With many people facing added mental, emotional, and financial stress, our overall health has never been more important. If you’ve been feeling less than yourself lately, you’re not alone. It’s normal to feel burnt out from everything that’s been going on. Unfortunately, burnout can extend to all parts of your life—from work to family and everything in between, including your finances.

Symptoms of Financial Stress:

There are obvious symptoms of financial stress that we can identify when we experience significant situations in our lives, as well as more subtle signs of burnout that can make problem-solving seem impossible. Watch for these signs and symptoms of financial burnout:

a. Constantly thinking about your budget, or lack thereof.

b. Feeling stressed about where your money is coming from and where it’s going.

c. Feeling guilty, exhausted, depressed, or overwhelmed about your finances.

d. Feeling cynical or apathetic towards your financial goals.

e. Lack of sleep or increased anxiety just thinking about money.

GET ORGANIZED

What’s the best way to help you stay on top of your finances? Get your finances organized and focus on the future! Understand the finer details of your finances, like when you get paid, when your bills are due, your monthly budget, and your savings. Find an organizational tool that works for you—whether that’s in an app, spreadsheet, or journal. We have lots of great resources to help you get started!

SET UP AUTO-PAYMENTS

If you haven’t set up monthly auto payments yet, why not? Take the guesswork out of your monthly payments so you never feel strapped for cash or worried about making payments on time. Keep track of your upcoming payments in your money diary so you’re aware of what’s coming in and going out of your bank account each week. And then don’t forget to check your bank statements at the end of each month to make sure your payments went through!

TALK TO SOMEONE

When you’re facing money problems, there’s often a strong temptation to bottle everything up and try to go it alone. Many of us even consider money a taboo subject, one not to be discussed with others. You may feel awkward about disclosing the amount you earn or spend, feel shame about any financial mistakes you’ve made, or be embarrassed about not being able to provide for your family. But bottling things up will only make your financial stress worse. In the current economy, where many people are struggling through no fault of their own, you’ll likely find others are far more understanding of your problems.

Keeping money worries to yourself only amplifies them until they seem insurmountable. The simple act of expressing your problems to someone you trust can make them seem far less intimidating.

DEVISE A SOLUTION

Brainstorm ideas with your family or a trusted friend or consult a free financial counseling service. You may decide that talking to credit card companies and requesting a lower interest rate would help solve your problem. Or maybe you need to restructure your debt, eliminate your car payment, downsize your home, or talk to your boss about working overtime.

EMBRACE YOUR DAILY ROUTINE

Get up at your normal time and stick to your usual routine. If you lose your routine, it can affect your eating – you may stop cooking, miss breakfast because you’re still in bed, or eat snacks instead of having proper meals.

LIVE A LITTLE

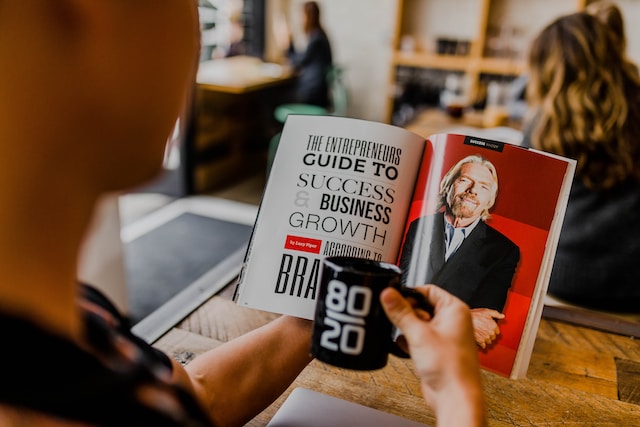

Image Credits: unsplash.com

Don’t make the mistake of budgeting out fun! Budgeting, like dieting, is all about balance and choosing moderation over deprivation. If you restrict yourself too much, you’ll feel unmotivated and less likely to see your financial goals through. Make sure to incorporate fun with friends, date nights, and “splurges” like spa days, haircuts, or coffee runs. Acknowledge your hard work by rewarding yourself when you need to.