The current pandemic has made more people take a closer look at their health insurance coverage and recalibrate to focus on what truly matters. Short waiting times, choice of doctors and being able to rest and recover in the privacy of a single room are some of the factors considered when choosing a hospital for treatment.

Timely, Quality Medical Care

One often overlooked characteristic of medical treatment is value. In fact, the importance of timely and attentive medical care cannot be underestimated. For example, patients sometimes delay seeking treatment out of procrastination or superstition. We all probably know of a family member or friend amongst us who dismiss the emergence of some symptoms as one-off incidents or simply the inevitable outcome of aging. However, this could potentially lead to unintended consequences such as deteriorating or irreparable medical conditions.

Seeking treatment early could mean reduced chances of having invasive treatments due to complications, which in turn can reduce the overall cost of treatment.

At the IHH Healthcare Singapore group of private hospitals namely, Gleneagles, Mount Elizabeth, Mount Elizabeth Novena and Parkway East, consumers can book an appointment with specialists for the next working day and even schedule surgery within 48 hours. They are also supported by multi-disciplinary specialists with years of experience under their belts and equipped with modern technology and facilities. This naturally leads to an environment where prompt treatment and care is prioritised in a space that promotes their subsequent rest and recovery.

Minimal Cash Outlay

Worried about the size of your medical bills? Some people choose to avoid hospitals because they fear huge medical bills. A survey conducted found that 2 in 5 patients spent most of their life savings battling illnesses. This shows how important it is to have proper medical coverage through an integrated shield plan so that you are protected from huge medical expenses.

Do you know that it is actually possible to receive quality medical care with minimal cash outlay? The key to this is to ensure that you have an integrated shield plan with rider where co-payment can be capped at 5% of the total hospitalisation bill. Here are some examples from Parkway East Hospital:

- A cataract surgery with lens implant is estimated at $7,718, pay either $0 (full rider) or $385.90* (co-pay rider)

- A surgery for removal of gallbladder with 3 days of hospitalisation in a standard single room is estimated at $29,696. Integrated Shield Plan holders pay either $0 (full rider) or $1,234.70 (co-pay rider)

**Examples are calculated using NTUC Income Enhanced IncomeShield Preferred and Deluxe Care Co-pay rider. Out-of-pocket costs may be further reduced by Medisave, subjected to claim limits, and corporate insurance, if any. The estimated bill and average length of stay are calculated based on historical data and serves only as a guide. The bill size will differ depending on the severity of condition and other factors. In the event of any dispute, the decision of Parkway East Hospital is final. Please confirm your coverage with your health insurance provider.

According to the Straits Times, 7 in 10 Singaporeans and PRs have an integrated shield plan. Of the 2.94 million people in Singapore covered by integrated shield plans, 1.75 million have coverage for private hospital care. In all, about 1.1 million people have riders.

Are you one of the seven in 10? For those who already have existing integrated shield plans, do speak to your insurance agent to understand what your health insurance coverage entails. It will be good to understand beforehand if you will be able to afford the co-payment if admitted into a private hospital. If your insurance agent is unable to assist, simply pick up the phone to dial or WhatsApp IHH SG’s Parkway Insurance Concierge hotline at 9834-0999. They will be able to address queries related to the coverage on your integrated shield plans, panel doctors and help patients make appointments.

Hospital Bill Estimator

To provide greater peace of mind, it is now possible to have an estimate of your hospital bill before seeking medical treatment. This service is available online at Gleneagles, Mount Elizabeth, Mount Elizabeth Novena and Parkway East Hospitals. All the customer needs to do is to provide information on his/her Integrated Shield Plan and riders to have an approximation of the out-of-pocket medical expenses for common surgical procedures.

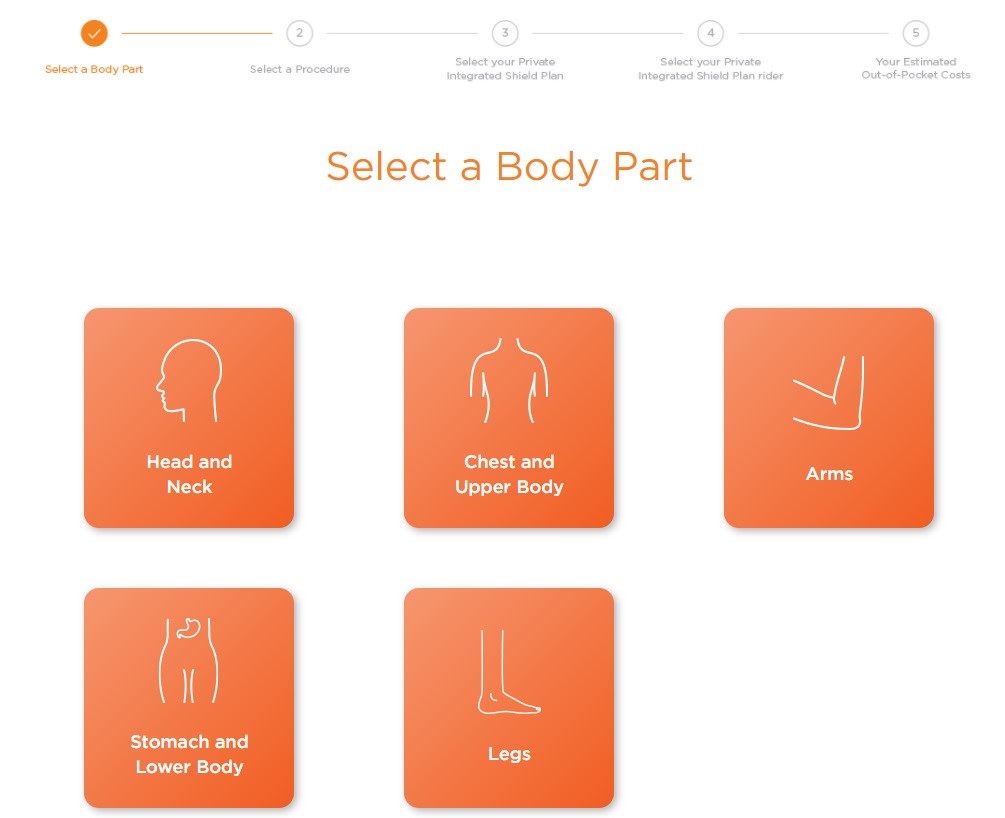

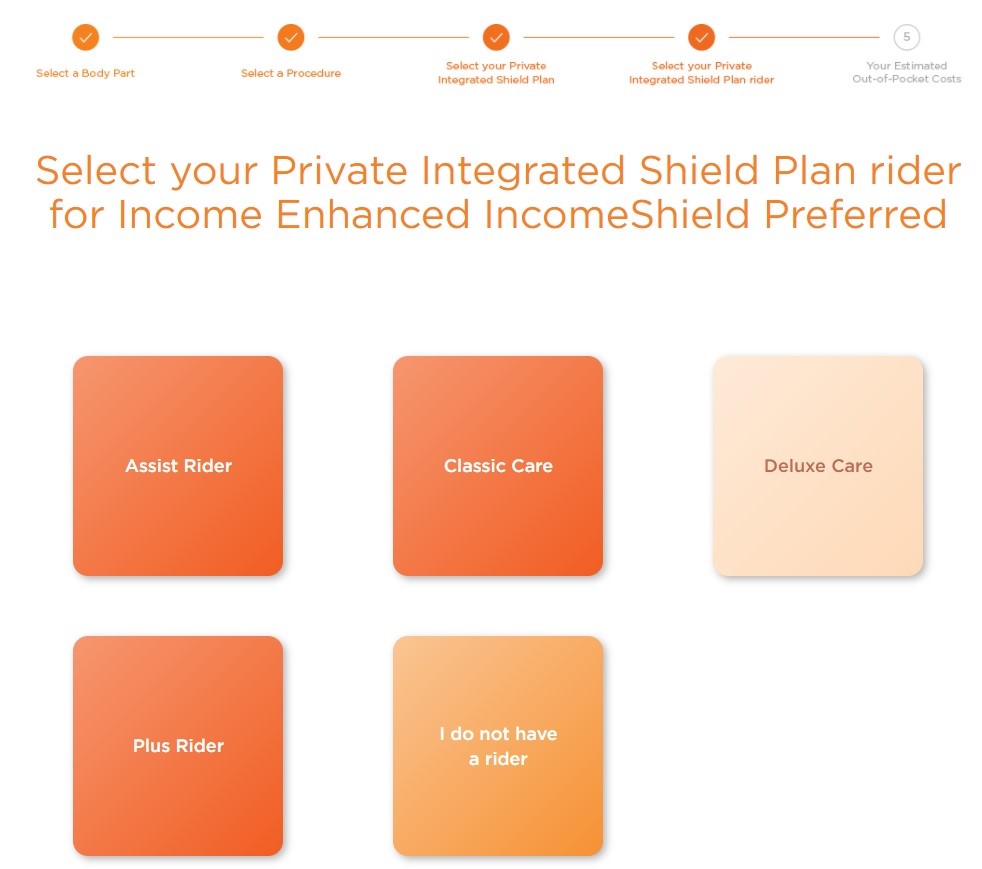

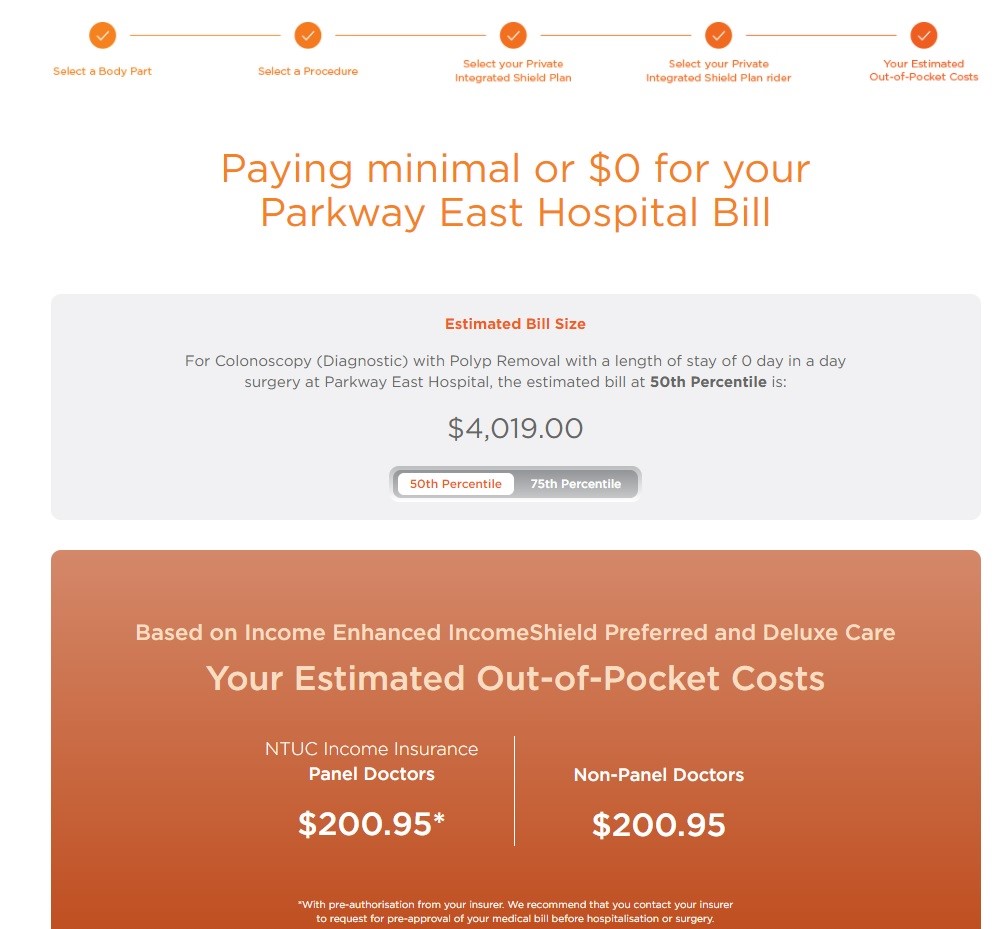

Here is an example of how to attain the out-of-pocket medical expenses for a colonoscopy (diagnostic) with Polyp Removal at Parkway East Hospital.

Step 1: Select a Body Part (Eg: Stomach and Lower Body)

Step 2: Select a Procedure (Eg: Intestine, Colonoscopy (Diagnostic) with polyp removal)

Step 3: Select your Private Integrated Shield Plan (Eg: Income Enhanced IncomeShield Preferred)

Step 4: Select your Private Integrated Shield Plan rider (Eg: Deluxe RiderCare)

Step 5: Receive your estimated out-of-pocket costs

Knowing the estimated bill size and estimated out-of-pocket costs allows the customer to plan and budget properly and seek medical treatment with greater confidence. In this example, having to fork $200.95 (only 5% of the hospitalisation bill) out-of-pocket means one less worry and ensures that a patient is able to focus on getting treated and recovering. This is an invaluable factor that contribute to a patient’s well-being. In addition, out-of-pocket costs can be further reduced with corporate insurance (if any) and MediSave.

Take Charge of Your Health Insurance Coverage

It pays to find out more about your health and hospitalisation coverage before you even need it. For those who have yet to purchase an integrated shield plan, take action now to ensure that you are guarded against the risk of insufficient medical coverage.

Remember, an empowered consumer armed with the correct information is always in a better position to make better healthcare decisions! Know your options.

Dial or WhatsApp IHH SG’s Parkway Insurance Concierge hotline at 9834-0999 to make an appointment or have your queries on integrated shield plans and panel doctors answered.