Congratulations on reaching the incredible milestone of owning your new home! As you stand in your living room, envisioning it as the perfect spot for get-togethers, reality sets in. Do I have the budget needed to create my dream home?

Sounds familiar? Well, you’re not alone.

Many of us have found ourselves in this situation. We need a temporary cash boost for home improvements but, at the same time, are hesitant to rely on awkward favors from friends or family members.

That’s where borrowing smart comes into play. Here’s why GXS Bank, Singapore’s home grown digital bank, might have the best solution for you.

The Best Friend To Borrow Money From

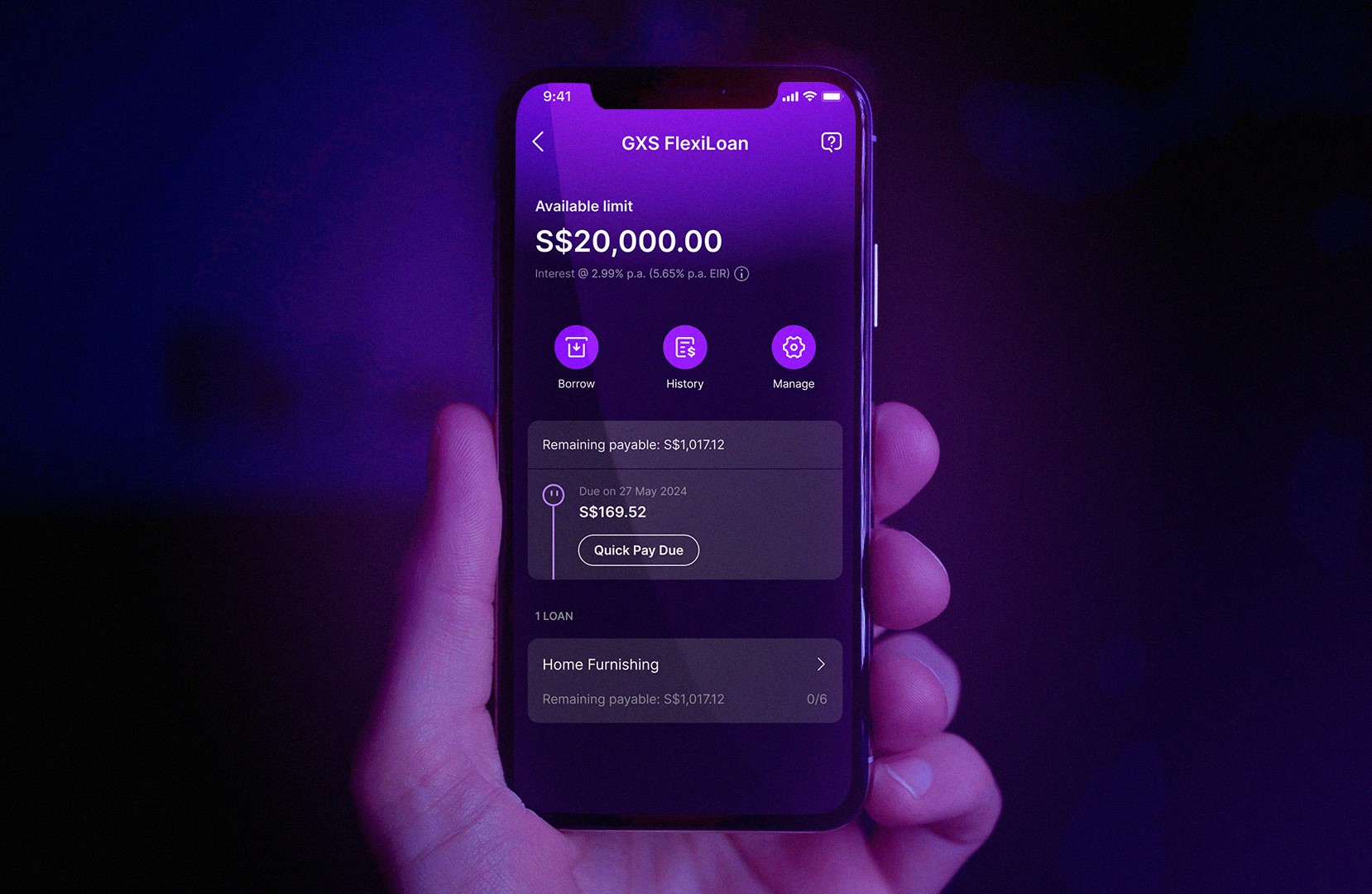

Borrowing from those close to you can be a double-edged sword. It might be easy to get that “loan” but fail to fully understand the unspoken terms, or worse, be late in paying them back, and you could end up with a very strained relationship. This is where GXS FlexiLoan steps in, like a trusted friend who understands your needs but less the drama.

The GXS FlexiLoan lives up to its name by being incredibly flexible. Whether you need a small amount for a quick fix or a larger sum for a home renovation project, it’s there to support you.

Why GXS FlexiLoan stands out as the ideal financing option:

Flexible Borrowing

Borrow what you need, when you need it, for however long you need it

When it was launched, the GXS FlexiLoan was hailed as a revolutionary game-changer in personal finance. It is the first financing option in the market that lets you tailor your borrowing experience according to your individual needs.

Think about it – a renovation loan typically has a higher loan quantum that is more suitable for larger renovation projects. If you just want to upgrade your kitchen or create a cozy haven in your living room, you might not need such a large quantum. The GXS FlexiLoan puts control in your hands and allows you to draw down multiple loans from your credit line starting from as little as S$200, up to $100k (subject to your available credit limit). GXS FlexiLoan has got your back, on your terms.

Low Interest Rates

Interest rates start from as low as 2.99% (EIR 5.65% p.a.) which is lower than the interest rate you’d pay if you used your credit card. By taking advantage of competitive rates, you can save on interest costs, and stretch your renovation dollar.

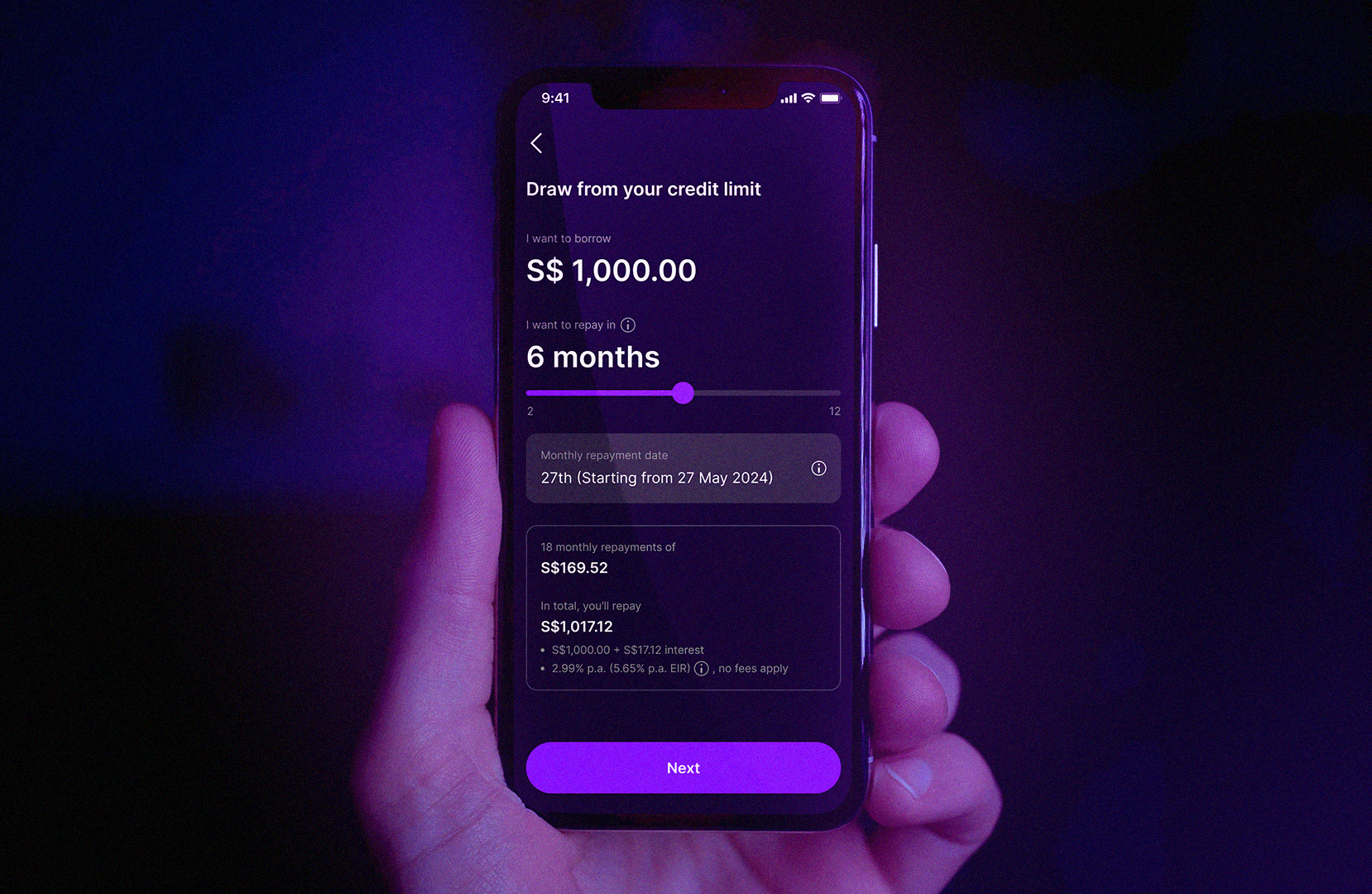

Flexible Repayment Options

You call the shots with GXS FlexiLoan

With GXS FlexiLoan, you call the shots. Imagine you’re in the midst of your home renovation project, and you want to establish a clear timeline with your interior designer to keep track of progress.

The GXS FlexiLoan is designed to let you call the shots on how much and how long you want to take up the loan. This means you have the power to align your repayment plan with your renovation timeline. Want a shorter repayment period of 2 months to swiftly tackle smaller upgrades or an extended tenure of up to 60 months for comprehensive renovations? The choice is yours.

No Early Repayment Fees

Why pay more when you can save on interest?

You can enjoy interest savings with GXS FlexiLoan because interest on the loan is calculated daily, based on the outstanding balance at the end of the previous day, without compounding interest. This means that if you make an early repayment, the outstanding balance is reduced, resulting in immediate interest savings.

Moreover, there are no early repayment fees, giving you added financial benefits and motivation to settle your loan sooner. This way, you can allocate more funds towards your home renovation project and achieve your dream space without unnecessary financial burdens.

No Hidden Fees

Suppose you’re still not ready to take the loan immediately, there’s no need to worry because, with GXS FlexiLoan, you have the option to apply beforehand and keep it as a reliable standby credit line. There will be no interest charged till you make a drawdown, giving you peace of mind as a backup during your renovation journey.

Limited Time Offer

From April 3rd till June 30th 2024, when you sign up and use your GXS FlexiLoan, you stand a chance to win fantastic prizes in their dream giveaway. Prizes include a dream home makeover, a thrilling overseas adventure for two, an iPhone 15 with free Singtel mobile postpaid bills for a year. You also stand to get a S$50 Grab voucher.

Apply via the app which it is available for download on:

For more information, and to check the results of the giveaway, check here

Visit www.gxs.com.sg/flexiloan for the full terms and conditions, and start your journey towards financial empowerment today.

Footnotes:

GXS is a digital bank proudly backed by Grab and Singtel. GXS FlexiLoan is provided by GXS. GXS holds a banking licence and is regulated by the Monetary Authority of Singapore. GXS is a separate entity and is not associated with the businesses of Grab Holdings, Singtel, and their entities, or Money Digest.

Terms and conditions apply. For the full terms and conditions on GXS FlexiLoan and the campaign, visit www.gxs.com.sg/flexiloan. All figures in the images are illustrative only.