What should you invest in? Equities or Bonds?

The answer depends on two major factors: how young/ old you currently are, and the riskiness of your job. To elaborate, it is good to understand some basic concepts:

There are basically two types of investment products, bonds and equities.

- Company issue bonds, which is borrowings with a fixed rate of return (interest rate). Bond holders do not own the company, so do not get to vote in company decisions.

- Company sell shares, which is equity to shareholders. Shareholders own parts of the company, so they get to vote in company decisions, as such, shareholders also undertake the risk the company takes.

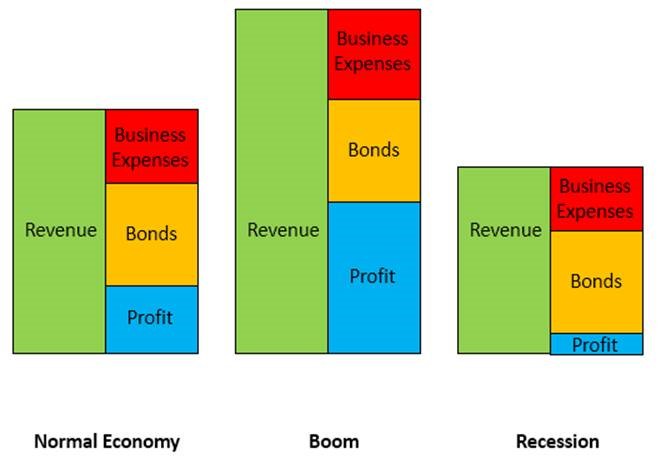

Basically, it shows the simplified balance sheet of companies.

The revenue that company earns goes back to pay business expenses (eg. employee salaries, tax, etc), before paying for the interest owed to bondholders, leaving what is left as the profit.

The company can then choose to distribute part of the profit as dividends.

So in the 3 scenarios, they look like:

- Normal economy – Revenue minus business expenses minus interests for bonds equals profit.

- Boom – Revenue increases by quite a bit, minus business expenses which is more or less fixed, might increase a little bit, minus interests payable to bondholders which is the same, and leaves quite a lot of profit. Shareholders then get to share in the profit.

- Recession – Revenue dropped by a lot, minus business expenses which is roughly the same, maybe drop a bit only because you can retrench some staff, but can’t retrench everyone, minus interests payable to bondholders which is the same, leaves very little as profit.

In the event the company goes bankrupt, it will have to pay the bondholders first, because in bonds, they owe money to bondholders. After that, any money left then goes on to paying the shareholders.

In the case of stocks and shares, share cycles typically lasts 8 to 10 years.

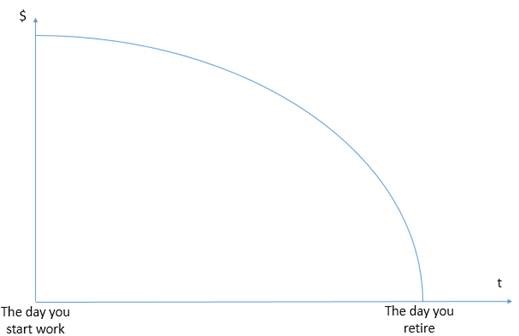

Total earning potential is the sum of your earnings from today until the day you retire. Given the above, which total earning potential scenario is higher?

- When you first started work fresh out of university or

- After working for some years and possibly earning at your peak?

The answer is obviously the former, where you first started your first job in your twenties. Why is this so?

Imagine that you retire tomorrow, your total earning potential will then be your salary today + your salary tomorrow.

This means when you first started work, you have a long earning timeframe until you potentially retire. While counterintuitively, when you are possibly earning at your peak after several years of working experience, you may not have a high total earning potential.

Diversification is then spreading your investments over a number of assets to reduce risk.

What this means is:

Age wise

- When you are young – you behave like a bond (because if you get fired when you are young, it is easier to find a new job because your salary is still low, and got more time to accumulate wealth)

- So when you are young (bonds) – you should buy equities

- When you are old – you behave like a share (because more risky, less time to accumulate wealth and see through the stock market cycle)

- So when you are old (equities) – you should buy bonds

Occupation wise

- When you are in a low risk job (eg. government sector, teacher although I know thatnowadays the “iron rice bowl” is not as low risk as it usedto be) – you behave like a bond (less chance to get fired)

- So when you are in a low risk job (bonds) – you should buy equities

- When you are in a high risk job (eg. private sector, banking) – you behave like an equity (more chance to get fired, but got potential to earn a lot in good times)

- So when you are in a high risk job (equity) – you should buy bonds

So there you have it. Depending on where you are in your career life cycle, and whether your career behaves like equity or bond, invest accordingly to achieve the desired diversification effect.

“Work hard, save up to invest, retire young.”