Renovating your home? Skip the awkward favors from friends and family members and borrow smart!

Congratulations on reaching the incredible milestone of owning your new home! As you stand in your living room, envisioning it as the perfect spot for get-togethers, reality sets in. Do I have the budget needed to create my dream home?

Sounds familiar? Well, you’re not alone.

Many of us have found ourselves in this situation. We need a temporary cash boost for home improvements but, at the same time, are hesitant to rely on awkward favors from friends or family members.

That’s where borrowing smart comes into play. Here’s why GXS Bank, Singapore’s home grown digital bank, might have the best solution for you.

The Best Friend To Borrow Money From

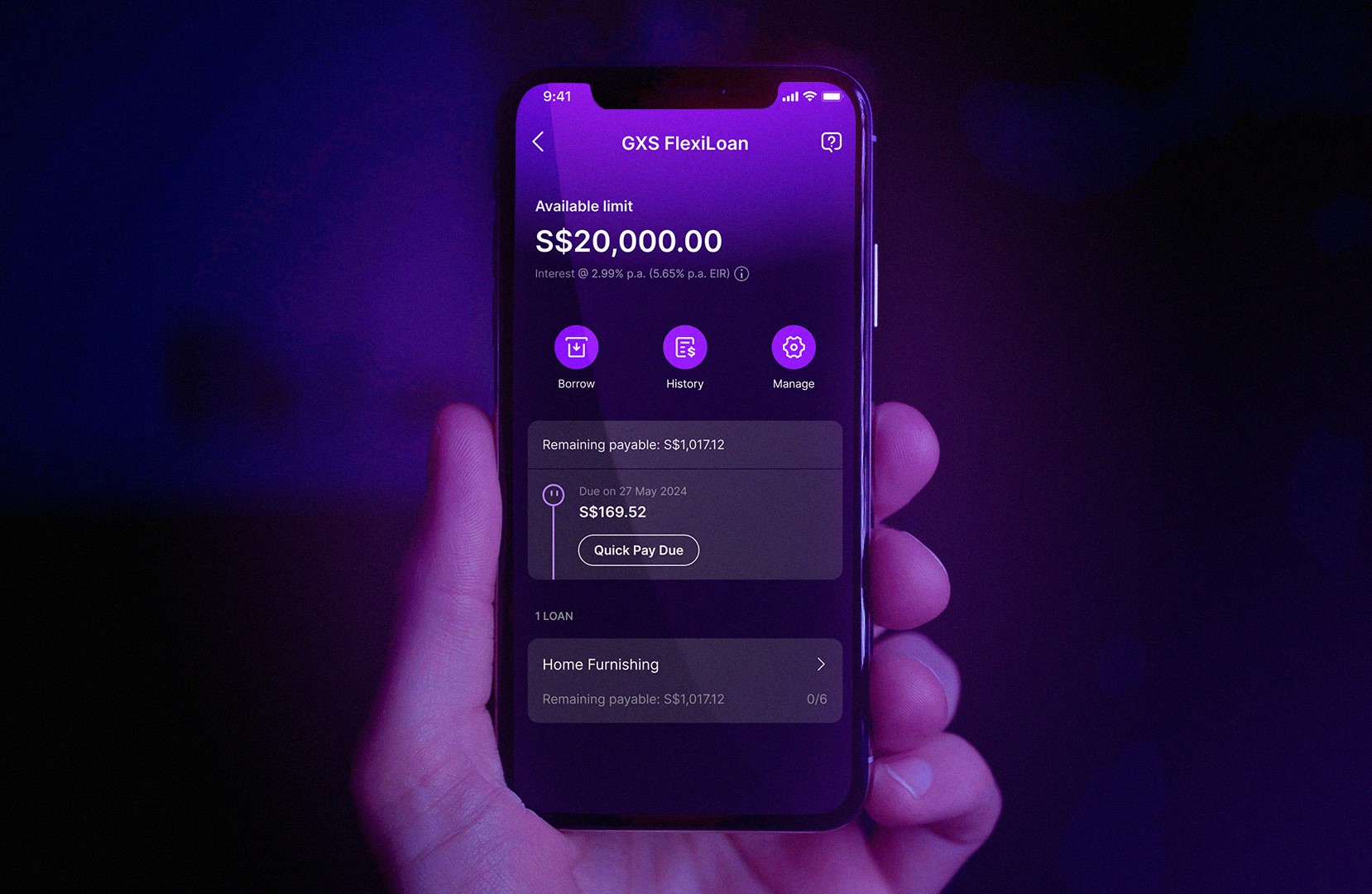

Borrowing from those close to you can be a double-edged sword. It might be easy to get that “loan” but fail to fully understand the unspoken terms, or worse, be late in paying them back, and you could end up with a very strained relationship. This is where GXS FlexiLoan steps in, like a trusted friend who understands your needs but less the drama.

The GXS FlexiLoan lives up to its name by being incredibly flexible. Whether you need a small amount for a quick fix or a larger sum for a home renovation project, it’s there to support you.

Why GXS FlexiLoan stands out as the ideal financing option:

Flexible Borrowing

Borrow what you need, when you need it, for however long you need it

When it was launched, the GXS FlexiLoan was hailed as a revolutionary game-changer in personal finance. It is the first financing option in the market that lets you tailor your borrowing experience according to your individual needs.

Think about it – a renovation loan typically has a higher loan quantum that is more suitable for larger renovation projects. If you just want to upgrade your kitchen or create a cozy haven in your living room, you might not need such a large quantum. The GXS FlexiLoan puts control in your hands and allows you to draw down multiple loans from your credit line starting from as little as S$200, up to $100k (subject to your available credit limit). GXS FlexiLoan has got your back, on your terms.

Low Interest Rates

Interest rates start from as low as 2.99% (EIR 5.65% p.a.) which is lower than the interest rate you’d pay if you used your credit card. By taking advantage of competitive rates, you can save on interest costs, and stretch your renovation dollar.

Flexible Repayment Options

You call the shots with GXS FlexiLoan

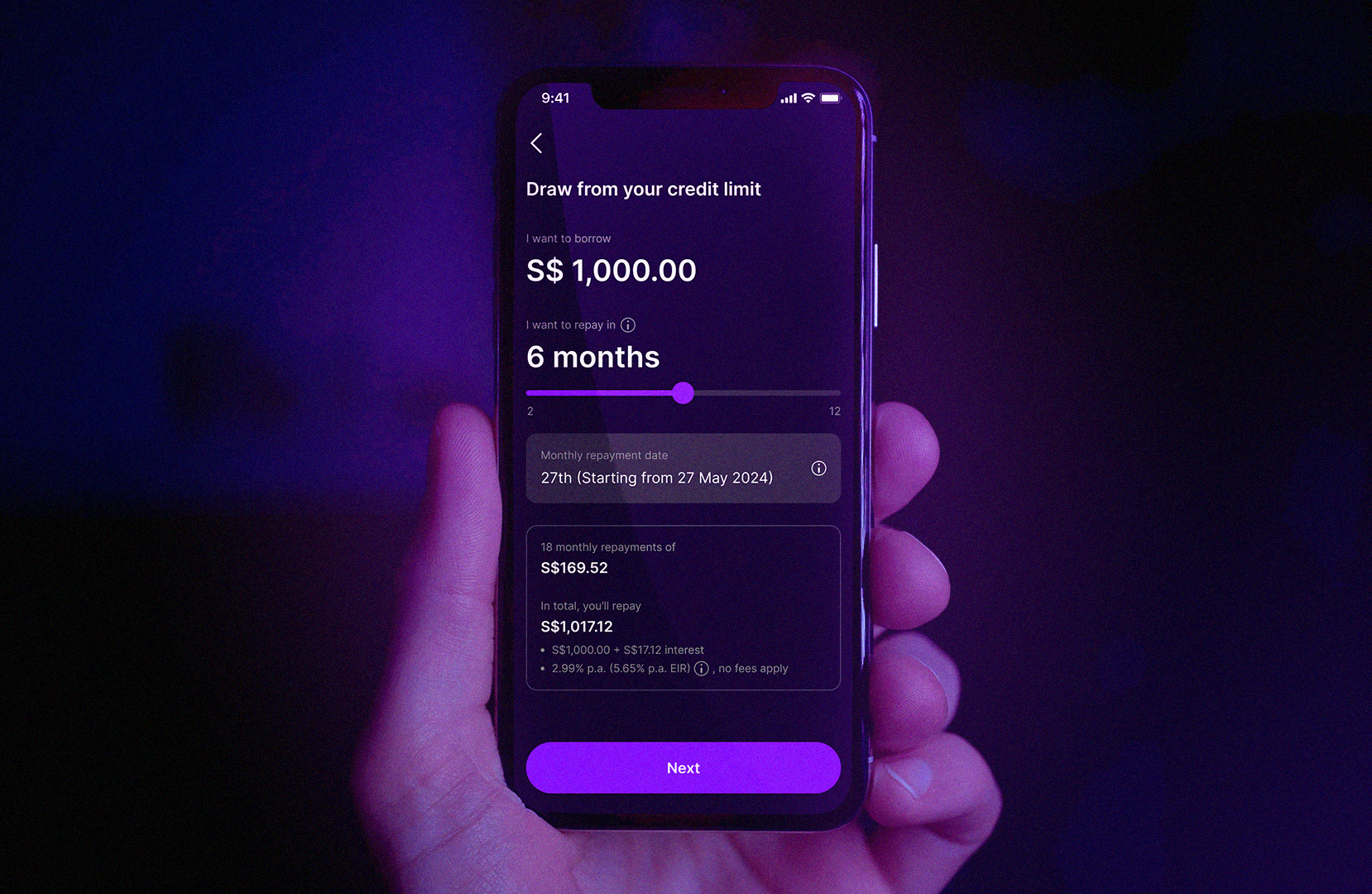

With GXS FlexiLoan, you call the shots. Imagine you’re in the midst of your home renovation project, and you want to establish a clear timeline with your interior designer to keep track of progress.

The GXS FlexiLoan is designed to let you call the shots on how much and how long you want to take up the loan. This means you have the power to align your repayment plan with your renovation timeline. Want a shorter repayment period of 2 months to swiftly tackle smaller upgrades or an extended tenure of up to 60 months for comprehensive renovations? The choice is yours.

No Early Repayment Fees

Why pay more when you can save on interest?

You can enjoy interest savings with GXS FlexiLoan because interest on the loan is calculated daily, based on the outstanding balance at the end of the previous day, without compounding interest. This means that if you make an early repayment, the outstanding balance is reduced, resulting in immediate interest savings.

Moreover, there are no early repayment fees, giving you added financial benefits and motivation to settle your loan sooner. This way, you can allocate more funds towards your home renovation project and achieve your dream space without unnecessary financial burdens.

No Hidden Fees

Suppose you’re still not ready to take the loan immediately, there’s no need to worry because, with GXS FlexiLoan, you have the option to apply beforehand and keep it as a reliable standby credit line. There will be no interest charged till you make a drawdown, giving you peace of mind as a backup during your renovation journey.

Limited Time Offer

From April 3rd till June 30th 2024, when you sign up and use your GXS FlexiLoan, you stand a chance to win fantastic prizes in their dream giveaway. Prizes include a dream home makeover, a thrilling overseas adventure for two, an iPhone 15 with free Singtel mobile postpaid bills for a year. You also stand to get a S$50 Grab voucher.

Apply via the app which it is available for download on:

For more information, and to check the results of the giveaway, check here

Visit www.gxs.com.sg/flexiloan for the full terms and conditions, and start your journey towards financial empowerment today.

Footnotes:

GXS is a digital bank proudly backed by Grab and Singtel. GXS FlexiLoan is provided by GXS. GXS holds a banking licence and is regulated by the Monetary Authority of Singapore. GXS is a separate entity and is not associated with the businesses of Grab Holdings, Singtel, and their entities, or Money Digest.

Terms and conditions apply. For the full terms and conditions on GXS FlexiLoan and the campaign, visit www.gxs.com.sg/flexiloan. All figures in the images are illustrative only.

Latest WFH internships posted from 8 to 11 April 2024

Welcome to another episode of WFH internships this Friday!

Here are the latest opportunities we have sourced for you.

#1: Sustainable Growth Experts – Public Relations & Communications Intern (Digital PR)

Website: sustainable-growth-experts.com

Allowance / Remuneration: $800 – 1,200 monthly

Job Qualifications

- Basic knowledge of Digital PR

- Experience in creating engaging and entertaining outreach campaigns using data and content

- Have experience in supporting a Digital PR campaign

- A strong understanding of the fundamentals of PR and SEO and how they integrate

- Able to learn fast and adapt to the dynamic world of Digital PR

- An excellent command of the English language, both written and oral

- The ability to multi-task and work with deadlines

- You’re generally a super high achiever, hate mediocrity, and love to win

- Passion for PR, journalism, marketing, advertising, or similar

Key Responsibilities

- Take part in content research and ideation of campaigns, helping to generate content that engages, sparks debate, and is newsworthy enough to be featured in high-quality publications. If you’re brilliant at headlines and angles, you’ll fit right in!

- Leverage trending events to achieve maximum PR impact on campaigns

- Use a range of tools and sources to collect data and audience insights to form the foundation of ideas for creative digital PR campaigns and strategy

- Execute the production of Digital PR campaigns – including working with creative teams, and reaching out to journalists

- Execute tailored outreach strategies, and pitches, write press releases, and find outreach opportunities that will get journalists interested in your content

How to apply?

View the job post in full here and follow the instructions accordingly to apply.

#2: Foodsta Kitchens – Data Analytics Intern

Website: foodstakitchens.com

Allowance / Remuneration: $800 – 1,500 monthly

Job Qualifications

Not specified.

Key Responsibilities

- Collect, consolidate, and analyze data from various food delivery platforms in Singapore (e.g., Grab Food, Food Panda, Deliveroo).

- Utilize data visualization tools to transform raw data into meaningful insights.

- Work closely with the finance team to understand their data requirements and provide relevant reports.

- Develop and maintain dashboards for tracking and presenting KPIs.

- Identify trends and patterns in the sales data.

- Assist in the creation of comprehensive reports.

- Collaborate with internal teams to ensure data accuracy and consistency.

How to apply?

View the job post in full here and write to Yuk Hei Chan via this link.

#3: Eatigo Singapore Pte Ltd – Marketing Intern

Website: eatigo.com

Allowance / Remuneration: $600 monthly

Job Qualifications

- Degree in Communication, Marketing, PR, or related disciplines.

- Graphic Design and video content creation skills are a plus.

- Strong sensitivity to current and upcoming APAC trends to generate engaging localized content.

- A natural team player with strong interpersonal skills.

- Proficiency in written and spoken English.

Key Responsibilities

- Completing clerical and administrative duties, building social media campaigns, and preparing marketing materials and presentations.

- Plan and manage social media accounts (Facebook & Instagram).

- Create engaging content across all the communication channels.

- Work closely with the HQ team to prepare & execute marketing plans, ensuring alignment with HQ standards.

How to apply?

View the job post in full here and apply for this position by submitting your CV to [email protected].

#4: HUGO BOSS South East Asia Pte Ltd – Training / L&D Intern

Website: hugoboss.com/sg

Allowance / Remuneration: $800 – 1,200 monthly

Job Qualifications

- Good presentation and communication skills (both written and verbal)

- Strong data entry skills, attention to detail and accuracy

- Good understanding of retail with a strong customer service mindset

- Energetic with a keen interest in the fashion industry

- Familiar and at ease with various e-learning and digital tools

- Good time management skills

- Self-motivated and highly adaptable with a positive attitude

- Ability to work independently as well as part of a team

- Computer literate

- Creative and conceptual thinking abilities

- Excellent MS Office skills particularly PowerPoint & Excel

- Experienced in developing visual or presentation aids and materials

- Ability to exercise tact and diplomacy in dealing with sensitive, complex, and confidential employee situations

Key Responsibilities

- Act as point of contact for participants and vendors

- Handles training administrative tasks such as maintenance and tracking of training records through LMS data, satisfaction ratings, session attendance, KPI results, course registrations and confirmations, etc.

- Manage the preparation and dissemination of training aids and materials such as learner’s guides activity sheets, presentation aids, tools, etc.

- Effectively communicates with the Human Resources team and other relevant departments to assist in the coordination of onboarding/orientation or WSQ programs

- Coordinate and oversee the proper setups for a variety of in-house HUGO BOSS in-person and virtual training programs for the retail team as well as external training

- Assist the team in preparing surveys, and enhancing the training feedback forms to gather accurate and specific feedback regarding subject areas of concern

- Assist the team in maintaining or developing training guides and procedures

- Ensure training expenses are processed promptly

- Source and manage external training providers to carry out defined training programs where necessary

- Assist in ad-hoc L&D projects where necessary

How to apply?

View the job post in full here and apply for this position by submitting your CV to [email protected].

#5: Arkolite Pte Ltd – Sales And Marketing Intern

Website: arkolite.com

Allowance / Remuneration: $800 – 1,000 monthly

Job Qualifications

- Currently doing or completed a Bachelor’s degree in Business/Marketing or other related disciplines.

- Strong writing and communication skills

- Excellent listening skills, a proactive self-starter with strong initiative

- Attention to detail and strong organizational skills

- Proficiency in Microsoft Office

- Experience with web design and digital marketing is a big plus – otherwise, the candidate needs to demonstrate interest and ability to pick up digital marketing skills quickly

- Pleasant personality and a team worker

- Able to work in a fast-moving, entrepreneurial environment

Key Responsibilities

- Support the development of the Arkolite website, including creating content and tracking web performance

- Drive and monitor digital marketing efforts on various platforms

- Help build out thought leadership and content that can be used for sales and marketing activities

- Support Consulting Practices by building essential templates on PowerPoint

- Help coordinate sales and business development process, including setting up and preparing for meetings and following up with prospects and clients

How to apply?

View the job post in full here and write to Eugene Yap via this link.

Editor’s note: These positions are selected based on the “remote” tag, but some are hybrid ones and you may need to report physically to the office. For more deets, do contact the employer directly.

4 accommodations under $64/night in Fukuoka, Japan, if you can free yourself up for these travel dates in June 2024

Escape to Fukuoka, Japan, with our guide to these four accommodations priced under $64/night.

If you have the flexibility to travel in June 2024, these options will ensure a budget-friendly stay.

Studio rental unit for 2 near train stations

Price: $42/night (for 2 persons)

Travel dates: 11 to 15 June 2024

First up, we have this studio rental unit is located near both Sasabaru Station and Ijiri Station, making it just the right size for a couple or compact for up to three guests.

Futons are provided along with a small kitchenette that includes a fridge, kettle, microwave, and sink—all the essentials for a short stay or simple home base.

Family restaurants, McDonald’s, and supermarkets are all within walking distance, so you have everything you need nearby while the cozy unit provides a place to rest your head between expeditions.

Clean & bright studio close to Minami-Fukuoka Station

Price: $53/night (for 2 persons)

Travel dates: 1 to 6 June 2024

Or consider this clean & bright studio close to Minami-Fukuoka Station, great for a short getaway.

Just a 3-minute walk from Minami-Fukuoka Station, the convenience can’t be beaten.

The elevator in the building means no stair climbing with luggage after a flight or after your day out, and the double bed is cozy for two.

While the studio sleeps up to four (at a different rate), be warned that it may be snug.

Still, you get a pantry area for preparing simple meals, plus an in-unit washer for doing laundry between sightseeing.

Simple & small living space great for backpackers

Price: $54/night (for 2 persons)

Travel dates: 15 to 20 June 2024

Next, we have this simple studio ideal for budget-minded travelers looking for an affordable place to rest their heads.

Located near the Fukuoka PayPay Dome stadium, this no-frills living space offers two single beds, a kitchenette with basic amenities for whipping up light meals, and an in-unit washer for your dirty laundry.

While not fancy by any means, the studio provides all the necessities for backpackers/travelers needing a comfortable place to recharge between their adventures.

Cozy studio near Box Town Hakozaki

Price: $61/night (for 2 persons)

Travel dates: 2 to 7 June 2024

Last but not least, this cozy studio could be good for a short stay in Fukuoka, situated between the Hakozakikyudai-Mae and Hakozakimiya-Mae stations with convenient access to Box Town Hakozaki shopping mall.

The fuss-free studio has futon beds for a restful night’s sleep, while the kitchenette near the entrance has everything you need for simple meals—even a rice cooker!

So unpack and feel at home right away.

There’s also an in-unit washer, allowing you to pack light for your stay in this convenient studio in Higashi Ward.

If you can free yourself for the abovementioned travel dates in June 2024, visit Fukuoka! While the accommodations we’ve introduced to you here aren’t fancy stays, the price is worth the adventure, ain’t it? Furthermore, they’ve gotten pretty decent reviews so you should be in good hands. Have a lovely time in Japan!

Inexpensive Ways to Reconnect with Old Friends

We all treasure the memories of old friends—the laughter, deep conversations, and shared experiences. However, as life progresses, it’s not uncommon for these connections to fade.

Busy schedules, diverging life paths, and geographical distances can all contribute to this gradual drift apart. But fear not, for reconnecting with old friends need not strain your budget.

USE TECHNOLOGY

The digital age offers myriad opportunities to rekindle old friendships. A simple online message or call can kick-start the process. Reach out to your old friends, expressing genuine interest in their lives. Inquire about their recent endeavors, families, or work. Demonstrating authentic interest lays the groundwork for rebuilding a meaningful connection.

SCHEDULE MEET-UPS

Once communication lines are reopened, take proactive steps to arrange face-to-face meetings. Whether it’s a casual coffee outing or hosting a dinner at your place, commit to spending quality time together. Mark it on your calendar and prioritize it accordingly.

INITIATE CONVERSATIONS

Initiate conversations by reminiscing about shared memories or amusing anecdotes. “Do you remember when…” These nostalgic recollections transport you both back to a time when your bond was strong, easing any initial awkwardness and facilitating more organic conversations.

TRY GROUP ACTIVITIES

Participating in group activities or events offers an excellent opportunity to reconnect with old friends while also meeting new people. Explore local hobby clubs or check out offerings on platforms like Klook, where activities are available at affordable prices (starting from S$6). Whether it’s treasure hunting, perfume making, or any other shared interest, these activities foster connections and create new memories.

Image Credits: unsplash.com

LET GO OF RESENTMENTS

Release any lingering grudges or unresolved conflicts from the past. While addressing these issues may be necessary in due course, focus initially on highlighting common ground and the positive aspects of your friendship.

STAY CONNECTED

Consistency is key to maintaining rekindled friendships. Keep communication lines open with regular texts or calls. Remember important dates like birthdays and holidays, using them as opportunities to strengthen your bond. End conversations or meetings by making plans for future get-togethers based on shared interests.

Image Credits: unsplash.com

By implementing these budget-friendly strategies, you can successfully reignite old friendships and nurture them into lasting connections without breaking the bank.

HDB flat assistance measures for young couples and families starting June 2024

News has it that the government is making it easier for young couples to buy their first HDB flat starting in June.

And here’s what they are going to do:

Lower the initial down payment from 20% to just 2.5% of the purchase price.

What are the requirements?

Right now, couples, where one is a full-time national serviceman, student, or recently completed their studies or national service in the last year, can defer having their income assessed until right before they get the keys.

This is because if they were assessed earlier, they might not qualify for grants like the Enhanced CPF Housing Grant (EHG), which requires being employed for at least a year.

By waiting until key collection to check income, the couples have a better chance of getting the grant or even qualifying for a higher loan amount.

Other requirements for deferred income assessment include one person being 30 or younger.

The couple must also be married or applying together under the Fiance-Fiancee Scheme, where the minimum age is 21.

Down payment benefits

Additionally, young couples currently have the option to split the minimum 20% down payment into two installments.

The first is either 5% or 10% depending on the loan, and the second is due at key collection.

Image Credits: unsplash.com

Since 2018, over 3,700 couples have used deferred income assessment and staggered down payments to make it easier to buy their first flat earlier.

Now, the government wants to help reduce the initial costs even more.

For some, the reduced initial down payment of just 2.5% will significantly lower the financial barrier to owning a home.

The changes take effect starting with the BTO sales launch in June.

Additional rental vouchers

Families who qualify for the Parenthood Provisional Housing Scheme (PPHS) will also get temporary $300/month rental vouchers while waiting for their new homes to be completed.

HDB is doubling the supply of rental flats they provide to help meet demand.

In the interim, the government will provide eligible families vouchers for a year starting in July to help cover renting an HDB flat or bedroom on the open market.

The $300 amount was carefully set to provide relief without over-inflating rental prices for others.

To qualify for the new vouchers, families must meet the PPHS requirements and have a rental tenancy registered with HDB when applying.

Those eligible will get reimbursed based on how long their approved tenancy falls within the year.

With that said, renting from family members won’t count.

More details will be shared closer to the official launch so stay tuned if you’re eyeing this segment from the government.