Own a UOB Credit or Debit Card? You are in for a treat!

Starting from 1 November 2015, you can enjoy 1-for-1 dining deals at more than 40 restaurants across Singapore.

Look out for buffets deals at Marriott Cafe and Cafe Mosaic and other attractive dining offers exclusive to you.

Valid till 31 January 2016. (or 31 December 2015 for some)

For all UOB Cards

Mitzo Restaurant & Bar

Burlamacco Ristorante

The Black Swan

Marriott Cafe, Singapore Marriott Tang Plaza Hotel

Café Mosaic, Carlton Hotel Singapore

Furama RiverFront, Singapore

Flavours At Zhongshan Park

Sakae Sushi

Billy Bombers American Diner

Cold Stone Creamery

Zen Japanese Cuisine

Bottura

Haha Thai

OPPA Chicken

Siam Society

The King Louis Grill & Bar

Pick Me Up Cafe

House of Seafood

Home of Seafood

OverEasy Fullerton

BWB – Burger, Wings, Bar

Chef’s Table by Chef Stephan Zoisl

The Pelican Seafood Bar & Grill

Pepenero

JIN Fine Dining

Lime House

High Society Café & Restaurant

63Celsius

Hombre Cantina

Motorino Singapore

Luxe

The Pump Room

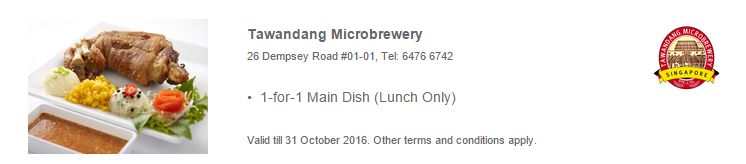

Tawandang Microbrewery

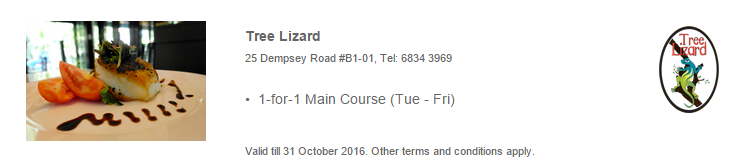

Tree Lizard

Laugen Restaurant

Berlin

CATO

Little Saigon

Highlander Asia

Exclusively for UOB Reserve, Visa Infinite and Privilege Banking Cards

Senso Ristorante & Bar

La Nonna

CATO

Alati

Long Chim

Don’t forget to share these offers with your friends and family members! Not a UOBCardmember?

Share it with someone you know and tag along.

Terms & Conditions

Offers are not valid on eve of and on Public Holidays and special occasions. Offers are not valid in conjunction with other offers, discounts, privileges, promotions, sets or vouchers. Offers are valid for dine-in only and is not applicable for takeaways. Offers are limited to one redemption per card, per table, per bill. Complimentary item must be of equal or lesser value than the item purchased. No splitting of table/bill is allowed. All prices are subjected to service charge and prevailing government taxes. All above-mentioned terms and conditions apply unless otherwise stated. Payment must be made with UOB Credit/Debit Card. UOB general dining terms and conditions apply. Images are for illustrative purposes and not representative of food served at restaurant.

All UOB Credit and Debit Cardmembers are eligible for UOB Dining Privileges at all participating outlets, unless otherwise stated. To ensure the Dining Privilege is being extended to you, please state UOB Dining Privileges prior to reservation or ordering. Please present your UOB Credit or Debit Card prior to ordering. All offers are not valid with accumulated receipts. All 1-for-1 offers are limited to one redemption per visit, per bill, per Cardmember unless otherwise stated. Offers listed may be subject to prevailing government taxes and service charges where applicable. All prices are subject to service charge and prevailing government taxes, unless otherwise stated. All participating outlets reserve the right to replace complimentary items with another item of similar value. Discounts, vouchers and privileges are not exchangeable for cash, or other goods and services. All prices listed are in Singapore Dollars. UOB shall not be responsible for the quality, merchantability or fitness for any purpose or any other aspect of the offers. UOB and the participating outlets reserve the right to vary/amend the privileges or terms and conditions without prior notice. UOB’s decision on all matters relating to the privileges or terms and conditions will be at its absolute discretion and will be final and binding on all participants. For more information, please call our UOB Call Centre Service (24 hours) at 1800 222 2121.

Singapore’s online shopping industry is projected to reach US$3.45 billion in 2015. While this is only a tiny fraction of the US$525 billion for the entire Asia Pacific region, the average Singaporean spends around US$1,800 annually. The yearly increase in online spending is also a healthy sign of the rapidly growing popularity of e-commerce in Singapore.

Singapore’s online shopping industry is projected to reach US$3.45 billion in 2015. While this is only a tiny fraction of the US$525 billion for the entire Asia Pacific region, the average Singaporean spends around US$1,800 annually. The yearly increase in online spending is also a healthy sign of the rapidly growing popularity of e-commerce in Singapore. You can take precautionary measures to minimise the risk of fraud, but there is only one guaranteed way to prevent it – that is to stop using your credit or debit card to shop online altogether. Sounds impossible? Well, there are many other methods you can pay for goods online that don’t necessarily require you to use your credit card.

You can take precautionary measures to minimise the risk of fraud, but there is only one guaranteed way to prevent it – that is to stop using your credit or debit card to shop online altogether. Sounds impossible? Well, there are many other methods you can pay for goods online that don’t necessarily require you to use your credit card.