The term “cost of living” can be translated as the money needed to uphold our current lifestyle habits.

When finances are on a stretch, lowering the cost of living can weigh heavily on our minds. If you’re ready to hit the pause button on your spendings or make lifestyle changes because of a recent job loss or pay cut, that’s not impossible.

Try doing these things to bring down your cost of living.

Move to a smaller home

Downgrading can be a powerful punch in the face for the prideful. But when it comes to finances, it’s a massive boost for maintenance. Take a good look at your money matters right now and decide if it makes sense for you to downsize. Remember that selling your property takes time, so plan ahead and get started early.

But sometimes, selling your home can be made secondary by getting rid of your car instead. With most of us shifting back to working from home, maybe you don’t really need a vehicle to add to your existing financial burdens?

Rent out rooms

Image Credits: ohmyhome.com

For peeps who are not so keen on selling their house, see if you can empty a room or two to rent out. This presents a quick solution to bring in extra cash every month, on top of your salary.

Alternatively, you can also choose to downsize and then rent out a small room for someone to occupy temporarily. But this method might only be suitable for people who don’t mind sharing their living spaces with an outsider. Be sure to discuss thoroughly with your family members beforehand.

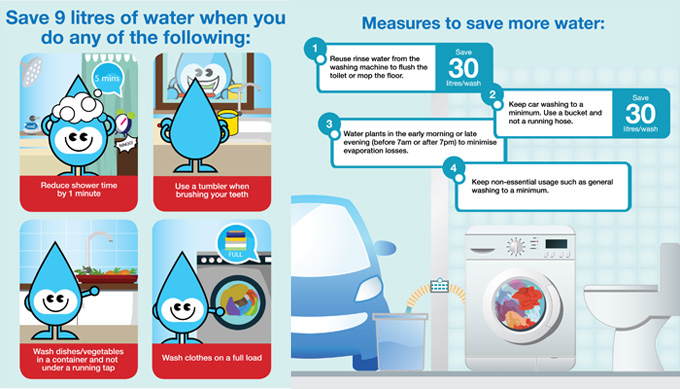

Minimise your energy consumption

Your current electricity appliances can be the culprit contributing to your steep monthly bills. Check to see if they are energy-efficient and make the switch if they aren’t. Since they are products you use for a long time to come, be sure to do your research and ask the salesperson about the specs before buying.

Another factor to consider is your air-conditioner. Yes, we get how Singapore’s weather is so humid and unbearable at times, but if you want to bring down your cost of living significantly, learn how to embrace the warmness. Can’t seem to give up on that? Use the timer setting to work your way around it when you hit the sack.

Rework your budget

Image Credits: procurementexpress.com

As we approach mid-year, maybe it’s time that you take a look at the budget you’ve drawn at the start of 2021. Changes are inevitable, and it’s okay to replan your spreadsheet to accommodate your income changes.

Study the spendings closely you have each month and maybe let go of a few inactive subscriptions. Examine if you genuinely require multiple content streaming services, or you could just do with one for the time being.

Singapore is undoubtedly a city with a high cost of living and seems to rise a little more each year. Unless you’re planning to move to another country with a lower cost of living, consider the above strategies to cut your money outputs.