The forex market extremely volatile market and in order to make a profit in the financial industry you need to execute your orders with an extreme level of precision. Most of the novice traders in the forex market jumps into the online trading world without knowing the market basics and ultimately loses money in real life trading. If you look at the professional traders in the Singapore trading community then you will notice that most of the traders are trading the live assets with the professional brokers like Saxo after developing solid trading knowledge in the financial industry.

Due to recent technical advancement, the traders can execute high lot size trade in the market during the extreme level of market volatility by using the robust trading platform like SaxoTraderGo. Most of the time the market exhibit a high level of volatility during the high impact news release. But trading the high impact news release requires precise knowledge about smaller time frame trading. In this article, we will discuss how to trade the smaller time frame in the options trading industry like the expert traders.

Find the key support and resistance level

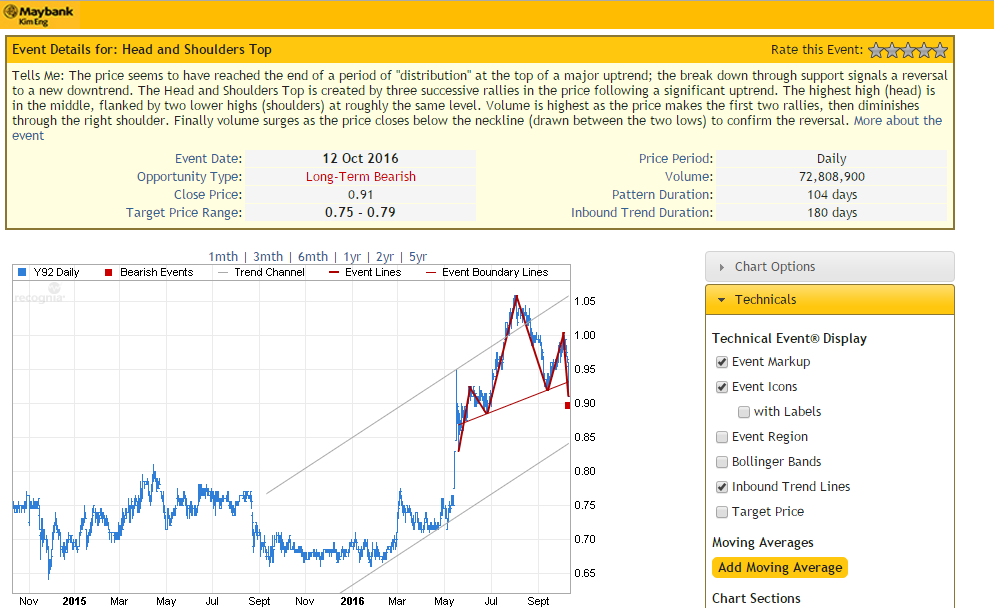

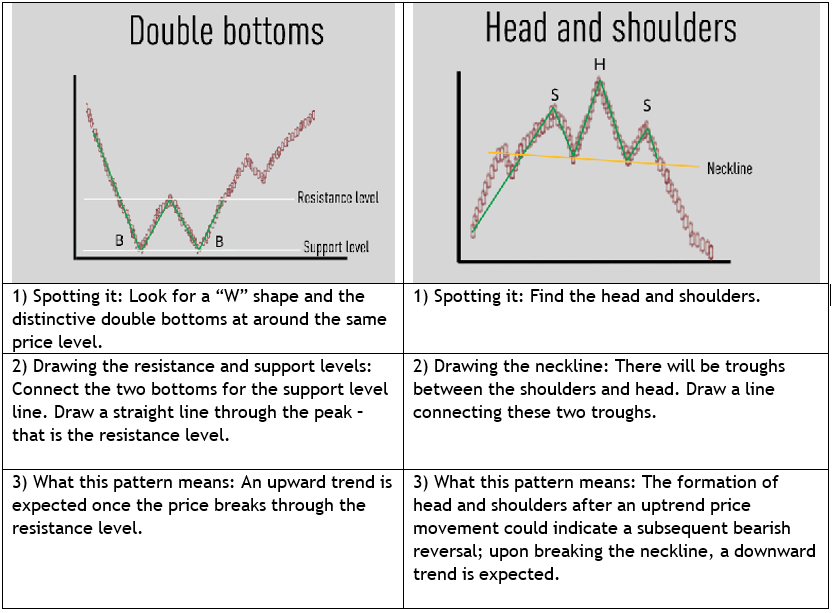

Most of the time the market tends to reverse its direction after hitting the key support and resistance level in the market. If you truly want to master the art of smaller time frame trading then you need to have a solid understanding about the support and resistance level in the market. The professional traders draw the key support and resistance level in the high time frame and switch back to the smaller time frame. They simply try to find confluence between higher time frame support and resistance level with the smaller time frame. Once they find the perfect confluence they execute their trades in the options trading industry with perfect risk management factors.

Price action trading strategy

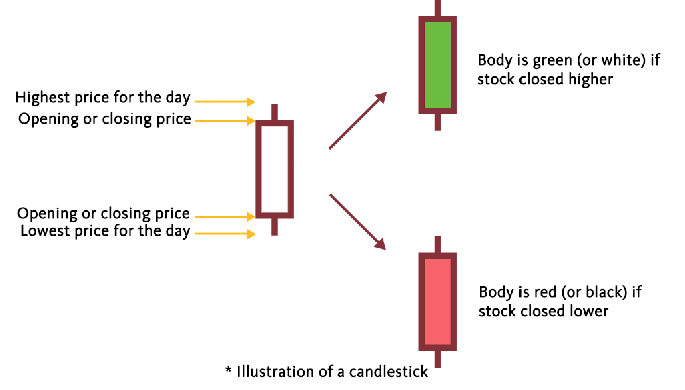

There are many different types of trading strategy in the world. If you look at the experts in the trading industry then you will notice that every single one of them is using the price action confirmation signal in the market. It’s true that if you trade the higher time frame then you will be able to execute high-quality trades by using the price action confirmation signal. But in options trading, you need to use some advanced technique to trade the smaller time frame by using the price action signal.

Most of the professional traders draw the key support and resistance level in the market prior to the high impact news release and once they news is published they try to find possible price action signal in the 5-minute time frame in favor of the long-term trend in the market. It’s true that you will face little bit difficulty in trading the high volatile market conditions but if you trade with solid risk management factors you can easily make lots of money in the high volatile market conditions.

Do the fundamental analysis

Fundamental analysis is one of the key ingredients to execute high-quality trades in the market. Most of the novice traders in the forex market trade the live assets without knowing the perfect way to do the fundamental analysis in the market. It’s true that mastering the art of fundamental analysis is a little bit difficult but if you trade with an extreme level of devotion then within a very short period of time you will see that there is no other alternative other than fundamental analysis to trade the smaller time frame in the market. The fundamental factors in the forex market are so powerful that event the long term prevailing trend in the market often gets changed due to this high impact data.

Trading the smaller time frame is a little bit risky and requires pin perfect execution of the trading plan. If you truly want to master the art of smaller time frame trading then make sure that you follow the above-mentioned tips very precisely.

Putting It Into Practice

Putting It Into Practice