You may have already known that there are two ways to analyse a company, fundamental and technical. In this post, I will be focusing on fundamental analysis and zoom into the things that are commonly looked out for when performing such analysis.

For a start, it would be good to have a foundation on basic accounting and financial accounting since you will be looking into Income Statements and Balance Sheets. Fundamental analysis is all about making sense of the numbers to give you meaningful information that can profit you.

Compare Against Past Data

When I first begin my analysis, I look at the latest financial statements released by the company. I simply look at their financial highlights to see what happened in the recent quarter if it’s a company that I’ve never researched on before. These numbers alone are not enough to tell you about the performance of the company. Always compare your numbers, quarter-on-quarter or year-on-year as some company businesses are cyclical in nature and what may seem to be a spike from the previous quarter may actually be normal or underperforming. This is one of the reasons why sometimes you may see companies report that their profits rise, but share price still falls. When you compare against past datas, you can also see trends which might help you to forecast the upcoming results and what you can expect will happen. These datas can be obtained from SGX’s website, which makes obtaining data or information really easy!

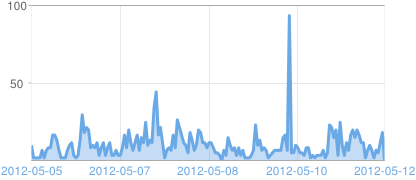

Look Out For Unusual Spikes Or Abnormalities

The numbers won’t lie. Thanks to FRS regulations and many other accounting regulations, companies must be transparent when reporting their results. You will notice that some numbers experience tremendous growth and these could be important or significant figures. This could be a spike in net profit margin, etc. It is then when you should open up your eyes and find out what is going on. There should be some questions that go through your mind as you see spikes. “Is it a one-off spike? If so, what is the impact?” Always question the numbers because this is where you can draw meaningful information out of it. Being able to discern what the information means can help you to gain a deeper understanding of the company and possibly give you a glimpse into the future of the company such as new projects, acquisitions, etc.

Financial Ratios

This is where your financial accounting will help you out. However even if you don’t have a financial accounting background, not to worry because these days the ratios are given to you already. Knowing how to calculate the different ratios and understanding the impact of a high or low ratio will give you that extra edge against other investors who do not know what the ratios mean. The few ratios that I like to look out for are Debt Ratio, Return (Efficiency) Ratio and Liquidity Ratio. These ratios are a way to make a better sense of the numbers that you see on the income statement or balance sheet. This is drawing out meaningful information from face value information. Do remember that these ratios are not one-size-fits-all. Different industries have different norms and you will have to take account of that. Always do a cross-comparison with other companies in the similar industry to get a rough gauge of what the norm is.

In A Nutshell..

There are a lot of information flowing around that we have access to. Simply put, it is how we make sense out of the information and taking the right steps to profit from the information given to us. All of this takes time to learn and it’s a never-ending journey of learning. Do not be too overwhelmed by the things that you have not learnt yet if you are just starting out, and take things one step at a time. Over the weekends, pick up a book in the library and expand your knowledge on the subject. Or you could also simply google the questions you have in mind. Even better, ask your friends who are already in the know. Investing is a journey to requires one to keep learning and improving. This is a long journey that will be worth it at the end!