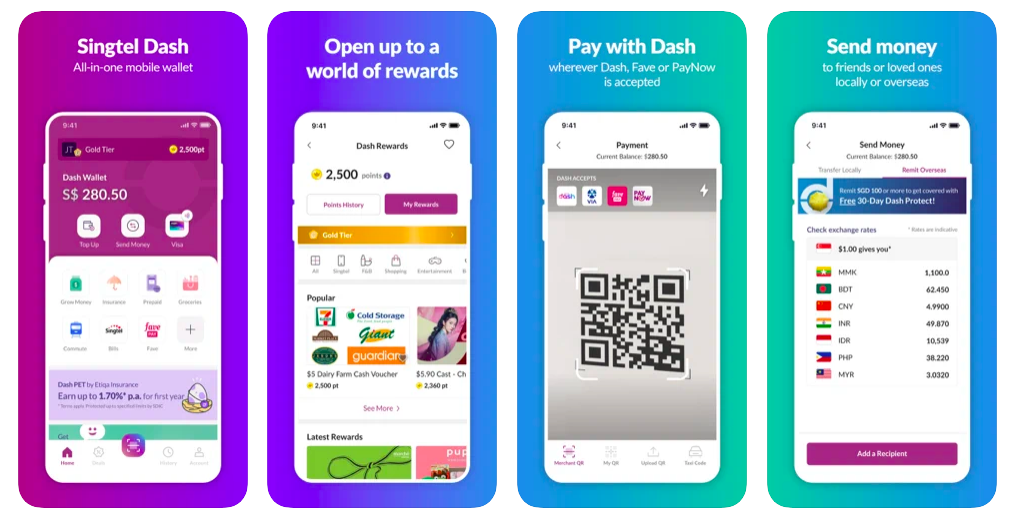

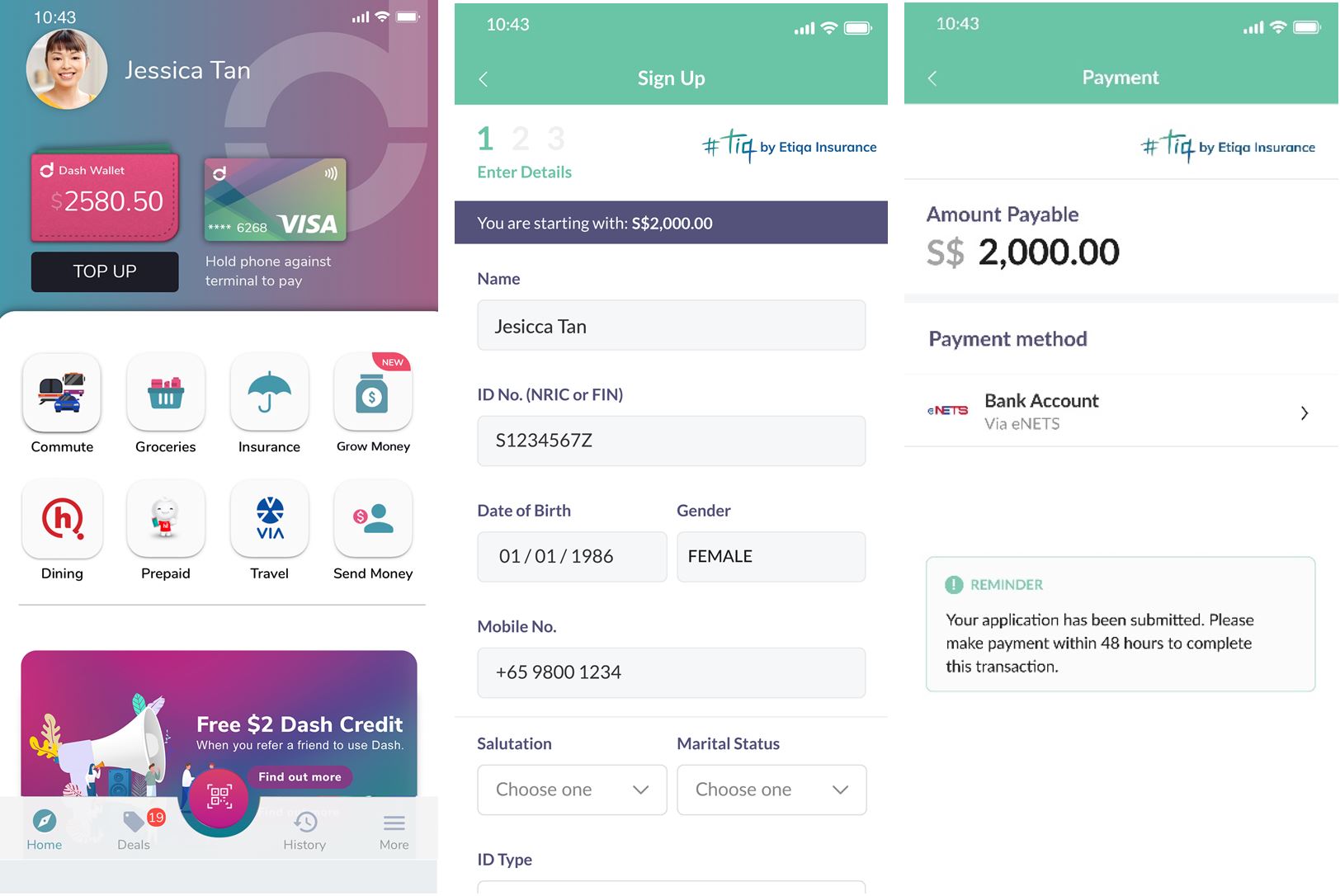

Singtel Dash is an all-in-one mobile wallet for your everyday needs, from your commute to paying at your favourite hawkers, supermarkets and restaurants, and even for your online purchases.

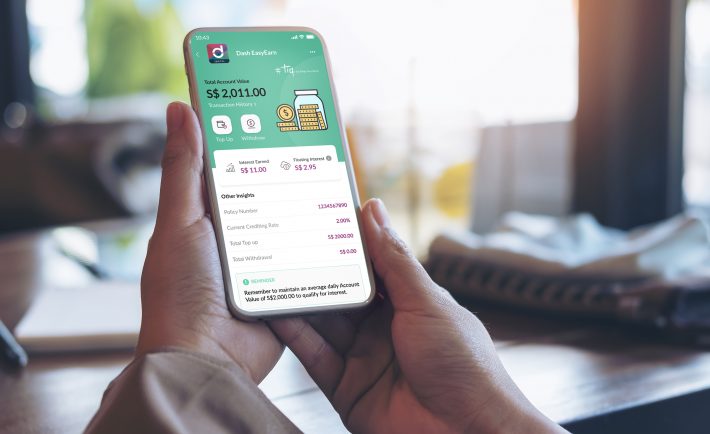

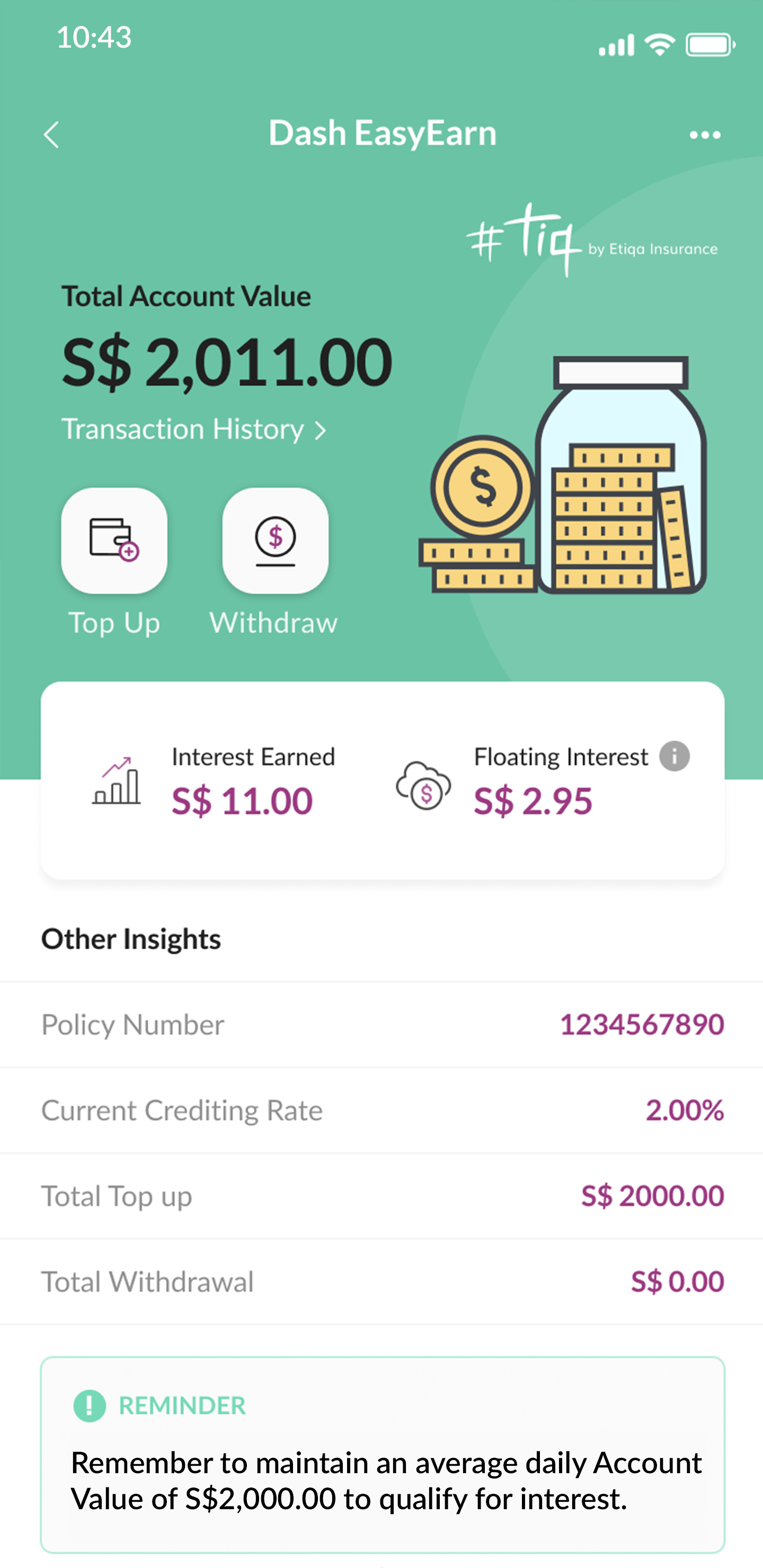

Enjoy attractive returns with capital guaranteed

Earn 1.7% p.a.* for your first S$50 – $10,000, and 1.2%* for amounts above S$10,000! This means that up to the first S$30,000 earn attractive returns of $410 (1.37%) per year. Ensure that you maintain a minimum account value of S$50 to start earning these high interest rates on your funds. You will be glad to know that your capital in Dash PET is guaranteed. It also comes with SDIC protection.

You won’t be kept on a tight leash with Dash PET (pardon the pun)

This insurance savings product offers the ultimate flexibility by having no lock-in period. Once your account is active, you can top up your funds anytime! This can be done at your convenience via Dash wallet or PayNow from S$1, or via eNets (minimum S$50 top up).

If you wish to use your money, you may withdraw anytime from S$1 to your Dash wallet (free) or to your bank account via PayNow (S$0.70 transaction fee applies for each transaction).

Highly accessible given low entry barriers

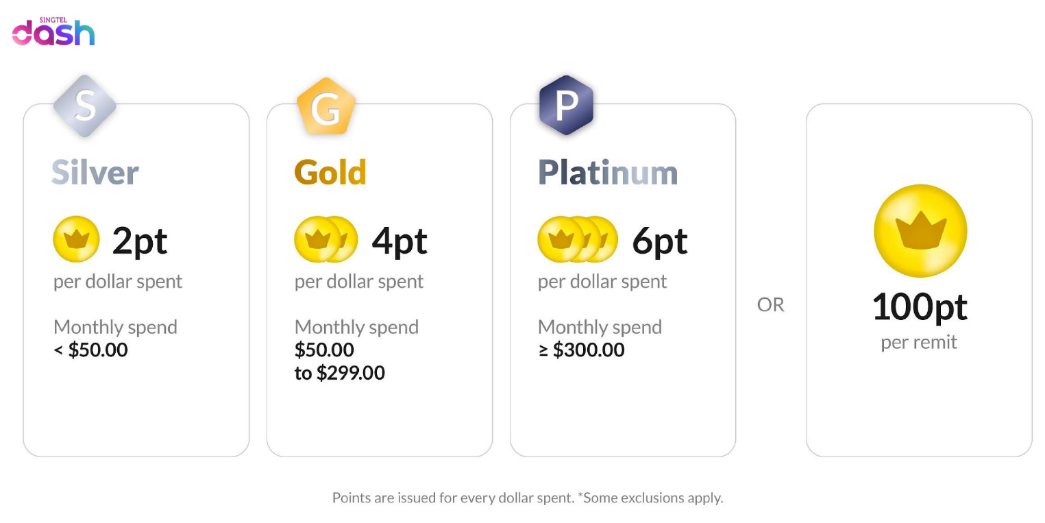

Some financial instruments in the market may require hefty contributions or long lock-in periods, which may not fit into some people’s financial needs. With Dash PET, all you need is S$50 to start saving and insuring. For instance, students can save their allowance or internship pay into Dash PET first to earn attractive returns. They can then withdraw via their Dash wallets to pay for their everyday expenses like their favourite bubble teas and even hawker meals.

Self-employed or gig economy workers who may not have regular monthly income can take advantage of Dash PET to save as it does not require them to complete the myriad of tasks required (e.g. meeting monthly salary crediting, minimum spends, etc) to unlock bonus interest rates.

Finally, there is no fall-below fee if the account runs low, so savers are not penalised when they have higher expenses for the month. One thing to note though, you’ll need to maintain at least S$50 average daily Account Value for the calendar month to enjoy the rates of return and Dash PET benefits.

Takes Care of You

The value provided by Dash PET is immense. It allows your capital to grow at an attractive rate, offers the flexibility for you to withdraw funds for everyday expenses and protects you by offering insurance coverage. Furthermore, the Protect element comes from the layer of insurance coverage of up to 105% of account value in case of death as well as financial assistance benefit for Covid-19.

As demonstrated, Dash PET is the PET that takes care of you by helping you to save and insure better!

All it takes are 3 simple steps to start your savings journey with Dash PET:

- Download the Dash mobile app (if you are not an existing user)

- Sign up for Dash PET through the Dash mobile app

- Top up your Dash PET account from either Dash Wallet, eNets or PayNow

In these uncertain times, it is prudent to consider safe and flexible options to start saving smarter and allow your hard-earned savings to work harder. With Dash PET, Singtel Dash aims to be the companion app for saving, insurance, payments and more!

Disclaimers

- The information is meant purely for informational purposes and should not be relied upon as financial advice.

- Dash PET is not a bank account or a fixed deposit. It is an insurance savings plan that earns a crediting interest rate.

- * Guaranteed 1% p.a. + 0.7% p.a. bonus on first S$10,000 for first policy year. Guaranteed 1% p.a. + 0.2% p.a. bonus on above first S$10,000 for first policy year.

- This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). This advertisement is for general information only. Terms apply. Full details of the policy terms and conditions can be found in the policy contract on dash.com.sg/dashpet. Protected up to specified limits by SDIC. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is accurate as at 1 February 2021.