Wealth Management Services used to be exclusive to the people who are insanely rich. These people were expected to pay at least 1% of the value of their assets as fees. Many wealth managers charge more than this! This is why these services leave no room for small-time investors.

Traditional wealth managers provide tailorized advice on financial matters such as investments, retirement, taxes, and estate planning. You must keep up with your annual fees to reap these benefits. However, a new wave just hit the country! Several FinTech (i.e., Financial Technology) companies have digitalized wealth management services.

These digitalized wealth managament services make use of “robo-advisors”, which allow all sorts of clients to build a portfolio at a cheaper rate. Robo-advisors measure your risk appetite and diversify accordingly. The gradual growth of robo-advisors is seen around the globe.

Know more about robo-advisors by watching this short video:

The local FinTech companies that I mentioned above include Bambu and Smartly. Let me kick off with Bambu. Bambu chose the B2B (i.e., Business to Business) route in marketing their robo-advisory platform. This means that they offer their services to the financial institutions themselves.

Ned Philips, the brainchild and CEO of Bambu, believes that the quick rise of digital adaption will greatly benefit the consumers. He explained that it may cost his company US$1 million (S$1.45 million approximately) to acquire 3,000 customers. The low fees that robo-advisors charge make it possible for him to sustain the business.

Smartly, on the other hand, allows its clients to invest in internationally diversified portfolios. The company offers ETFs or Exchange-Traded Funds. You can invest for as low as S$50 per month. You read that right! Their fees are very affordable!

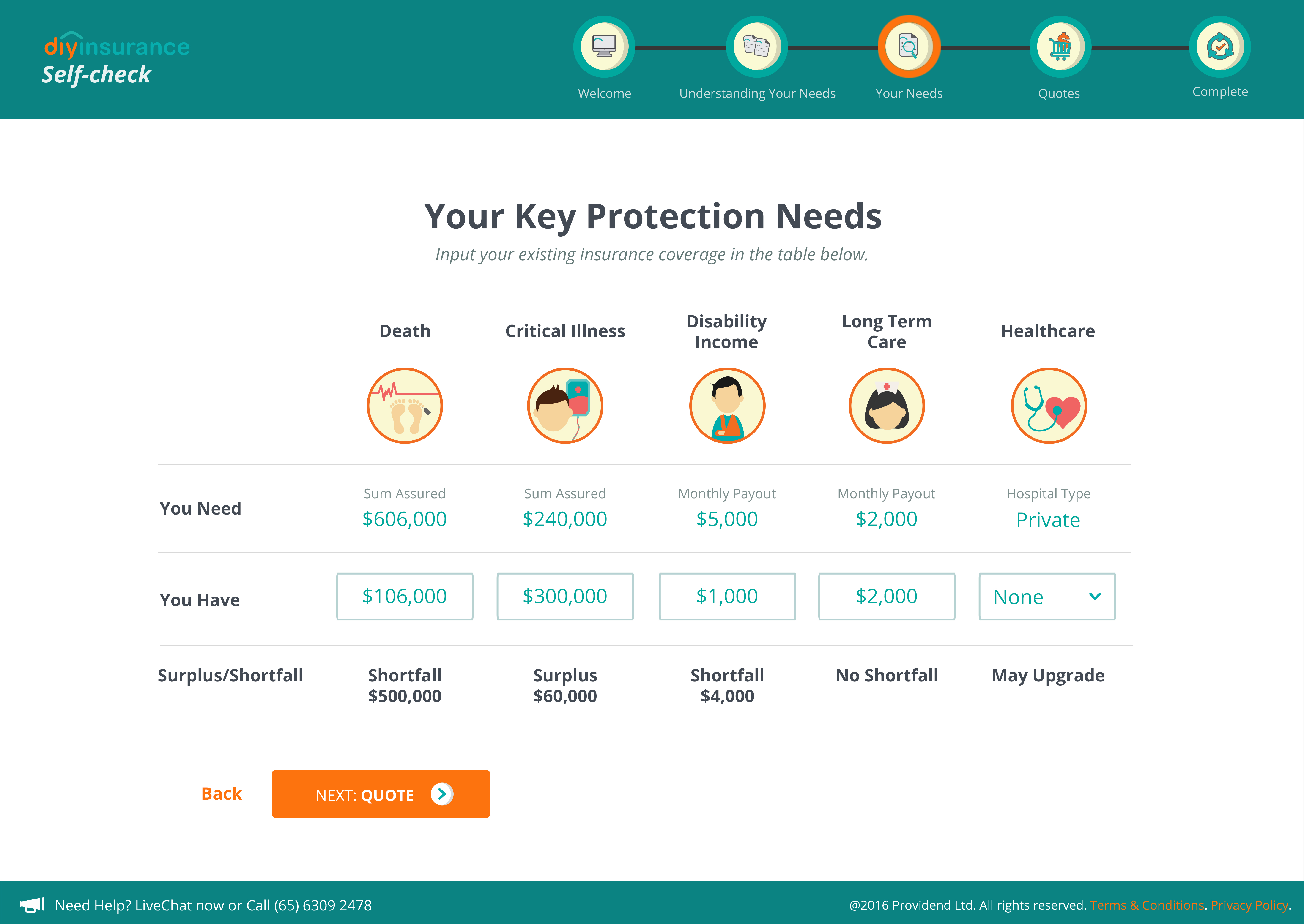

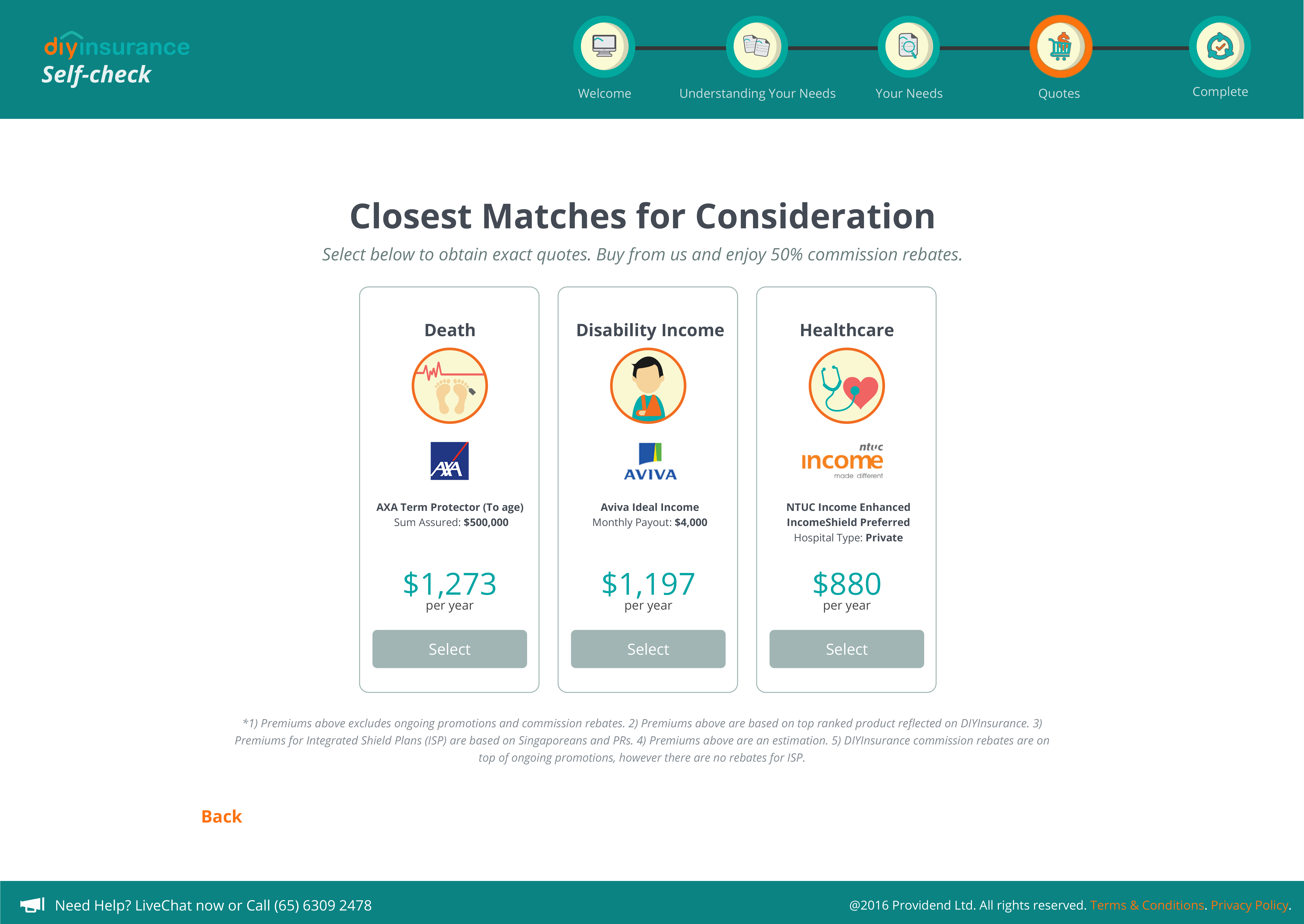

Clients or investors are mandated to provide basic information about themselves. Then, Smartly’s proprietary algorithms will suggest a personalized portfolio based on the profile. It is possible to change the allocations of the funds if the client does not agree with it. Its mere slogan will say it all: “Anyone can be an investor – an investment service built for you.”

In summary, robo-advisors allow you to create a portfolio on autopilot. The digital algorithms access your tolerance to risks and your preferred timeline. Afterwards, a portfolio will be built. It is undeniably cheaper than the traditional wealth management services. This is why it welcomes more and more small-time investors to open their accounts.

Image Credits: pixabay.com

Do you think that this will benefit the Singapore market? Well, I hope so!